Today, you are going to learn what pre-seed venture capital (VC) funds are, and how they can fuel the growth of the early stage of your startup.

And the 11 VC Companies Investing in African Startups.

Understanding Pre-Seed VC Funds

The startup journey can be challenging, particularly in the early stages when founders often struggle to secure funding. This is where pre-seed VC funds come into play.

Pre-seed funding bridges the gap between self-funding (bootstrapping) and more formal seed rounds.

It provides the necessary capital for founders to refine their ideas, build prototypes, and validate their business models.

The Importance of Pre-Seed VC Funds

1. Financial fuel for initial development

Pre-seed funds offer startups the financial resources required to transform their concepts into tangible products or services. These funds can cover essential expenses like product development, market research, and hiring key team members.

2. Access to expertise and networks

Beyond financial backing, pre-seed funds often provide mentorship, guidance, and access to an extensive network of experienced entrepreneurs, industry experts, and potential investors. This support ecosystem can significantly enhance the startup’s chances of success.

3. Validation and traction

By securing pre-seed funding, startups gain validation from professional investors who see potential in their ideas. This validation can pave the way for subsequent funding rounds and attract additional investors, creating a snowball effect of momentum and traction.

Key Characteristics of Pre-Seed VC Funds

To optimize your chances of securing pre-seed VC funding, it’s crucial to understand the key characteristics that investors seek:

- Investment size: Pre-seed VC funds typically provide smaller investments compared to later-stage funding rounds. Amounts can vary significantly, but they generally range from $50,000 to $1 million, depending on the startup’s needs and the investors’ appetite.

- Equity stake: In exchange for their investment, pre-seed funds typically acquire equity in the startup. The exact percentage depends on various factors, such as the startup’s valuation, market potential, and the level of competition.

- Investor expectations: While investors understand the inherent risks associated with early-stage ventures, they seek potential high-growth opportunities. Startups should demonstrate their ability to scale, disrupt the market, and deliver substantial returns on investment.

Finding the Right Pre-Seed VC Fund

When embarking on the search for pre-seed VC funding, keep these tips in mind:

1. Research and due diligence: Thoroughly research different pre-seed funding to identify those aligned with your startup’s industry, niche, and growth trajectory. Look for funds that have a track record of investing in companies similar to yours.

Click to get access to 200 Pre-seed Funding Companies Providing Support and Funding

2. Build connections: Attend industry events, startup conferences, and networking sessions to connect with venture capitalists and potential investors. Building genuine relationships and leveraging your network can help open doors to pre-seed VC funds.

3. Prepare a compelling pitch: Craft a compelling pitch deck and business plan that clearly outlines your vision, market opportunity, competitive advantage, and growth potential. Also, highlight how pre-seed funding will propel your startup toward future milestones.

VC Companies Investing in African Startups

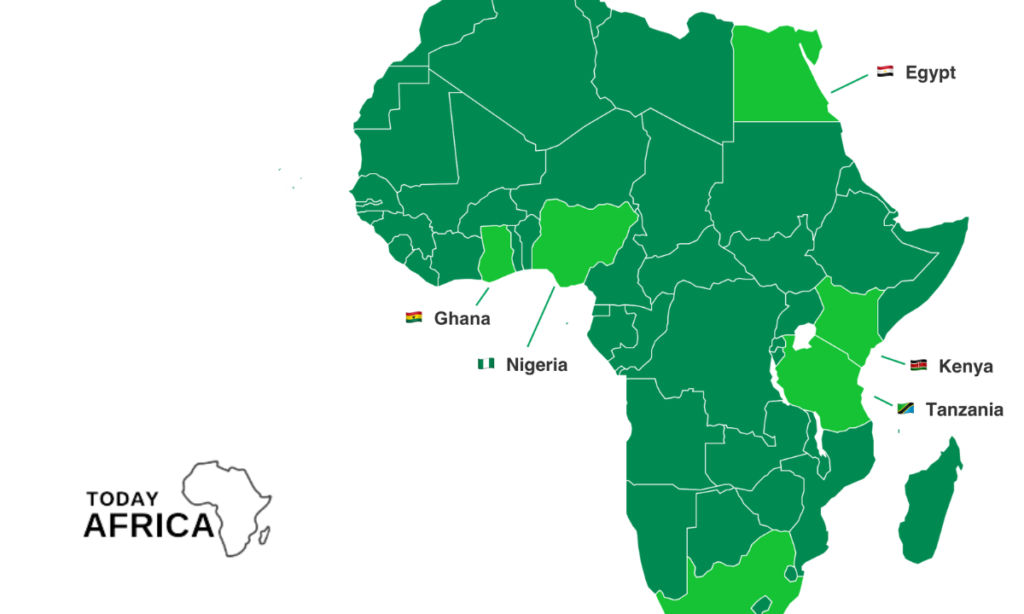

As the African startup ecosystem continues to flourish, venture capital (VC) firms are recognizing the immense potential and investing in promising startups across the continent.

Here are some notable VC companies that have shown a keen interest in African startups:

1. Y Combinator

Y Combinator (YC) is a renowned startup fund and program that provides seed funding, mentorship, and resources to early-stage companies.

Since its establishment in 2005, YC has invested in nearly 3,000 companies globally, including several African startups.

Notable African companies backed by YC include Flutterwave, Paystack, Cowrywise, MarketForce, Kudi, WaystoCap, WorkPay, Healthlane, Trella, 54gene, CredPal, NALA, and Breadfast.

