Choosing the right business structure is one of the most critical decisions you will make when starting your business. This decision will significantly impact your business’s taxes, liability, and overall management structure.

But, it can be overwhelming to determine which structure is the best fit for your business. That’s why we’ve written this blog post to help you navigate the process of choosing the right structure for your business.

Without further ado, let’s jump into it.

What are Business Structures?

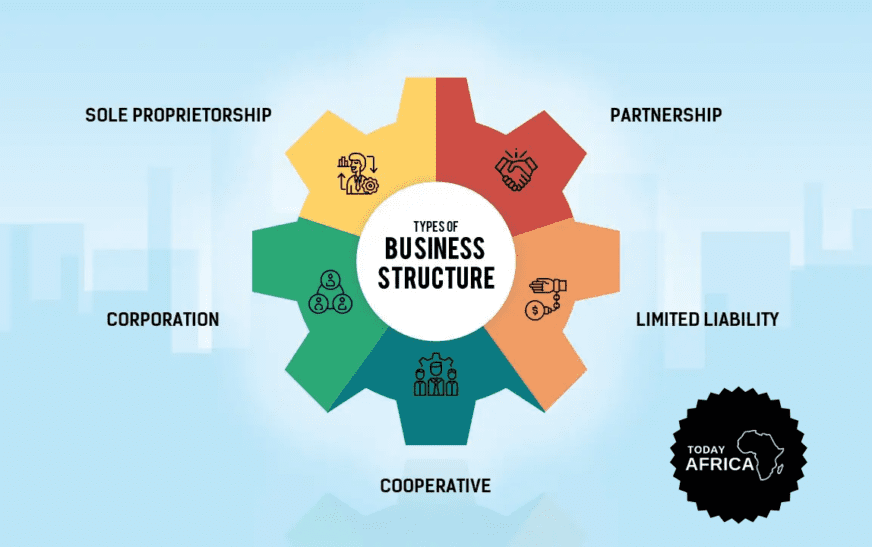

A business structure is the legal framework within which a business operates. It defines the relationship between the owners, the business itself, and the laws governing its operations. The most common business structures include:

- Sole Proprietorship

- Limited Liability Company (LLC)

- Corporation

Each structure has distinct legal, tax, and operational implications, which can significantly affect how your business runs and how much you pay in taxes.

What is a Sole Proprietorship?

A sole proprietorship is the simplest and most common business structure. It is owned and operated by a single individual, who is responsible for all aspects of the business. There is no legal distinction between the owner and the business, meaning the owner receives all profits and is liable for all debts and obligations.

Advantages

- Easy to set up: A sole proprietorship is easy to establish. You may not need to file any paperwork to start, aside from local business licenses and permits.

- Complete control: The owner has complete control over all business decisions. This autonomy can lead to a faster decision-making process.

- Tax benefits: Profits from the business are reported on the owner’s personal income tax return, simplifying the tax process. This means you may benefit from certain deductions available to sole proprietors.

- Low costs: There are typically low startup and operating costs, making it an affordable option for many entrepreneurs.

Disadvantages

- Unlimited liability: The owner is personally liable for all debts and liabilities incurred by the business. This means that personal assets (like your home or savings) can be at risk in the event of a lawsuit or debt.

- Limited capital: Raising capital can be more challenging, as sole proprietors cannot sell shares and often rely on personal funds or loans.

- Limited lifespan: The business may cease to exist upon the owner’s death or decision to close the business, making succession planning important.

- Less credibility: Some customers and vendors may perceive sole proprietorships as less professional or credible than LLCs or corporations.

What is a Limited Liability Company (LLC)?

A Limited Liability Company (LLC) is a hybrid business structure that combines the benefits of a corporation and a sole proprietorship. An LLC provides limited liability protection to its owners (called members) while allowing for flexible tax treatment and management structures.

Pros of LLC

- Limited personal liability: One of the primary advantages of an LLC is that it shields the personal assets of the owners. If the business faces legal action or accrues debt, only the assets of the business are at risk, not the owners’ personal property.

- Flexible tax options: By default, LLCs are taxed as pass-through entities, similar to sole proprietorships. However, LLCs have the flexibility to elect taxation as an S Corporation or C Corporation, which can provide tax benefits depending on the size and profitability of the business.

