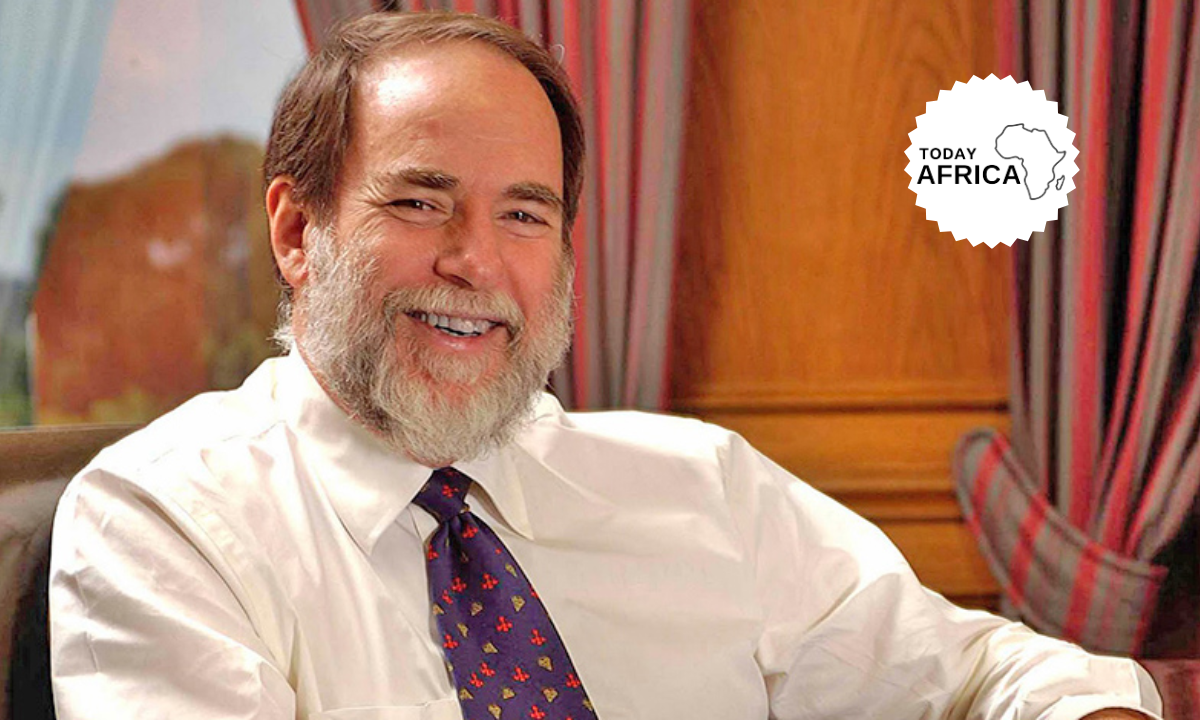

Playing in the investment fiefdom that has come to be his forte over the years. Femi Otedola, the Nigerian billionaire and former owner and chairman of Forte Oil, an oil and gas marketing giant, a Nigerian conglomerate with tentacles in hospitality, energy and power.

He owes his wealth to his years of bold investments, grit and hard work. His username on social media and his signature remain written as Femi Ote$. A double entendre showing his surname, Otedola, and his status as a dollar billionaire.

Femi Otedla Biography

Femi Otedola is a Nigerian businessman, philanthropist, and former chairman of Forte Oil PLC, an importer of fuel products. Otedola is the founder of Zenon Petroleum and Gas Ltd, and the owner of a number of other businesses across shipping, real estate and finance.

Born on November 4, 1962 in Ibadan, the capital of Oyo State, western Nigeria, into the family of the late Sir Michael Otedola, Governor of Lagos State from 1992 to 1993.

In the late 1980s he ran the promoting for his family’s print machine before proceeding to exchange oil based commodities.