YC’s programs and resources offer ongoing support to founders throughout the lifespan of their companies, making it a significant player in Africa’s startup ecosystem.

2. Techstars

Techstars operates one of the largest startup networks globally, with a wide range of resources, mentors, and programs aimed at supporting startups.

With over 54 programs in 14 countries, Techstars has invested in numerous African tech startups.

Their accelerator program provides intensive mentorship and funding opportunities, with around 90% of startups going through their program successfully raising funds.

Techstars has made investments in various African countries, including Nigeria, South Africa, Kenya, Mauritius, Tanzania, Ghana, Benin, Rwanda, Egypt, and Uganda.

3. Convergence Partners

Convergence Partners is an investment management firm focused on Africa’s Telecommunication, Media, and Technology (TMT) sector.

With an asset base exceeding $500 million, Convergence Partners actively invests in private equity and infrastructure opportunities across sub-Saharan Africa’s technology and digital sectors.

Some of the companies in their portfolio include 4DI, Dimension Data, and Fibreco.

The recent launch of the Convergence Partners Digital Infrastructure Fund further underscores their commitment to driving digital inclusion across Africa.

4. Ingressive Capital

Ingressive Capital is a venture capital firm based in Lagos, Nigeria, that targets tech-enabled startups in Nigeria, Kenya, Ghana, and Egypt.

With a focus on early-stage investments, Ingressive Capital aims to provide funding and support to founders solving significant problems in Africa.

Their portfolio includes successful African startups like Paystack, Bamboo, Tizeti, 54gene, and many others.

5. Ventures Platform

Ventures Platform is a VC firm headquartered in Abuja, Nigeria, that invests in early-stage mission-driven founders building capital-efficient platforms in Africa.

They provide funding, mentorship, and support to innovative companies across the continent.

Ventures Platform has made investments in various African startups, including Printivo, Tizeti, Thrive Agric, crowdForce, Accounteer, Kudi, and Reliance HMO.

6. Century Oak Capital

Century Oak Capital is a venture capital firm that specializes in early-stage investments in Europe and Emerging Markets.

Based in Vaduz, Liechtenstein, the firm focuses on investing in various verticals, including ride-hailing/transportation, fintech, AI-based travel tech, food delivery, Q-commerce, healthcare, circular economy, Edtech, and others.

While primarily focused on Europe, Century Oak Capital has also made investments in African startups.

Some of the African startups in their portfolio include Alpha Direct, Charger, Finaccess, Kuda, MVX, Payhippo, Trove Finance, and TruID.

7. QED Investors

QED Investors is a venture capital firm that specializes in investing in early-stage, disruptive financial services companies.

Founded in 2007, QED Investors was initially a fintech operator before transitioning into fintech investing.

The firm is based in Alexandria, Virginia, and has a strong focus on supporting pragmatic disruptors who represent the future of finance.

While QED Investors primarily invests in companies outside of Africa, they have made an investment in TeamApt, an African startup. TeamApt is a Nigerian fintech company that provides financial services and infrastructure solutions to businesses.

8. Harlem Capital

Harlem Capital is a venture capital firm with a long-term vision of investing in 1,000 diverse founders over 20 years.

The firm focuses on startups operating in various sectors, including business products, business services, healthcare, software, media, robotics, wellness, prop-tech, fintech, and hr-tech.

Founded in 2015, Harlem Capital aims to provide capital to minority and women founders.

One of the African startups in their portfolio is Lami, an insurtech company that provides digital insurance solutions.

9. Acuity Ventures

Acuity Ventures is a venture capital firm that invests in early to growth-stage technology companies in Africa.

Leveraging its partners’ strong investment track record in technology and deep data science expertise, Acuity Ventures employs a data-driven strategy to inform investment decisions and support investee companies in realizing significant growth.

The firm focuses on enterprise, soft infrastructure, and platforms that integrate Africa. By providing smart, data-driven decisions, Acuity Ventures aims to support promising startups in overcoming challenges and achieving success.

10. Ajim Capital

Ajim Capital is an early-stage venture capital firm that identifies substantial opportunities in under-capitalized markets across Sub-Saharan Africa.

They believe that these markets offer the best risk-adjusted returns for early-stage investments.

Ajim Capital’s Fund I is a $10 million pre-seed and seed-stage fund that invests in 50 tech startups across Sub-Saharan Africa.

The firm looks for B2B and B2B2C startups with solid teams, post Minimum Viable Product (MVP), and traction.

Some of the challenging problems they seek to address include access to finance, infrastructure, healthcare, education, and more.

11. Seedstars Africa Ventures

Seedstars Africa Ventures is an early-stage venture capital fund that focuses on investing in high-growth companies operating across Sub-Saharan Africa.

With extensive experience and a deep understanding of African entrepreneurship ecosystems, Seedstars Africa Ventures provides smart capital and access to pan-African and international support for entrepreneurs.

They invest in innovative models addressing critical product and service needs, particularly in markets with limited access to capital.

By nurturing partnerships and pathways to exit, Seedstars Africa Ventures aims to support the growth and success of the companies they invest in.

Conclusion

In the ever-evolving startup landscape, pre-seed VC funds have emerged as a crucial catalyst for early-stage success.

They provide founders with the financial backing, expertise, and validation needed to transform their ideas into thriving businesses.

By understanding the characteristics of pre-seed funds and leveraging effective strategies to secure them, aspiring entrepreneurs can navigate the challenging startup ecosystem with greater confidence.