Flutterwave shuts down Barter to focus on its businesses and remittance solutions. In 2017, Pan-African fintech startup Flutterwave partnered with Visa, a global payments company to launch Barter (then GetBarter), a consumer payment product to facilitate personal and small merchant payments within Africa and across its borders. The product provided a virtual card service.

Following a year-long hiatus to revamp its offerings, Flutterwave has announced the permanent closure of Barter. Citing evolving customer needs and shifting market trends, the platform will cease operations entirely on March 12.

In an email, the fintech informed users that after the date, their Barter accounts will become inactive, and accessing their funds will be impossible.

Barter’s virtual card service faced challenges in the past. In July 2022, a temporary halt occurred due to an update with its card provider. Recall that Flutterwave initially launched the product alongside Visa, but it later switched to Mastercard. Startups who had previously issued virtual Visa dollar cards provided by Barter told Bendada.com that it was not reliable enough.

“While retail remains important to us, our immediate focus is optimising services for businesses and remittance solutions,” the fintech said.

This news follows the recent temporary shutdown of Disha, another platform owned by Flutterwave. This move aligns with their shift towards enterprise and remittance solutions. We’ve seen this focus with the rebranding and global expansion of their Send into markets like Canada, the US, and India.

Read Also: LemFi Hires Ex OPay COO For China Expansion

“Everything is growing very fast,” said founder and CEO Olugbenga Agboola. “Send app is growing at over 100%, and our portfolio of business is growing massively. So we have been growing massively YoY now.”

In the United States, it has acquired money transmission licences enabling it to provide remittance in 29 states in the United States.

Before Flutterwave Shuts Down Barter

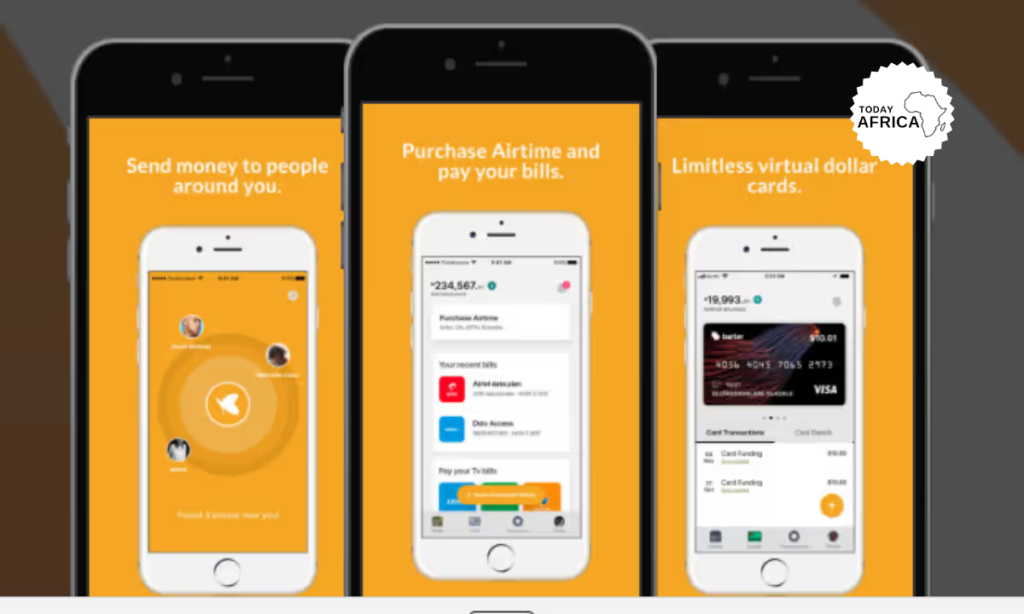

Before the shutdown of Barter, the app was a lifestyle payment solution that operated globally with an initial user base in Nigeria, Kenya, Ghana, and South Africa.

The app enabled Visa cardholders to initiate payments within the app and make online and mobile payments by attaching their card details to their GetBarter app profile while non-card carriers can generate a virtual card upon registration.

The app also enabled Visa users to receive money from any Visa card account either domestic or international. With the shutdown of Barter, Flutterwave is doubling down on proven winners by focusing on remittance and enterprise. In October last year, the fintech disclosed that its biggest revenue driver was the enterprise segment. In comparison, Barter only accounted for about 1% of the company’s $2 billion worth of transactions.

Over the last few years, Flutterwave has doubled down on consumer payment services with new products such as Send App and Swap. The fintech remittance product aims to capture a significant market share in Africa’s $54 billion remittance market. It however remains unclear how much progress both products have made.

Frequently Asked Questions

1. What is Flutterwave and how does it work?

Flutterwave provides multiple Software Development Kits (SDKs )and plugins, and businesses can use its payments APIs to build customizable payments applications. In addition, the company’s collaboration with PayPal allows users around the world to make purchases from African merchants using the service.

2. Who is Flutterwave CEO?

Olugbenga Agboola is the co-founder and CEO of Flutterwave. Prior to co-founding Flutterwave, Olugbenga contributed to the development of fintech solutions at several tech companies and financial institutions such as PayPal, Standard Bank, among others.

3. Does Flutterwave refund money?

For card refunds, it takes between 3-15 business days. For account refunds, it takes between 24-48 business hours. If you are unable to fulfill an order after a customer has paid for a product or service on your Flutterwave business, you can make refunds directly from your dashboard.

4. How long does Flutterwave withdrawal take?

The payment will be subsequently moved to their Available Balance or paid directly into the business bank account within 5 days from when the payment was made.

5. How does send by Flutterwave work?

You can start sending money using the Send App as soon as you complete the sign up process. To set up a transfer: Enter the transaction details (the amount to be sent and the recipient’s country/currency). Choose a delivery method (how you want the recipient to receive the funds).

6. Can I use Flutterwave in USA?

They can now enable transfer of money to and from 29 U.S. states and to African countries and beyond.

7. Can I receive money from send by Flutterwave?

With Send App, you can easily make instant money transfers to recipients in various countries around the world. This includes transfer options to local bank accounts, Mobile Money wallets, Barter accounts, as well as cash pick-up locations.

8. Can I send money from Nigeria to UK with Flutterwave?

With a wide range of payment options, including card payments, bank transfers, and mobile wallets, Flutterwave enables you to accept payments from customers across multiple channels. Sending money with Send by Flutterwave from Nigeria to the UK is straightforward and transparent. And yes, at amazing rates.