Egypt-born FlapKap raises $34 million pre-series A to scale SME financing across MENA nearly two years after securing $3.6 million in seed funding, bringing the company’s total funding to $37.6 million.

The round, which includes debt and equity financing, was led by BECO Capital and saw significant new investment from Pact VC, with follow-on contributions from A15, Nclude, QED Investors, and debt financing from Channel Capital.

The fintech company will use the new investment to expand its small and medium enterprise (SME) financing services across the Middle East and North Africa (MENA) and the Gulf Cooperation Council (GCC) region.

Part of the funding will also go towards optimizing the fintech’s technology infrastructure to launch trade finance products designed specifically for B2B businesses.

Founded in 2022

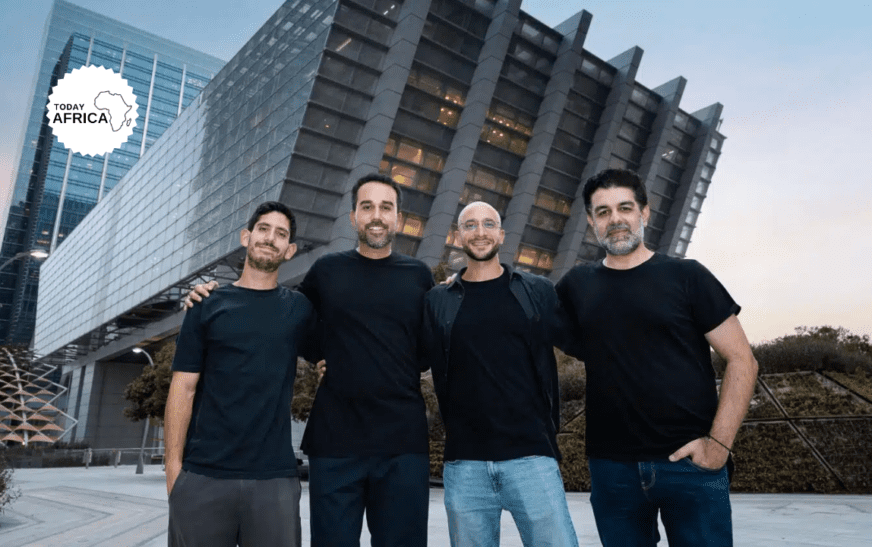

FlapKap, co-founded in 2022 by Ahmad Coucha, Khaled Nassef, Sherif Bichara, and Kunal Harisinghani, provides revenue-based and embedded financing solutions to help SMEs — especially those in eCommerce, retail, and restaurant sectors — scale their inventory and digital ads through instant funding, with the flexibility to pay later.

The fintech addresses several financial challenges for these businesses, most of which have limited access to traditional bank loans or venture capital, by streamlining the loan approval process.

“The growth in data has made it easier than ever to support SMEs,” said Coucha, FlapKap CEO and Co-founder

“This investment will support our continued growth in the UAE and Egypt and further our expansion into the rest of the GCC.”

Data-driven company

The platform’s data-driven approach integrates unconventional data sources from eCommerce sites, social media, payment gateways, and bank accounts to assess applicants.

The fintech platform uses AI-powered models and open banking to provide accurate underwriting while lowering operating costs.

The Abu Dhabi-based fintech, which has since expanded its services to support a broader range of online and offline SMEs, claims that it can evaluate, approve, and provide prospective companies with offers in less than 48 hours after they sign up.

Read Also: Telegram’s New Moderation Policy Could Target Illegal Content in Private Groups

SMEs represent up to 90% of all businesses in most MENA countries, yet many struggle to secure the financial support needed to grow. The UAE-headquartered fintech addresses this by automating the lending process.

FlapKap aims to continue to address a major challenge in the MENA region, where the SME financing gap is estimated at $180 billion, per the International Finance Corporation. So far, the platform says it has doubled quarter-on-quarter originations and disbursements over the past two years while building a solid network of merchants across Egypt and the UAE.

Leave a comment below and follow us on social media for more tips and updates:

- Facebook: Today Africa

- Instagram: Today Africa

- Twitter: Today Africa

- LinkedIn: Today Africa

- YouTube: Today Africa Studio