Ethiopia excludes diaspora and foreign investors from Ethio Telecom IPO (Initial Public Offering), for Ethio Telecom — the state-owned telecom giant that holds a dominant 95% market share, TechCabal reports.

This decision comes ahead of the launch of the Ethiopian Securities Exchange (ESX), the country’s first stock market, which is set to begin operations later this month.

The government aims to raise $255 million by selling a 10% stake in Ethio Telecom through Ethiopian Investment Holdings (EIH).

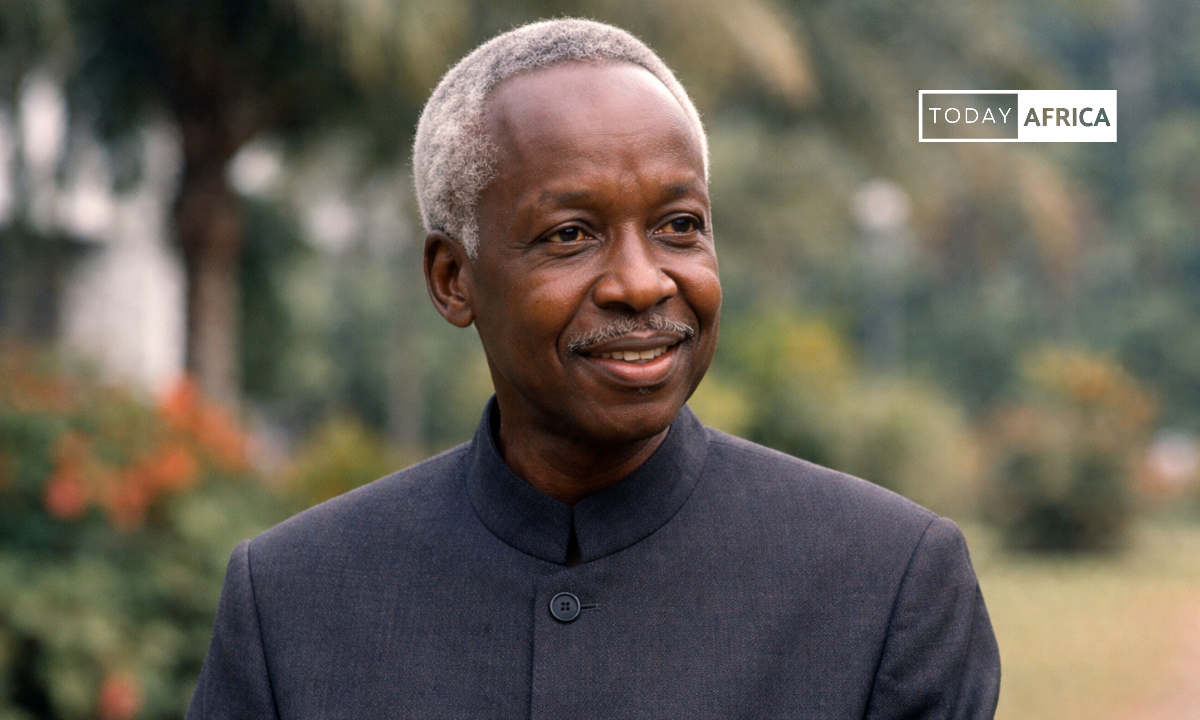

The exclusion of foreign and diaspora investors, however, could slow the anticipated development of Ethiopia’s capital markets, which has been a key pillar of Prime Minister Abiy Ahmed’s financial sector liberalisation agenda.

By barring external investors, the government risks stalling the opening up of the country’s economic space, a move many expected would attract significant foreign capital.

Per Ethio Telecom’s prospectus, “The offer is being made only to Ethiopian citizens who are physically present in Ethiopia. The offer is not available to any other jurisdiction outside of Ethiopia.”

Despite the expectation that liberalisation would include international and diaspora participation, this decision shows the government’s caution towards allowing foreign involvement in key strategic sectors.

Read Also: IZI Secures $222,000 Funding to Expand Fleet in Rwanda

Until the arrival of the Safaricom-led consortium in 2022, which was a strategic move to boost competition, Ethio Telecom enjoyed a monopoly over Ethiopia’s telecom market for decades.

Ethio Telecom remains the dominant force

Despite this, Ethio Telecom remains the dominant force, with an impressive market share of over 94.5% as of June 2024. The company attributes its market dominance to high customer satisfaction and a broad range of high-quality services available nationwide.

While other sectors seem to welcome foreign capital, the Ethiopian government remains protective of the telecom sector, which it considers critical to national interests. This is a contrast to expectations that Ethiopia would fully open its doors to external capital as part of its economic reform process.

In addition to Ethio Telecom’s IPO, the Ethiopian Investment Holdings (EIH) plans to list other major state-owned entities, including the Ethiopian Shipping and Logistics Services and the Ethiopian Insurance Corporation.

The ESX, which recently raised $26.6 million to facilitate its launch, is expected to list over 10 companies by 2025.

The exchange has attracted investment from international institutions such as the Nigerian Exchange Group and COMESA’s Trade and Development Bank Group.

Although foreign participation in the IPO is restricted, these investments signal growing international interest in Ethiopia’s financial sector.

Follow us on social media for more tech news:

- Facebook: Today Africa

- Instagram: Today Africa

- Twitter: Today Africa

- LinkedIn: Today Africa

- YouTube: Today Africa Studio