Interswitch promotes the adoption of the feature by businesses and consumers, allowing them to take advantage of its ease, security, and adaptability while demonstrating a dedication to ongoing innovation and providing customers with the newest and safest payment alternatives.

Elizabeth, OPay’s Vice-President of App and Cards, stated that the “Pay with OPay” two-step payment method will provide customers with faster and more secure transactions.

Remember that there have been cases of fraudulent activity on OPay, where scammers open accounts using innocent people’s personal information and then use that account to commit fraud.

Unauthorised withdrawals from OPay agents’ accounts escalated the problem to the point where they had to organise protests.

Thus, the fintech implemented a new security feature that requires customers to provide a National Identification Number (NIN) and a Bank Verification Number (BVN).

Meanwhile, Interswitch has actively pursued partnerships to bolster its operations in Africa over the years.

In June 2023, the fintech company announced a collaboration with Equity Bank in Uganda, aiming to provide customers with quicker and more cost-effective access to banking services across over 650 Interswitch-enabled ATMs nationwide.

Further, in October 2023, Interswitch announced its support for Google Pay through a collaborative effort that combines Interswitch’s extensive merchant network with the user-friendly efficiency of Google Pay’s digital wallet platform.

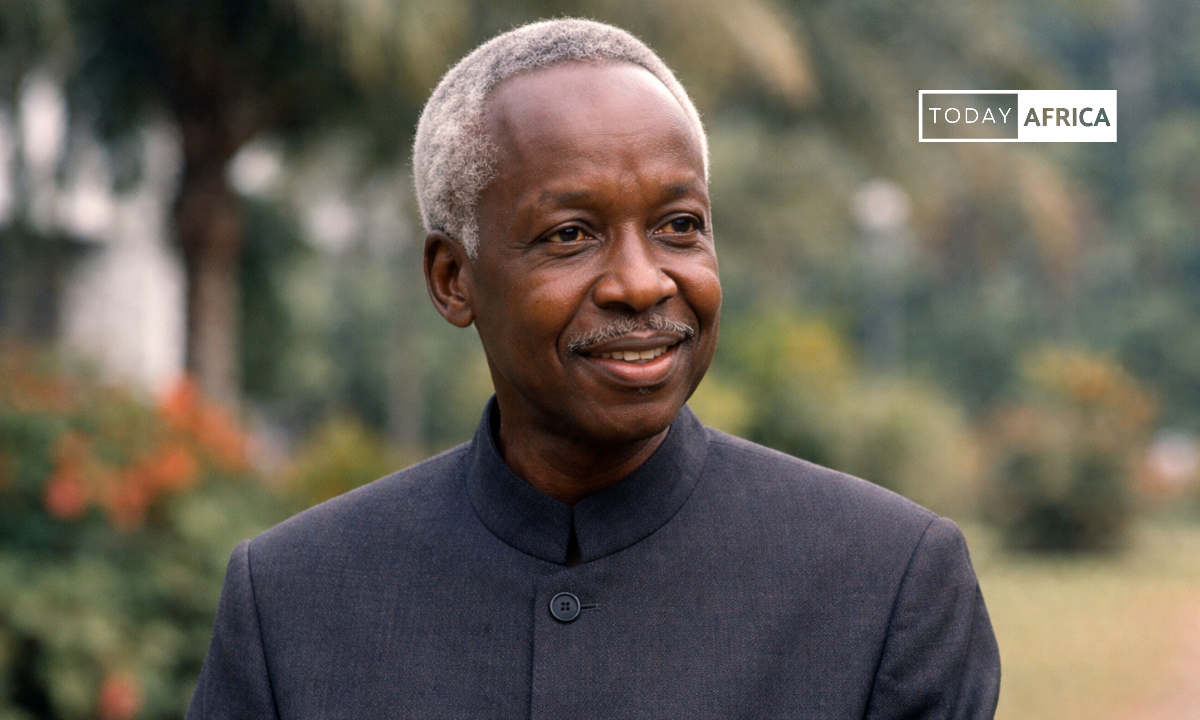

Muyiwa Asagba, Managing Director of Digital Commerce and Merchant Acquiring (Paymate) at Interswitch, said this new development demonstrates the fintech’s commitment to introducing innovations that improve the digital payment experience.

Also Read: Kenyan Agritech, Shamba Pride, Raises $3.7 Million Pre-Series A