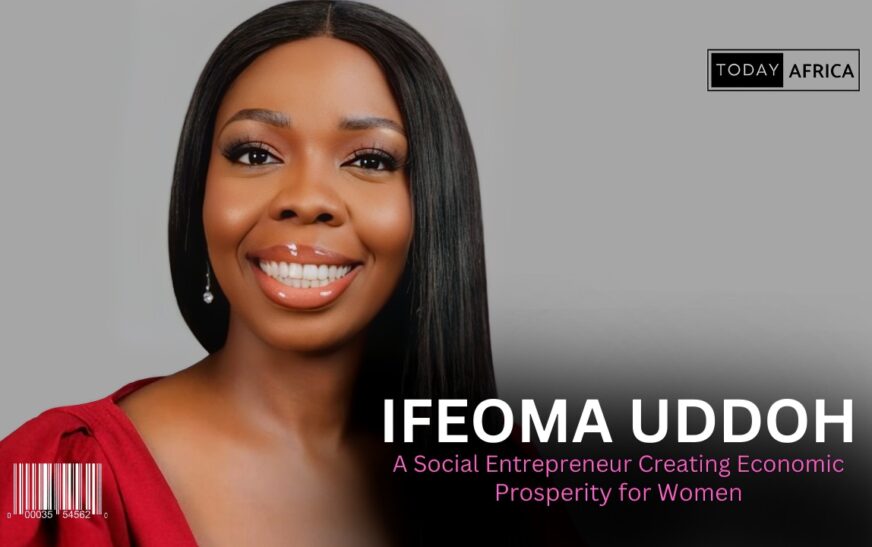

Ifeoma Uddoh is a social entrepreneur and the founder of Shecluded, a female-focused venture company dedicated to creating economic prosperity for women through access to financial services.

Her journey is inspirational, especially considering the personal experiences that motivated her to start Shecluded. Her story of witnessing her mother’s struggles after her father’s death and the subsequent challenges women face in accessing credit resonates with many and adds a human touch to her entrepreneurial venture.

The challenges Ifeoma Uddoh faced as a female founder and CEO in the fintech space, particularly the need to upskill in technical areas and the initial skepticism around a female-focused company, highlight the resilience required in such a competitive industry. Her approach of using personal funds to prove the concept and attract initial clients is a testament to her commitment and belief in the cause.

The insights into fundraising strategies, emphasizing the importance of revenue as a sustainable source of funding and leveraging personal and professional networks, provide valuable lessons for aspiring entrepreneurs, especially in regions where access to funding can be challenging.

Tell Me More About Yourself and What Your Company Does

My name is Ifeoma Uddoh. I run a female-focused venture company called Shecluded. We provide access to credit for female entrepreneurs in Nigeria and some parts of Africa.

What Inspired You to Start Your Company and Why Focus on Women?

My dad died when I was nine and my mom was 27 with four kids. And she had to become a businesswoman. And in that journey, I quickly realized that she was turning down opportunities because she couldn’t get credit. She was considered high-risk. And very quickly, when I grew up, I was working in a funding company and I quickly realized that women were not getting funded.

So for me, it was a problem because 50% of the Nigerian population are women. And if you don’t get funding, you’ll always, always be small. So I decided to say, you know what, why don’t I start a company where the only customer is female and see what it will do.

And that’s just what I did. I just said, you know what? If I start a company and the only customer is female, I’ll think about smart, creative ways to reach them. And that’s what I did.

What Challenges Have You Faced as a Female Founder and CEO in the Fintech space? And How Did You Overcome Them?

Challenges that I faced. One is, I mean, it’s not peculiar to women. As a non-technical founder, I had to quickly upscale in some technical areas, at least to be able to deliver the milestones that I want at different times.

Another challenge that I faced was the fact that at the time when we started Shecluded the whole women thing had not started. So, proving to people that just starting a company focused on women was a bit new at the time. Convincing them, talking to them was a challenge.

But I think that one thing that worked and made me successful was that I also put in my own money. Like we proved, and we got our first 100 clients with my own funding, with my own savings. So I think after a while, it was just easy for people to see our attraction and all. With any other entrepreneur in Nigeria, talents, unclear government policies, and funding.

From Our Research Funding in Africa is a Challenge in Africa. What Other Strategies Did You Use to Raise Fund for Your Venture?

I’m one of the advocates that any business that the customer can not fund in Africa in the long-term, it’s going to be a problem. So for me, the sweetest source of funding is revenue. So we started generating revenue and I started by pitching to investors.

The first person invested in me, I worked with him together at a company I used to work with before he left his own company. And when I was pitching to him he said yeah, I found out that my sister struggled to also get credit and that’s why I did that investment.