Fuel Marketing

In 2003, having distinguished an open door in the fuel retail showcase, Otedola tied down the money to set up Zenon Petroleum and Gas Ltd, an oil based goods advertising and appropriation organization.

As proprietor and executive of Zenon, in 2004 he put N15 billion in downstream framework improvement and procured stockpiling terminals at Ibafon, Apapa just as four payload vessels, adding up to a consolidated complete stockpiling limit of 147,000 metric tons. That year he obtained an armada of 100 DAF fuel-big hauler trucks for N1.4 billion.

By 2005 Zenon controlled a significant portion of the Nigerian diesel showcase, providing fuel to the greater part of the significant producers in the nation including Dangote Group, Cadbury, Coca Cola, Nigerian Breweries, MTN, Unilever, Nestle and Guinness.

In March 2007 it was declared that ten banks had endorsed a coordinated advance of US$1.5 billion (N193.5 billion) to Zenon as working funding to assemble the biggest premium engine soul storeroom in Africa.

Soon thereafter Zenon procured a 28.7 percent stake in African Petroleum, one of Nigeria’s biggest fuel advertisers.

Investing in banks

Zenon likewise contributed over the monetary part, turning into the biggest investor in various Nigerian banks including Zenith Bank and United Bank for Africa (UBA). Just as diesel, Zenon additionally turned into a significant player in the lamp oil showcase.

In 2012 Zenon was among various organizations named in a report into a supposed fuel appropriation trick. As indicated by the report Zenon owed the legislature $1.4m.

It was additionally revealed that Farouk Lawan, the Nigerian official who arranged the report, had evidently been recorded gathering $500,000 of an alleged absolute aggregate of $3m from Femi Otedola to expel Zenon from the rundown.

It in this way developed Otedola had recently detailed Lawan’s badgering and requests for pay-offs to the State Security Services, who had organized a sting activity. Lawan was accused of debasement in February 2013.

African Petroleum

In 2007 Otedola was selected administrator and CEO of Africa Petroleum through the obtaining of a controlling stake in the business. In December that year he by and by procured a further 29.3 percent of the organization for N40 billion. A merger of this individual holding with Zenon’s carried Otedola’s all out stake to 55.3 percent.

Following Otedola’s entrance into the organization African Petroleum’s offer cost rose forcefully, expanding the market capitalisation from N36 billion to N217 billion of every a half year.

In 2008, because of open worries over the accessibility and valuing of lamp fuel, African Petroleum propelled an activity to soak the market and sell the fuel at N50 per liter from in excess of 500 help stations across Nigeria.

Otedola in March 2009 turned into the second Nigerian after Aliko Dangote to show up on the Forbes rundown of dollar designated very rich people, with an expected total assets of $1.2 billion.

In October 2009 Otedola reported a transition to overhaul African Petroleum’s melted oil gas (LPG) stockpiling terminals in Lagos, Kano and Port Harcourt.

Troublesome monetary conditions brought about by the droop in world oil costs and credit crush of 2008–09 drove African Petroleum to record a misfortune in 2009.

Forte Oil

In December 2010 African Petroleum rebranded, changing its name to Forte Oil Plc. Otedola did a rebuilding of the business, concentrating on innovation and improved corporate administration. Strong point Oil came back to benefit in 2012.

In 2013, as a major aspect of the Federal Government’s push to change Nigeria’s weak force area, Otedola financed 57% of Forte Oil auxiliary Amperion Ltd, which procured the 414 MW Geregu Power Plant for $132 million.

Read Also:

- Adaora Umeoji, Zenith Bank’s First Female GMD/CEO

- Koos Bekker, the South African Billionaire Tech King

Strong point’s improved money related position and broadening into influence age brought about a 1,321 percent ascend in its offer cost during 2013. The primary portion of 2014 saw the organization’s pre-charge benefit more than twofold year-on-year to 4.19 billion naira ($25.7 million).

Income development for the entire year was 33%. In November 2014 Otedola came back to the Forbes rich rundown having dropped off it following the fall in share cost during 2009.

