Remittances to Africa are a vital lifeline for millions of families on the continent and play a crucial role in the economies of many African nations. They are generally used to cover essential expenses such as healthcare, education, housing, and small business investments, thereby directly impacting the recipients’ quality of life.

According to a World Bank report, remittances to sub-Saharan Africa reached $54 billion in 2023, underscoring their importance in the region’s economic development. For instance, in countries like Nigeria and Ghana, remittances contribute as much as 5.7% and 6.4% of GDP, respectively.

However, sending money to Africa has traditionally been plagued by several challenges. Sending money to the continent sometimes consumes up to 8% of the total amount sent, significantly reducing the money received by families in need.

Traditional transfers can take up to a week to be processed, causing unnecessary delays that can be critical, especially in emergencies. There’s also a lack of transparency regarding fees, making it difficult for users to accurately estimate how much recipients would get.

Until recently, the remittance market was dominated by financial institutions like MoneyGram and Western Union, but recent developments in the fintech space have spurred competition and innovation. One of the startups driving these developments is TransferGo, a Lithuanian startup.

TransferGo’s Solution for African Remittance

TransferGo was founded in 2012 and was born out of the founders’ personal frustrations with transferring money across borders while running an import-export business in Europe.

After struggling with high transfer costs and delays, the founders figured out a way to get money home by bypassing the banking system and were soon offering the service to others. Today, more than seven million customers globally use TransferGo to send money home. In 2022, it expanded its coverage to Nigeria, Ghana, and Morocco.

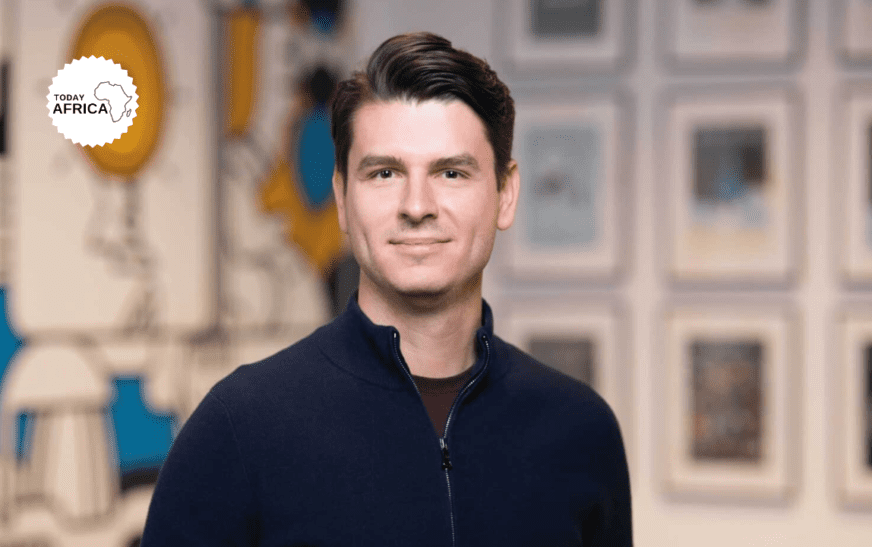

On a recent visit to Nigeria, Co-founder and CEO Daumantas Dvilinskas spoke with Techpoint Africa, sharing some of the company’s goals in Africa.

“Our vision is that Africa’s GDP will be greatly supported by remittances in one way or another, and we’re here to remove and decrease the cost of that as much as we can.”

With remittance costs in sub-Saharan Africa one of the highest globally, TransferGo’s success in reducing the cost of transfers positions it favourably. In Europe, Dvilinskas believes that it has reduced the cost of remittances by as much as 95% through what he refers to as a local in, local out strategy.

Rather than send money across borders, it receives money from the originating country and pays out of pocket in the recipient’s country. Payout options include cards and bank accounts, while it plans to integrate payouts into mobile money for its African markets. This approach also enables it to guarantee instant payouts to users.

Remittances in Africa Are Not a Zero-sum Game

Despite the entrance of new players from Africa to the space, Dvilinskas maintains that there’s still immense potential to grow the pie in the remittance space and points to the fact that remittances through unofficial channels are estimated to be at least 50% higher than official figures.

“Ultimately, it’s such a huge market; it’s not a zero-sum game. As long as we get people to go digital, everybody is expanding the market. I think it’s going to be years and years until we run out of money to be made in Africa.”

An important factor in TransferGo’s ability to keep remittance costs low lies in its insistence on not dealing with cash, but even with the majority of transactions done in Africa taking place using cash, Dvilinskas is not worried.

While he recognises that years of conducting transactions using cash would not change instantly, he explains that TransferGo is more concerned with getting more people to use its solutions in the hope that the speed and convenience it offers serve as a motivation to abandon cash.

“A lot of customers are [used to] cash because of habits, so what we’re saying is, ‘Hey, try this.’ What we’re seeing is that if you offer a trusted, reliable, instant solution, it accelerates the transition from cash to digital. So our job is to offer payout methods that are convenient for the user but are digital.”

For the markets it currently serves, he notes that TransferGo has not had to do much user education as it has launched just as the digitisation of financial services in these markets became mainstream.

In the past four months, monthly transaction volumes in Nigeria have increased to $20 million, while it continues to witness an uptick in both demand and usage in markets such as Ghana and Morocco.

Successful Regulators are Consistent and Reliable

Nigeria’s fintech sector is perhaps the most regulated in the country, but regulations have not always gone down well with fintechs. Having begun operations in Europe, TransferGo is no stranger to operating in regulated environments.

While he welcomes regulations, Dvilinskas notes that the most important qualities of a regulator are reliability and consistency. Knowing what to expect from a regulator frees up businesses to operate confidently and shores up investor confidence in the region. He adds that regulatory uncertainty also leads to unintended consequences, such as remittances passing through unofficial channels.

“The regulators that I’ve seen do better are those that have very consistent and reliable policies that they execute very methodically. You know what to expect and that the regulation and changes are simple and clear to understand.”

While a proactive approach by startups has been encouraged by stakeholders, he maintains that the onus lies on the regulator to maintain an open mind and be willing to engage startups when necessary.

Having recently raised $10 million, TransferGo is expanding its coverage and product offerings cautiously. According to Dvilinskas, its long-term survival is dependent on how well it satisfies customers, but he’s also aware of how difficult that can be.

“As long as you provide amazing customer service and you can build scale, you will have a successful business, but it’s easy to say and difficult to do. Most companies prioritize growth over client services, so a lot of lessons that we actually didn’t have to learn now put us in a very good position.”

Read Also: Mastercard Foundation Convenes EdTech Conference in Abuja