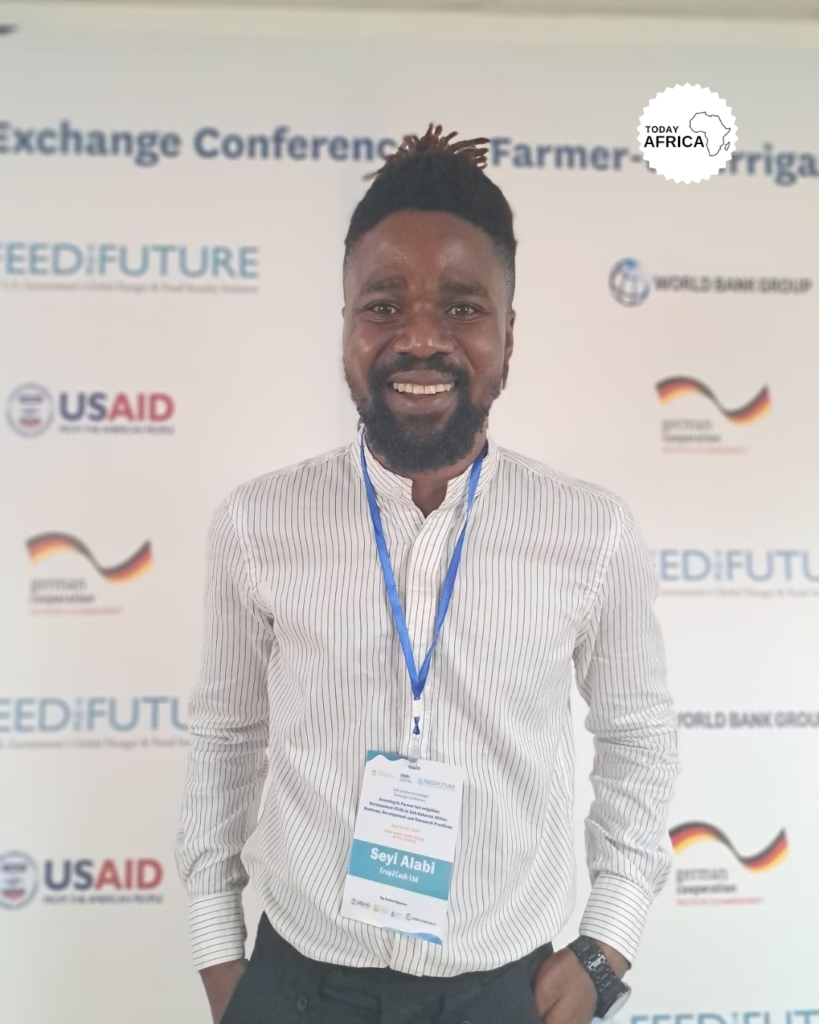

Seyi Alabi is the co-founder at Crop2Cash, a leading Agritech startup is providing famers with financial inclusivity, building their identities and empowering them with tools for success..

As the research lead at Crop2Cash Ltd, Seyi Alabi responsible for overseeing the company’s research and development initiatives, focusing on innovations and practices to improve Crop yield and sustainability. And also in dissemination of knowledge materials and findings in the most readily accessible manner.

Seyi Alabi shared with Today Africa the story of Crop2Cash, how it began, and where they are now.

Tell us a bit about yourself

Seyi is an agronomist first, an agronomist, an agribusiness consultant and I’m the co-founder of Crop2Cash. What I do at Crop2Cash is I lead the innovation design and research team at Crop2Cash. So I’m the head of research. I am responsible for most of the innovations that feed our technological products. So you can just think of me as the Crop in Crop2Cash.

What inspired you people to start Crop2Cash and what problems are you guys solving in the market?

The inspiration behind us starting Crop2Cash was my co-founder Michael. We’re both friends from university, so we’re both from the same hostel and we’ve been friends since our first year in the university.

Michael was the one that approached me with the original idea. He is a computer scientist. I was an agronomist in training then. And then he was like, what problem can we solve in the agricultural sector? And I’m like, how long do you have? Like, how many problems do you think you can solve in the agricultural sector? I can give you a list.