In September 2015 Forte Oil sold 17 percent of its value to Swiss ware broker Mercuria Energy Group, giving Forte access to worldwide item advertises. The arrangement was thought to have given Otedola an expected $200 million.

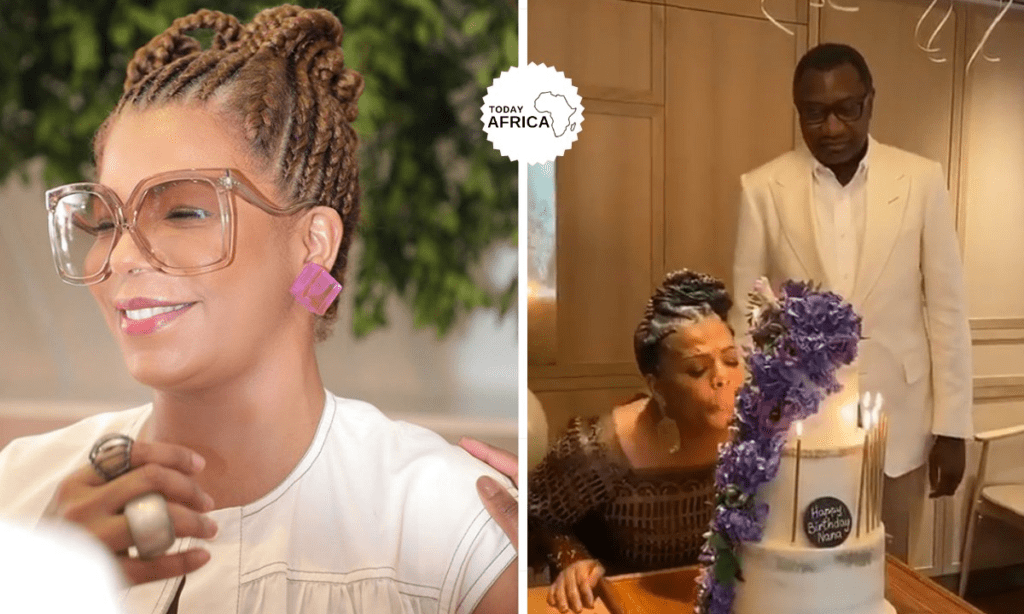

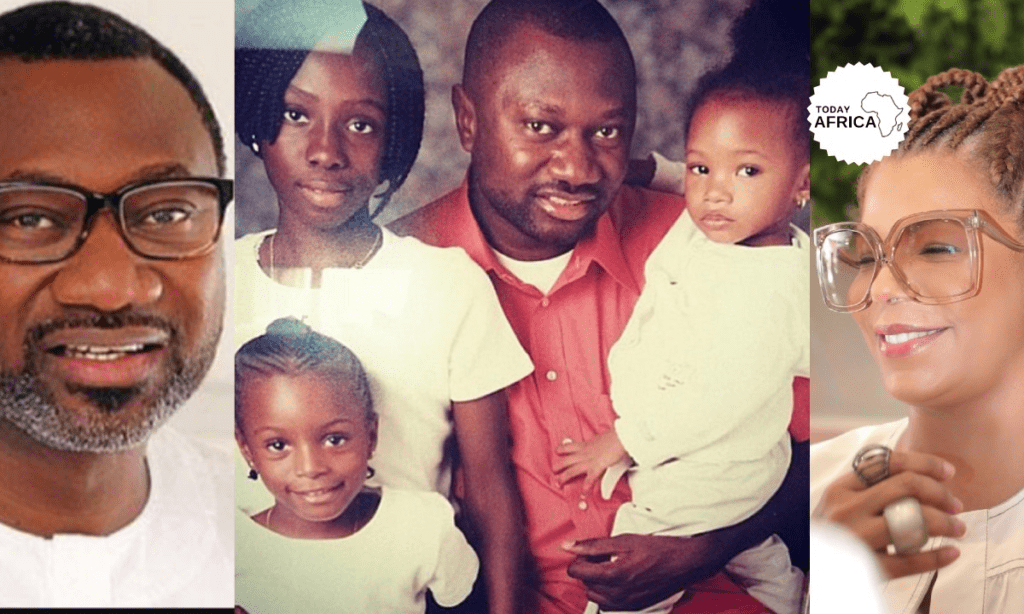

Femi Otedola’s Family

Otedola once said in an interview that his family while growing up was close-knit and fun. His dad, Michael Otedola, returned to Nigeria in 1959 and worked in the media, oil sector and then established a printing press after which he became Lagos state governor in 1992.

He is the second of his parents’ four boys who grew up in a close family in Ibadan, where they were born, and then later to Lagos. Although their father is an indigene of Epe Town in Lagos State. This upbringing definitely rubbed off on his relationship with his wife and children.

He is happily married to his lovely wife Nana Otedola, and together they have four wonderful children. He has residences in Lagos, Dubai, Abuja, London, and New York City.

Tolani Otedola, the only child of Femi Otedola’s first ex-lover, Olayinka Odukoya, is Femi’s first daughter. She prefers to maintain a low profile as opposed to the other two sisters.

DJ Cuppy, also known as Florence Otedola, is a music producer, DJ, and Nigerian tourism advocate. She also served as the official DJ for Nigerian President Muhammadu Buhari’s inauguration in May 2015.

Temi Elizabeth, DJ Cuppy’s younger sister, is a fashion blogger and aspiring fashion designer and his son, Fewa.

Femi Otedola Net Worth

In 2008, a shipment containing one million tons of diesel set sail, heading for the shores of Nigeria. The owner of the vessel, Femi Otedola, Chairman of Forte Oil, a petroleum and power generation company, had grown the company to one of the largest in Nigeria.

Otedola had about 93 percent of the diesel market on his fingertips. All of a sudden, oil prices collapsed, and he had over one million tons of diesel on the high seas, and the price dropped from $146 to $34.

