Egypt’s Lucky ONE secures $3M in a convertible bond round to expand its credit platform and facilitate entry into new regional markets over the next two years.

The funding round saw participation from existing investors, including Lorax Capital Partners, KEM, and DisrupTech Ventures.

With this funding, the fintech also aims to enhance its path to profitability by the first quarter of 2025.

This development aligns with Egypt’s effort to promote financial inclusion and provide improved access to credit services for the underbanked population on the heels of initiatives, including a new digital payment system, establishing the National Financial Inclusion Strategy, and launching a national financial literacy campaign.

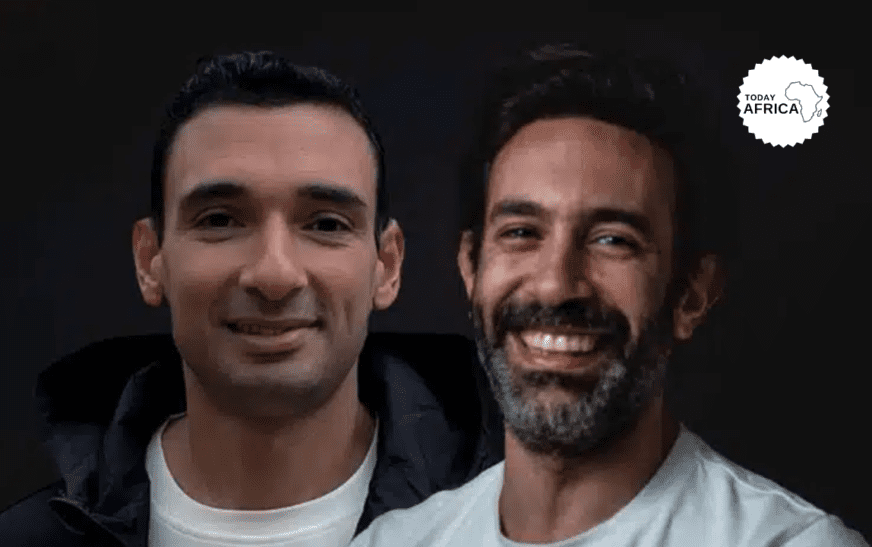

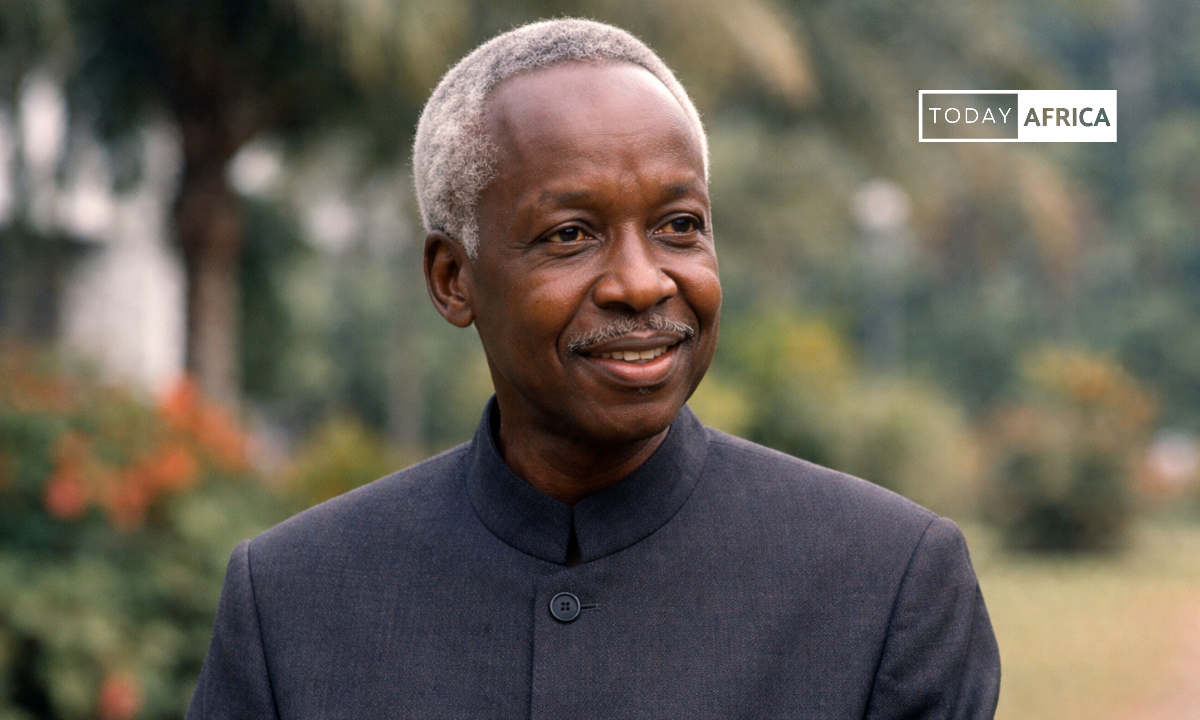

Ayman Essawy (Chairman), Momtaz Moussa (CEO), and Marwan Kenawy founded Lucky ONE in 2019. The fintech offers a range of financial services including credit, discounts, and cashback focusing on serving the unbanked population and empowering them through accessible and affordable financial solutions.

According to Forbes, the fintech works with a merchant network of over 20,000 local and international stores and provides instant credit approval, with more than 13 million registered users and 300,000 issued cards. Over the years, the fintech has raised $50 million in funding and has operations in Morocco.

Read Also: MTN Nigeria Renegotiates Tower Deal with IHS and ATC

Essawy emphasised the fintech’s commitment to profitability and outlined plans for regional market expansions over the next 24 months. He stated that these initiatives will establish it as a significant player in the evolving Egyptian fintech sector.

Purpose of the new funding

Moussa also acknowledged that the new funding will fuel the fintech’s growth plans and support its mission of providing accessible consumer credit solutions to underbanked Egyptians.

He highlighted the company’s strategy to leverage its solid collection processes and low default rates to scale its consumer credit offerings effectively and efficiently. Speaking on the path to sustainable profitability, he said “Lucky is leveraging its solid collection processes and low default rates to ultra-scale our consumer credit vertical to ensure timely and effective offerings,

Mohamed Sayed, General Manager of Lucky ONE also expressed that the momentum the fintech has gained over the past five years has prepared it to take the next step towards offering a comprehensive range of financial services.