Going to your network. So it means that you have to be very intentional to make sure that you work in some places. Or you need to network properly to make sure that your network is able to link you up and put in good words for you with the people that you intend to raise funds from. I think that helped me.

So my first seed investment came from someone I worked with. My second seed investment came from a friend that met somebody that said, hey, I want to invest or do something like this. And she said, hey, I know somebody. So, yeah, those two people, they’re my third investor. I worked with him also in PWC.

So without thinking about it. People that I invested in my company are people that I worked with. So the two of them, I worked with them directly. The other one person, somebody that I know professionally did an intro and she said that’s fine. She wanted to do something with this.

What Do You Look Out For When Granting Women or Businesses Owned by Women Access to Growth Loans?

We have a checklist of criterias that we look at including how much they make, their debt to income ratio, alternative data, which association are they in, how is their business, how much support can we give them except access to credit.

So over time, we’ve been able to narrow down to what our ideal customer looks like. And it’s a continuous iteration and learning process, especially with the way that the Nigerian economy is always unstable. So we find ourselves always refining and refining who we want to lend to at different points just in response to the macroeconomics that is happening in Nigeria and how it’s impacting business owners.

Beside the Growth Loans Which Other Services Do You Provide?

We do a number of upscaling activities. In fact, we’ve done so many. We’ve done two major ones, one with GIZ and another one with CFYE. GIZ is Germany and CFYE is Netherlands. So what makes us special is the fact that apart from giving these women capacity, we can actually give them money.

A lot of people give women capacity and no money. We can give you assets to capacity and money. We also have a co-working space where they come in, hang out with their peers and just share ideas. They also come in here to make videos about the things that are important to them. We make it in a way that we want to be able to provide both the soft and the hard things that we think that they need to be able to do wow or do better.

How Do You Approach Your Marketing and Can You Highlight the Tactics That Have Been Successful for Your Business?

When I see a lot of people with marketing, I’m usually like, gosh, you put all this money in marketing. We’ve been very fortunate in the sense that I think when we started, I learned from Jumia and I think some other tech companies, to see that sometimes marketing can stimulate a fake market.

And I wanted to know if this was really a need. So the first thing I did was to say, how do I market without any marketing? And I quickly went to Instagram and I learned from, I think it was Jessy Njoku’s tweet then that says that, I can’t remember it, but the strategy would just go for the heads of the homes.

So I looked for associations that had a lot of women and I made sure that I tried to do business and please the head woman. Once I pleased them, I’m in. So I always look for creative ways to make sure our marketing spend is competitive, I think that’s the word. But I mean, now that we’ve scaled to a certain level.

We are also thinking about branding, positioning, and other things. So at different points, I knew it was first of all, how do I make sure the customer acquisition was low? But at this point is how do I make sure that our brand is seen as a brand?

How Do You See Technology Affecting or Impacting the Fintech Space?

I’ve seen a lot of people fixating on technology in Nigeria. And just by playing in Nigeria and having been in the tech space for the last seven or ten years. I realized that there would just be a few technology disruptions that will change the way that people do things. So when we’re talking about the Inter-switch, the Paystack, there’ll be few of them. But there will always be problems that, or technology enabled startups that solve problems.

Nigeria is still an informal offline country. And the way that I see it is when I’m thinking about disruption with technology is to say, how do everyday community local problems, how do we use technology to enable it and make it more efficient. I feel that those are the only type of technology that will scale in Nigeria. I think when you think about the likes of some of the big POS companies that have come up or that have become big names over time.

You’ll see that they just targeted the informal sector. And maybe for some of them, the thought process was to give them their money quickly, and reduce the time it takes them to go to the bank. That’s practical. We need to say, how does technology solve everyday problems for the small people that are already informal.

Ifeoma Uddoh, as One in the Fintech Space What Do You Think About the Unbanked in Nigeria?

When I think about the unbanked and why they stay unbanked, I think it’s because they don’t see any need for it. They don’t see how it’s going to solve their problem or increase their revenue and stuff. And the truth about it is that social cultural barriers and misinformation might be a bit of it there.

But aside from keeping their money in the bank, which is what they feel that their next door neighbor is doing for them. They don’t see any other use of the bank. And I feel that that’s where financial literacy comes into play. And just be able to, first of all, accept the fact that maybe most of them will never convert, but make sure that a few of them will convert. I think that what happened with the cash swap in 2023, was that a lot of people were forced to go digital.

And some of them stayed that way, but some of them have gone back to their normal way. So I feel that just saying I want to bank the unbanked and going to meet people that have been keeping their money under their bed for centuries and they are happy that I want to bank you.

It’s not a good enough value proposition. It means that we need to find what is of value to them. And change the narrative from saying we want to bank the unbanked to saying that we want to do whatever it is that we find will get them into the banking sector.

Click to read part two of this interview.