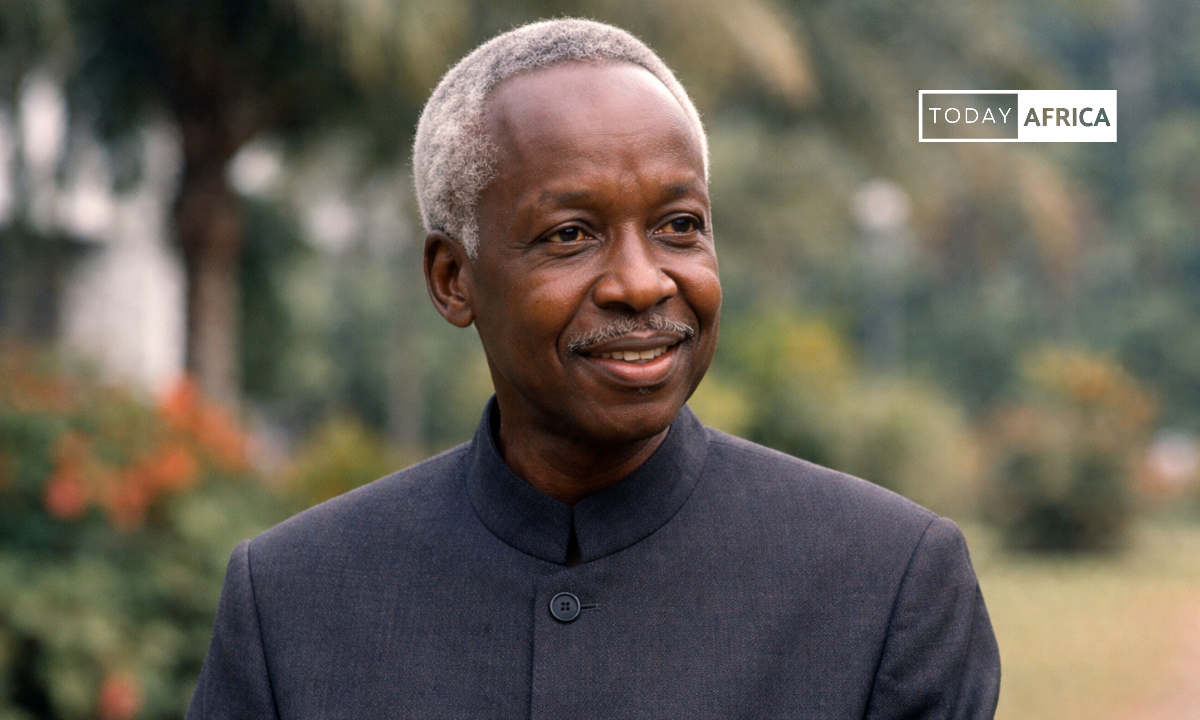

MultiChoice plans cost-cutting measures amid revenue and subscriber declines for the fiscal year ending March 2024. The South African media firm’s CEO, Calvo Mawela, reportedly stated that the company can still realise a lot of cost savings without retrenchments.

According to a MyBroadband report, the company intends to reverse the decline and has set a savings target of R2 billion by 2025 to improve its financial position.

Furthermore, these savings will be applied across the board, focusing on “big ticket” items such as satellite leases. Also, contracts for this move will soon be up for renegotiation.

The company is also developing digital products that can be added to its existing pay-TV base to increase revenue. “Our strategy to grow these additional revenues is no longer just a vision, it is gaining real traction,” said Mawela.

MultiChoice Group has released its operational performance for the fiscal year ending March 2024 (FY24), which shows a 9% decrease in total active subscribers. Subscribers fell by 13% in Nigeria, Angola, Kenya, and Zambia, while South Africa saw only a 5% decline due to a “strong focus on retention initiatives.”

The decline was attributed to the depreciation of local currencies in these markets, “Rest of Africa,” which reduced the Group’s USD revenues by 32%.

The Group’s organic revenue increased by 3%, but reported revenue fell 5% to ZAR 56.0 billion (£3.04 billion). Similarly, subscription revenue increased by 2% organically but declined by 7%.

Target for Showmax

Mawela claimed that its streaming service, Showmax, is on track to generate $1 billion in revenue within five years. Moreover, in its recent operational report, Showmax achieved a 22% organic revenue growth to ZAR 1.0 billion (£54.475 million), despite incurring some trading losses.

Canal+, which has been on a share acquisition spree in MultiChoice and is in talks to buy the company out for up to R35 billion, has also recently stated that it has no plans to change MultiChoice’s brands after the takeover, emphasising its high brand value.

Read Also: Egyptian Bill Payment Startup ‘Sahl’ Raises $6m Funding Round

According to reports, Peter Takaendesa of Mergence Investment Managers believes MultiChoice’s new revenue streams are insufficient to offset the challenges facing its traditional pay-TV business, which is experiencing structural and cyclical pressures.

However, he stated that Canal+’s offer to acquire MultiChoice shares for R125 per share has become the primary driver of the share price, which is a positive development for shareholders.

According to the report, South African pay-TV operations have faced significant challenges, exacerbated by the start-up losses incurred to fund Showmax.