So we started on that. And the first thing we decided to solve was supply chain management and post-harvest loss. That was the first problem we addressed with our innovation. And then we just started from there.

And the idea that started in that little school hostel developed into what is now Crop2Cash today. So basically, I would say it was Michael that inspired the innovation. He basically challenged me to be creative. And that’s what we’ve always been doing.

Can you describe the process of launching Crop2Cash?

Like I said, when we started then, we were just young guys that were very passionate. There was a lot of passion and little knowledge. I would say we grew in knowledge as we evolved in the business. So the funny thing is we did some things first before doing other things.

We had ideas. We’ve had innovations, we’ve been applying for grants without having a registered business. This is very funny. So we got a contract from GIZ. It was for the competitive African rice initiative and we were supposed to develop a supply chain management platform for rice meals across Nigeria.

We got a contract. And the first thing we did there was information gathering. So we sent an invoice hoping to get our payments for the first batch. Mind you, without having a registered business, or a corporate account. So when they were ready to send the money, we sent an individual account.

They have to jump on a call with us, asking, are you guys joking? Imagine being brilliant enough to land a contract, but not being brilliant enough to register your business before even going through all of that. I would say they were very gracious and very patient with us.

They gave us a two-week ultimatum to get our affairs in order because, obviously, they could even arrest them for sending a contract fee to an individual account. We did not know that, but then after then, we registered our business and that was the first step to making things official.

That was when we realized that we have to be very mindful of compliance. And since then we’ve never made that kind of mistake. That happened and then we started developing innovations now that we had business registration, and we basically took an entire course on compliance, how to run a tech company in Nigeria, outside Nigeria.

So right now when it comes to compliance, hosting, and every single thing like that, we are very, very much good at that because we realized how much non-compliance can basically jeopardize your business. So we just take that going forward and we always operate on that modus operandi.

What’s Crop2Cash all about and what do you guys do?

What we do at Crop2Cash is we make formal financing accessible to smallholder farmers. That’s basically what we do in a nutshell. And what I mean by formal financing, it includes financial orientation, financial inclusion and financial assets.

So to me, I feel like a lot of people try to create solutions in a not so suitable manner. It’s more or less like trying to feed a baby solid food from like two months old. There has to be a process. It has to be accessible. It has to be digestible for the farmers.

So one of our innovations is our USSD technology. And it’s basically the USSD code that farmers can dial. We understand that telling a farmer to maybe get a smartphone, subscribe to an internet access on a smartphone, try to maybe download apps off Play Store, Google Store is very cumbersome.

And to some of these farmers, they don’t even have smartphones, they use function phones. And any function phone can dial a code and once you dial the code and you follow the prompts, you get connected to a digital economy, you get access to a sort of wallet account that basically enables you to perform both agricultural and non-agricultural transactions.

So a lot of our farmers call it the farmer’s bank because of this product offering. I don’t think there is any USSD food or USSD-based wallet that can help you buy airtime, which is a basic financial transaction, and at the same time where you can buy insurance, crop insurance, buy cropping fuels, and also get access to advisory.

Read Also: Legal Mistakes to Avoid When Starting Your Startup – Oladimeji Kuforiji

What we do is we bundle e-extension services and agricultural financial services together in a nutshell. And all of this also helps to feed our data bank, which we use to profile our farmers for credits from financial institutions. We understand that there is a lending gap in the agricultural sector in Nigeria right now.

I think the lending gap is about 90%. Banks don’t feel the need to lend to agriculture because they perceive that it’s a risky enterprise. So what we basically do is we derisk this entire process with data based on what the farmers have done with our USSD code and send them to the financial institutions. We don’t tell farmers to bring money because they don’t have the money.

What we basically do is we try to make things as free and as accessible for them as possible. A lot of people might look at it as giving them freebies. We have other revenue models that exclude these farmers because they are underserved.

It’s more or less like telling the beggar to give you money. It sounds very ironic when you think about it. So we try as much as possible to make things easy for these small-holder farmers as possible.

