Jumia’s stock price decline raises concerns over secondary share sale. The stock price dropped significantly on Thursday, August 8, 2024.

Extending the decline that started two days prior after the eCommerce company reported 2024 second quarter revenues of $36.5 million. F falling short of the projected $41.7 million.

In the last three weeks, Jumia’s share price rose to $13, boosting its market value to over $1.3 billion. However, those gains have now been completely lost.

Jumia stock was trading at $4.91 before the market opened on Thursday, marking a market capitalization of $496 million.

This setback is expected to hinder the eCommerce platform’s plans to sell 20 million American depository shares over the next couple of weeks, as reported by TechCrunch earlier this week.

With its share price at around $5.70 when the stock market opened on Tuesday, the company was set to potentially raise around $100 million through its new share offering.

However, the final projection will depend on the prevailing share price, which dropped to $4.9 on Thursday. Putting a question mark around Jumia’s initial plan to take advantage of July’s rally to sell new shares.

Not the first time they are opting for secondary share sale

The sales of secondary shares would have increased the e-tailer’s cash position, with $92.8 million already in cash and cash equivalents.

This is not the first time the company has opted for this approach. From 2020 to 2021, Jumia raised nearly $600 million by selling secondary shares.

Read Also: Hohm Energy Faces Financial Struggles Despite Raising $12M in Two Years

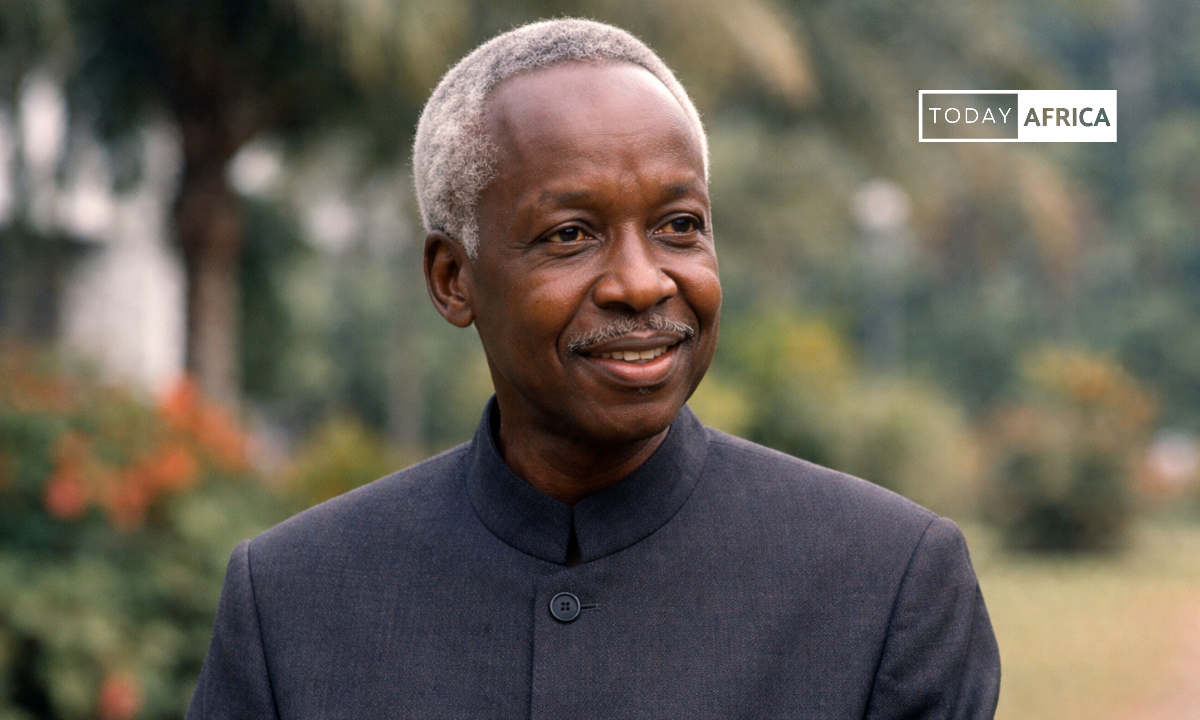

Francis Dufay, Jumia CEO, noted the platform is raising this money to accelerate its operations following its major progress with cost management and efficiency.

“The new funding will be used to expand our supply chain network, particularly by enhancing logistics to reach smaller cities and broadening our overall network. We also plan to invest in technology, focusing on marketing and vendor technology, which we believe will significantly impact growth,” Dufay explained.

If the company succeeds in raising money, the company says it’ll shift its focus towards growing and putting more to “scale the company faster and break even faster.”