That was only the beginning of his problems. The naira was subsequently devalued, and interest began to skyrocket.

When the dust settled, Otedola had lost over $480 million due to the plunge in oil prices, $258 million through the devaluation of the naira. A further $320 million due to accruing interest, and then finally $160 million when the stocks crashed.

Otedola was now $1.2 billion in debt. He sought solace in the only thing that had set him on the path to discovering oil, destiny.

Just after the global banking crisis had struck, the Nigerian government established the Asset Management Corporation of Nigeria (AMCON) to buy up distressed loans. Otedola’s loan was sold to AMCON, by the bank he blamed for his challenges.

The banks had to shave off about $400 million from the debt leaving Otedola $800 million in the red. AMCON offered him a restructuring deal, which Otedola declined. He opted instead to repay what he owed and start all over again.

So they got a reputable firm to value his assets. Otedola had about 184 flats, which he gave up. He was the largest investor in the Nigerian banking sector, he gave up that too, he was also a major shareholder of Africa Finance Corporation, and I was the Chairman of Transcorp Hilton.

Femi was a shareholder in Mobil Oil Nigeria Limited, the second-largest shareholder in Chevron Texaco, Visafone, and several companies which they valued, and he had to give up to repay the debt.

Otedola now had only two properties, his office space and a 34-percent stake in African Petroleum, which he rebranded to Forte Oil in 2010.

In 2014, Otedola bounced back to reclaim his place on the Forbes rich list and currently has a net worth of $1.8 billion, according to the FORBES wealth unit.

Investments and Positions

In 1994 Otedola built up CentreForce Ltd, spend significant time in the fund, ventures and exchanging. He is likewise the proprietor of Swift Insurance.