That means you’re targeting the informal sector in the agricultural space, like the farmers in the villages

Yes, exactly. Most of our farmers are in the northern part of Nigeria and they are mostly informally backed, not formal or should I say contract farmers. So they are farmers that own from one hectare to five hectares of land and they cultivate this amount of land.

And basically we just basically support them through their entire crop process. And if some of them are up for financing, they get access to financing. If not, they have other product offerings that we give to them. And that’s basically how we’ve been operating.

What were the challenges that you could face in the early days of Crop2Cash and how did you overcome them?

I already highlighted one of them. Not being knowledgeable enough to navigate the industry. But that changed really fast for us. Because one thing that I and my co-founders pride ourselves on is it makes one look stupid if you keep making the same mistakes.

So once you take a learning from a particular thing, you always look at ways to improve, ways to move forward from that. Not necessarily maybe pinpoint blame or whatever. Just try as much as possible to move forward. Try as much as possible to keep the ball rolling. So we try not to make the same mistakes. That’s one.

The other challenging thing is working with farmers themselves. Most of the time when it comes to lending and financing. Like I said, it’s very interesting. Sometimes having good intentions and your pure intentions is a very good trait to have. But at the same time, you should try not to assume to protect yourself.

What I mean by that is most times when we lend, we try to make it impute financing and not cash financing. Cash can easily disappear, and you might not really have an overview. And it is also part of the lessons that we learned from financial orientation. So sometimes when you give someone cash, you might give the person say the economics of production is like N300,000 and you give the person N300,000 cash.

And the purpose of the cash is to get fertilizer, get this, get that. We are all human beings. Even me, if you give me N300,000 to hold for you right now and you come back in maybe a day or two you tell me to account for the N300,000.

And I might forget about the air time that I purchased with some of the money. So basically to instill financial discipline, we make it impute financing strictly for these small holder farmers.

Another lesson that I would say we learned is, or should I say, the challenge that we face, is we do a lot of monitoring and evaluation, and the core of our operation is in the north. There are the security risks that we incur just to travel to these places. But then those are occupational hazards, but it doesn’t change the fact that it’s a challenge.

There are so many times where we have to keep our GPS tracker on when we are in the car, just to let people at the office know where we are at different intervals. There’s also the risk of navigating the field. I’ve had an accident at a dam once before. It was like a dam and it was supposed to be very shallow and I didn’t know there was a deep part.

Thank God for the improvisational classes and all of that. Those are some of the challenges that we faced on the field, some of the security challenges, security threats that we faced on the field. But then overall, we’ve never had any incidents.

And I think it’s a little bit of being very security conscious and also coupled with, should I say luck. Because you can’t overemphasize the role of luck in some of these things. I’ve been to over 30 states in Nigeria, majority of them in the north.

I have been to most of these threat zones and we’ve worked with farmers there, we’ve deployed innovations there. Basically, those are most of the challenges that we’ve faced.

How did you raise capital for your business?

Two ways actually. Equity funding, which is one of the fastest ways to also lose ownership and also, should I say, sometimes it can be the reason most businesses fail. But then you still have to do a lot of equity financing.

We basically do debt financing from the financial institutions that we work with, that is debt towards the farmers, so most of the risk is not on us. It’s just a risk sharing formula with the financial institutions. So we are immune to that. And we also do lots of grants financing. A lot of our funding has been through grants.

And that is what I try to mostly encourage with entrepreneurs. A lot of entrepreneurs try to shy away from grant financing because obviously for grant financing, you have to show workings and you also have to show proof of certain milestones that you’ve completed before you can access the fund.

So most times when people are scared of work, they shy away from grant financing. But I really enjoy grant financing because when you look at this from a business standpoint, it is free money to get your business done. So why not just do it? All you need to do is be accountable and be open to scrutiny.

That is the only downside to grant financing, which I obviously welcome because my business is compliant in every way and I can easily show proof of what I’ve done, what I will be doing and then get financing for it. So we try to also focus on lots of grants financing and we’ve been very fortunate to secure grants from multiple organizations.

We work with USAID, we’re still working with them. We’ve worked with GFMA, we’ve worked with organizations under CGIAR and trust me, grants financing is just very good for business and also helps you at a very stupendous rate.