- Fewer formalities: Unlike corporations, LLCs do not require a formal board of directors, shareholder meetings, or detailed record-keeping, making them easier to manage.

- Management flexibility: LLCs offer flexibility in management structure. They can be managed by their members (owners) or by appointed managers.

Cons of LLC

- Formation costs: LLCs typically require more paperwork and fees than a sole proprietorship. Most states charge a filing fee to form an LLC, and some states have ongoing annual fees and reporting requirements.

- Self-employment taxes: In most cases, the income of an LLC is subject to self-employment taxes, which can result in a higher tax burden compared to a corporation that distributes dividends.

- State-specific rules: LLC regulations vary from state to state, so it’s important to understand your state’s specific rules. Some states may impose additional taxes on LLCs, like franchise taxes or annual report fees.

Read Also: 13 Proven Strategies to Scale Your Small Business

What is a Corporation?

A corporation is a legal entity separate from its owners (shareholders). It can enter into contracts, sue and be sued, and is responsible for its own debts and liabilities. Corporations can be either C corporations or S corporations, with different tax implications.

Advantages

- Limited liability: Shareholders are generally not personally liable for the corporation’s debts and liabilities, protecting personal assets.

- Access to capital: Corporations can raise funds by issuing shares of stock, making it easier to attract investors and venture capital.

- Perpetual existence: A corporation continues to exist independently of its owners, allowing for easier transfer of ownership through the sale of stock.

- Tax benefits: Corporations may have access to certain tax deductions and benefits not available to sole proprietorships or LLCs.

Disadvantages

- Complex formation: Establishing a corporation requires more paperwork, including filing articles of incorporation and obtaining various licenses and permits.

- Double taxation: C corporations are subject to double taxation—once at the corporate level and again on dividends paid to shareholders.

- Regulatory requirements: Corporations face strict regulations and must hold annual meetings, maintain corporate minutes, and file reports with the state.

- Reduced control: Shareholders may have limited control over the business, as decisions are often made by a board of directors.

Comparative Analysis

| Feature | Sole Proprietorship | Limited Liability Company (LLC) | Corporation |

|---|---|---|---|

| Liability | Unlimited liability | Limited liability | Limited liability |

| Taxation | Pass-through taxation | Flexible taxation | Double taxation (C Corp) or pass-through (S Corp) |

| Control | Full control | Shared control | Board of directors |

| Formation Cost | Low | Moderate | High |

| Ongoing Requirements | Minimal | Moderate | High |

| Funding Options | Limited | Moderate | Extensive |

| Lifespan | Limited to owner’s life | Limited in some states | Perpetual |

Read Also: Leveraging Royalties as a Tool for Business Financing This Year

Factors to Consider When Choosing a Business Structure

- Liability protection: Assess your tolerance for risk and whether you need personal liability protection. If your business is high-risk, consider an LLC or corporation.

- Tax implications: Understand how each structure will affect your taxes. Consult a tax professional to evaluate which option provides the most beneficial tax treatment for your situation.

- Control and management: Consider how much control you want over your business. Sole proprietorships offer complete control, while corporations require shared decision-making.

- Cost and complexity: Evaluate the costs and administrative burdens associated with each structure. If you prefer a straightforward approach, a sole proprietorship may be best.

- Future growth and funding: If you plan to seek outside funding or grow your business significantly, an LLC or corporation may be more suitable due to their ability to attract investors.

- State regulations: Different states have varying regulations and fees for forming and maintaining each business structure. Research the laws in your state before making a decision.

Conclusion

Choosing the right business structure is a critical decision that can have long-lasting implications for your business. A sole proprietorship is an excellent choice for those seeking simplicity and complete control, but it comes with significant personal liability.

An LLC provides limited liability protection and flexible tax options, making it a popular choice for many entrepreneurs. A corporation offers extensive funding opportunities and limited liability but comes with increased complexity and costs.

Ultimately, the best business structure for you will depend on your specific circumstances, including your business goals, risk tolerance, and financial situation. It’s often wise to consult with legal and financial professionals to help you navigate this important decision.

With the right structure in place, you’ll be better positioned to grow your business and achieve your goals, ensuring a solid foundation for your entrepreneurial journey.

Leave a comment and follow us on social media for more tips:

- Facebook: Today Africa

- Instagram: Today Africa

- Twitter: Today Africa

- LinkedIn: Today Africa

- YouTube: Today Africa Studio