Otedola is CEO and leader of SeaForce Shipping Company Ltd and was at one point Nigeria’s biggest boat proprietor subsequent to broadening authority over the dissemination of diesel items. One of his ships, a level bottomed shelter vessel with a capacity limit of 16,000 metric tons, was the first of its sort in Africa.

In January 2006 Otedola was named a non-official chief of Transnational Corporation of Nigeria Plc, a multi-sectoral combination set up in 2004 by then-President Obasanjo to react to advertise openings requiring overwhelming capital interest in Nigeria and across sub-Saharan Africa. He held this post until February 2011.

Otedola has made various land ventures, remembering a N2.3 billion securing for February 2007 by Zenon of Stallion House in Victoria Island in Lagos, from the Federal Government. The next month he was designated executive of the Transcorp Hilton Hotel in Abuja and entrusted with driving its extension and move up to a seven-star office.

He is the proprietor of FO Properties Ltd. Otedola has been accounted for to be a significant agent of the People’s Democratic Party and is said to have contributed N100 million to President Obasanjo’s re-appointment costs in 2003. He was a nearby partner of President Goodluck Jonathan.

Otedola has filled in as an individual from the Nigerian Investment Promotion Council (NIPC) since 2004, and that year was delegated to an advisory group entrusted with creating business relations with South Africa.

In 2011 Femi Otedola was delegated by President Goodluck Jonathan to Nigeria’s National Economic Management Team.

Femi Otedola ventures into the world of cement

Otedola has ventured into the world of cement as he acquired shares worth an impressive N6 billion in Dangote Cement Plc, Premium Times reports, citing sources.

This latest addition to his diverse investment portfolio comes at a time when Dangote Cement has soared to new heights. Surpassing Airtel Africa to become Nigeria’s leading company by market capitalization, currently valued at a staggering N8.35 trillion.

The shares, strategically procured in Mr Otedola’s name, highlight his continued influence in shaping Nigeria’s corporate space.

Dangote Cement, Sub-Saharan Africa’s largest cement maker, has showcased remarkable performance, boasting an 81.4% return in the last 52 weeks and holding 17.04 billion outstanding shares.

The majority of these shares, approximately 85.8%, are under the control of Dangote Industries Limited, overseen by Africa’s wealthiest individual, Aliko Dangote.

It’s noteworthy that Dangote Cement engaged in two tranches of share repurchase between 2020 and 2022, buying back 166.9 million shares to fortify its stock valuation.

Already holding a significant stake in Geregu Power Plc, a power-generating company with a market value of N1.2 trillion, Femi Otedola has proven his versatility in navigating various sectors.

Though a lot of criticisms have trailed Otedola’s acquisition of Dangote Cement shares, many see it as a smart move to expand his diverse investment portfolio, which not only reflects his dynamism and strategic acumen but also solidifies his position as one of Nigeria’s most influential and savvy business leaders.

Controversy

Bribery and corruption

In 2012, Femi Otedola was reported by reliable media houses to have given bribe to Boniface Emenalo and Farouk Lawan who was at then, the Chairman of the House Committee on Fuel Subsidy Regime, “integrity group” a sum of $620,000.

The reason reported by witnesses as pertains the actions of Femi Otedola was that he wanted the name of his company removed from the list of firms indicted by Farouq Lawan’s committee for abusing the fuel subsidy regime in 2012 .

Farouk Lawan and Boniface Emenalo were at risk of going to prison if found guilty of receiving money from Femi Otedola as receiving of bribe by a government official is an offense punishable by Imprisonment.

On 2 February 2013, Both individuals Farouk Lawan and Boniface Emenalo were charged to court by Independent Corrupt Practices and other related Commission (ICPC). Their trial was at the Capital Territory High Court in Abuja to face a seven-count charge of bribery, an offense that violates Section 10 (a) (ii) of ICPC Act, 2000 and punishable under Section 10 of that same Act.