There was a grant.that we recently secured with Crop Trust that enabled us to train over 1,500 extension agents at one go. And it was really interesting and challenging at the same time. It basically pushes you to work. And I really welcome it. It’s very instrumental to growth. Grants financing and equity financing is basically how we are able to raise funds.

Read Also: Meet Lusanda Omelo Building Africa’s Largest AI Tools Directory

What is your business model and how does Crop2Cash generate revenue?

Our model is very commission based and the reason why I would say that is because we try to shift most of the cost of some of these products and most of the cost of these activities away from the small farmers that we serve.

So we basically charge a percentage commission on impute and need demand aggregation. What I mean by that is we have different value chain actors, impute providers, insurance partners, and we basically aggregate demands on their behalf.

Take for instance, when we lend to farmers it is in the form of impute financing, we aggregate impute needs and we basically facilitate the supply to the farmers and which are the percentage commission.

And also on credit unlocked, we charge a percentage of every credit recovered from our financial partners. So they basically are responsible for the interest rate, which is their profits. So we basically enter a profit sharing formula. Sometimes it is 40, 60, sometimes it varies.

Basically we help them with monitoring and evaluation and we get a cut of the profits. So our revenue model is mostly commission based. Most partners, we help them with aggregating demand. And the thing about agriculture is it is very interesting when you play at scale. You might look at maybe a 5% margin on imputes, like maybe it’s very small or something.

But when you do that at scale, when you do metric tons of that you start to see returns. So we try to make it commission based just to shift the burden of costs from our farmers. And that’s how we basically operate. Commission based, we charge commission on imputes and also other services. And then we also charge a percentage of credit unlocks.

Since you people launched Crop2Cash, what has worked in attracting and retaining customers?

Two things, how much you’re willing to work. And what I mean by work is, getting to where these customers are. Then number two is your product offering. You see a lot of products, you get users at the beginning, and then after a while, they just stop using it.

So to retain customers, your product offerings have to be very solid and value-based. Our products are readily accessible and you can basically use it on any device. You don’t have the excuse of, oh, because I don’t have internet and I may not be able to interface with your products.

And also we’ve focused a lot on our customer acquisition strategies. So we did lots of traveling to these communities, sensitizing the farmers and also you. People are most likely to adopt your products when you demo it instantly.

So if it is a product that works like magic, what I mean by magic is when you tell a farmer that you can create an account in less than two minutes, if you follow this prompts, and the farmer actually follows this prompts and he sees that he gets an account immediately.

They will find the need to talk about it, even when they get back to their local communities, they’ll basically tell you, oh, this works. When your product works most times, farmers are most likely to use it.

Another good example is our weather advisory products that we launched sometime in 2020 after COVID, which was part of a strategy to reduce crop loss due to flooding and also drought periods. So we use rainfall data to give farmers advice on different parts of their production.

For instance, maybe you’re trying to apply fertilizer today and the rain is going to rain heavily. Don’t apply fertilizer at this time because if you basically apply it at that time and heavy rain comes, it basically washes away your fertilizer. So that purpose is already betrayed and you even done more harm to the ecosystem by putting fertilizer in the water system.

So we deployed that, and there was a particular time where farmers got rainfall advice in the northern part of Nigeria, like, don’t perform this operation at this period. Some listened, some did not.

When it happened and rain fell and everything happened, we got the best user feedback from the farmers that did not listen to the advice because they basically called like, are you guys witches or what? How come you told us it was going to rain and it rained?

I’m like, did you guys go to your field or did you not? We’re not witches, it is technology. So most times when what you’re bragging about works like it is supposed to. It is the best proof of concepts that you can get. And people basically become your champions themselves.

If this works for this person and he knows the value you got for maybe relatively with nothing, they basically use other FinTech platforms. If they can do what they do on those FinTech platforms on your platform coupled with agricultural transactions, they feel the need to talk about it, they feel the need to continuously use it. So that is one thing that has worked for us.

What’s your approach to hiring and building a team?