Farouk Lawan pleaded not guilty, and initially so did Boniface Emenalo; however, events at the court of law took an unforeseen turn as Boniface Emenalo eventually admitted he was guilty and, in fact, had received several bribes on behalf of Farouk Lawan.

Be that as it may, new evidence provided by the persecution was very concrete as Femi Otedola was caught red-handed in a video of him giving a bribe and Farouk Lawan accepting it.

Canadian escorts

In December 2016, Otedola was embroiled in a controversy where two Toronto-based sisters—Jyoti and Kiran Matharoo—reportedly tried to extort him by cyberbullying and blackmail, claiming they had evidence of Otedola cheating on his wife that they would post on a notorious sex-scandal website.

The sisters dispute Otedola’s account. According to their account Jyoti met Otedola, straight out of University, in 2008. He whisked her and Kiran to Nigeria, and began an affair with him.

They acknowledge that his gifts enriched them, as did gifts from other wealthy boyfriends, but dispute they ever engaged in blackmail, or even demanding gifts.

Otedola and Dangote

In 2009, his company Africa Petroleum ran ads in the media accusing his now close friend, Aliko Dangote, of using his companies to run down his company’s stock by 80% in weeks through “certain unwholesome and unethical activities.”

The move which dipped Otedola’s net worth from $1.2bn to $500m was seen as a personal attack on him by Dangote who had outbid him by $800m to acquire Chevron Nigeria’s portfolio (Texaco) in 2008.

Looking at Otedola’s long history of investment in Nigeria’s business environment, the analyst concludes, “For me, we need more Otedolas, that is, more people that are willing to make the Nigerian bourse and business environment more vibrant and exciting”.

Philanthropy

Otedola has made a few gifts to the Michael Otedola University Scholarship Scheme, which was set up in 1985 to give oppressed understudies in Lagos State access to advanced education.

In 2005 Zenon gave N200 million to the plan’s reserve. Since its commencement the plan has profited in excess of 1,000 understudies.

In 2005 Otedola made a N300 million individual gift to the culmination of the National Ecumenical Center – Nigeria’s essential spot of Christian love – in Abuja.

In 2007 he was among a gathering of benefactors who gave N200 million to the State Security Trust Fund in a drive to diminish wrongdoing in Lagos State.

Soon thereafter he gave N100 million to the Otedola College of Primary Education in Noforija, Epe. In 2008 he gave N80 million to the Faculty of Agriculture at the University of Port Harcourt.

Lessons to Learn from Femi Otedola

- Bright idea born in the dark: Mr. Otedola’s eureka moment happened on the back of the perennial blackout that has plagued most African economies. The energy crises caused Mr. Otedola to see the gap in the market and supply gas and oil to power the nation. This a perfect example of turning life’s lemons into lemonade.

- We all have a value: According to Forbes, Otedola’s net worth is a staggering $1.8 billion. With great wealth comes great responsibility, and judging from Mr. Otedola’s charitable investments, he is shouldering that responsibility quite well.

- Nothing wrong with competition: One of Otedola’s mantras is “I do not have friends or enemies, only competitors”. To succeed in the cutthroat world of business, you need to outperform the competitor. According to Otedola, his loss, among other factors, occurred because he did not have the proper business structure in place and the banks failed to effectively advise him on the best way to run his empire. Instead, they only focused on the profits.

- Always have two options in any situation: Whether you think you can do it, or whether you think you cannot, you are right on both accounts. For Otedola, his options were to commit suicide or to weather the storm, and fortunately for us, he chose option B. Remember, your perspective is vital in difficult times

- Invest in assets: When he lost everything, he recovered by selling over 180 flats and houses to pay off his debt. Assets are resources with an economic value that we acquire to provide a future benefit. Spend your money wisely.

References:

![Biography of Tony Elumelu [Investor, Entrepreneur, & Philanthropist]](https://todayafrica.co/wp-content/uploads/2023/12/Blue-Simple-Dad-Appreciation-Facebook-Post-1200-×-720-px-7-1.png)