I would say the best approach to building a team is having the ability to spot potential. At the same time to also spot certain soft skills like collaborative efforts, all of those things while hiring.

Also, our team is actually a team of three founders. We have a third co-founder, Emem, he’s in charge of our operations. Michael leads the team while I’m in charge of innovative development and research. So Emem joined us when we first started the idea. And we met at an Ancathon competition, he was supposed to be a part of another team.

Then he met myself and Michael, and was like, guys I would like to be a part of your team if you don’t mind. And since then, we’ve been partners and co-founders. Emem is much older so he brings that perspective sometimes when we’re working. He basically calls you children when we are having strategy sessions sometimes and maybe I’m trying to get ahead of myself or my co-founder is trying to get ahead of himself.

We just combine a lot of these attributes. He’s also an agri-economist and an agricultural extensionist. So he has that coupled with my knowledge of agronomy and agribusiness and then Michael with his computer science experience. We just perfectly combine it. And that’s what gives us Crop2Cash.

When it comes to hiring, we hire lots of software engineers because lots of our innovations are software innovations. We also have an entire team of customer support associates because we prioritize customer experience and customers should have a point of contact, someone they can easily reach.

We have a marketing team, a business development team, and a financial team. That’s basically how our team is formed. We basically just built our approach to team building: first culture, you have to be able to work in Crop2Cash.

You have to understand what working in Crop2Cash entails. We try as much as possible to operate an open-door policy. Even if someone is not around, you can easily drop a message on Google Space. We, the co-founders, are easily accessible to our team. Anybody can text me at any time, even if you send a text at an inappropriate time. I will try to attend to it even if I’m sleeping, I’ll wake up to it.

So we try as much as possible to keep a very open line of communication. And also we have a well-balanced team. It’s not very obvious in our founding team because the three of us are men, but we have, I think, a 50% female to male ratio in the organization. And we have even more female team leads within the organization.

We have like a 60-40 distribution of things that are female. And that gives us perspective. Like I always say, you think a man is brilliant until you meet a woman that is just like that man. So I prioritize perspective.

And most times when you’re working, especially in the tech space, you are sometimes working with the aggressiveness of a man. And sometimes you just need an additional perspective from different other people.

Also when it comes to strategy, I feel like females champion strategy and also transcending strategy into active tasks and all of that. I also believe in the female mind when it comes to activities like that. So that is basically our team approach. We always look for a balanced team, someone that can balance both culture and work, and it’s actually been very interesting.

Read Also: Meet Ishaq Willson Building Africa’s First AI Property Search Platform

How is Crop2Cash doing today and what does the future look like?

Well today, because we’re in Nigeria, I’ll say we’re doing our best. What the future looks like is, I see us becoming the leading service or software service provider in the agricultural space in Nigeria in the next couple of years.

We are actively working to become industry leaders and that’s basically the goal. Most times I don’t, that is the only goal in my life that I didn’t set like a fixed time frame, it might not sound like a smart goal, but that is the goal actually.

So that is what we’re looking to do. We’re developing innovations, we’re constantly working to also further position ourselves in that particular spot. And also, I didn’t speak about this, we recently launched an AI powered hotline that is toll free for farmers. And basically what it does is, it bridges the extension gap in Nigeria.

Imagine an extension agent that you can call at any time and it gives you up-to-date information. Whatever query you put in, it gives you a response or it works on a response for you. And it is real-time, you can call it at midnight, you can call it anytime, and it is full-free.

As long as you have power on your phone, you don’t have to worry about how much it is going to charge or whatever. That is what we recently launched and it has been game-changing for us. So when I say I see us becoming industry leaders in the service delivery space in agriculture. I am not lying.

What are some key lessons that you have learned in your journey as an entrepreneur?

What I’ve learned is that it’s actually very interesting because I have always been an entrepreneur even before Crop2Cash. I was a student entrepreneur in school. But what I discovered was that running is a totally different ball game to running Crop2Cash. Because Croc2Cash is both impact-based and profit-oriented and also it requires lots of brain knowledge.

So with my other entrepreneurial activities, all you need to do is just keep inventory, keep things going and market. But with Crop2Cash, you have to deploy solutions in the best way they could be accessed.

So one thing I’ve learned that really stands out for me is that as a founder, you have to grow alongside your business. So Crop2Cash is six years going to seven years in operation now officially and we started the idea for over seven to eight years now.

What I’ve discovered from them is, if I am to compare anything, at least in this space, we’ve grown so much in knowledge and in expertise, that no amount of maybe training or acceleration can do that to you.

Most times, my co-founder, Emem makes a joke that we don’t need business school given what we’ve gone through in the Nigeria agri-tech space. And I still say, oh, don’t worry, we need business school. So there is lots of knowledge that you get.

You just have to be very open to growth and learning. There are so many things that I’m forced to do that I normally don’t see myself doing. For an introvert, I do a lot of stakeholder management, because it is money. I need money. I have to call these people, keep them in the loop of sending emails, all sorts of things, and generate invoices.

Like I would like to think of myself as someone that is not so pushy. But then when the need comes, I have to be pushy and all of that. So it’s actually very interesting. I will say I have grown a lot because when you do things that you normally do not do as a person, it shows growth. It shows being able to take initiative.

And those are two things that have really stood out for me. Things happen very fast in the startup space. So you have to be very quick on your feet. And you also have to be open to doing a lot of things and at the same time growing alongside your business.

So I try to tell people that even as a founder, you’re most likely the most hardworking person in your organization because you’re doing this at the same time doing that, at the same time talking to investors, trying to raise funds, trying to also do grant applications, and all those other things.

If you’re not a very hardworking person, your business might suffer. And I also try to acknowledge the fact that I have co-founders. Trust me, if it was a one-man business, maybe I would have more grey hair or something. Because sometimes they give you the ability to delegate.

There is no shame when it comes to where we want to delegate. Michael will delegate the task to me. I will delegate the task to him. Emem will delegate too. We basically just share the burdens sometimes. When we notice there’s a lot of pressure on Michael, we take the task off his hands. So I would also acknowledge the fact that co-founders sometimes save your life.

Read Also: How I Built a Successful PR and Digital Marketing Agency – Nomsa Mdhluli

What advice would you give to other entrepreneurs who are about to start their business?

This is actually a very good question. I would say don’t start if you’re not ready. And what I mean by that is running a business is very difficult. But running a business as an African or as a Nigerian entrepreneur is almost seven times more difficult than our counterparts in the Western world or in Europe.

And I have all the facts to back this. It is deeply depressing. You cannot export capital in foreign currency when your currency keeps dropping or should I say keep depreciating. There is the perceived risk of investments coming to this part of the world. You have to be ready for that.

Also, there’s also the perception that has been created for Africans, or should I say Nigerians. Recently, I was in Berlin and there were lots of African founders in the place. And while we were introducing ourselves and the country that we come from, I mentioned Nigeria and someone said fraud capital. And I’m like, oh my gosh.

So in a world like that, you have to be super open and also operate with transparency because what we try to do is we try to break the stereotype. If they say Nigerians are 419, I know that I am not one. So we’re trying to break the stereotype that has been created for African founders and Nigerian founders.

You should be open to scrutiny. And if you know that you want to do illegal stuff, all the best to you, EFCC will catch you one day. But if you want to run a legal legit business, be open to compliance, be open to scrutiny. You can’t run a business and not be tax compliant.

You can’t be paying employees salary and not be remitting tax to the federal government. And you can’t be creating software innovations and not be paying hosting fees and all of these things. So you have to be open.

Also when it comes to investments, what we try to encourage that really impresses most of our investors is, we are open to physical due diligence meetings. So you want to get to know my business, why not come over to our office? We’ll show you around.

You get to meet the people building the innovation. That way, you know that we’re running a transparent business. It is not a money laundering front or anything. So that is what I would advise as an entrepreneur.

Prioritize what you’re doing and try as much as possible to carry yourself the way you want to be viewed outside the country. So that’s basically my advice to anybody in entrepreneurship.

Click here to read the rest of the interview with Seyi Alabi.

To find out more, contact Seyi Alabi via:

Leave a comment below and follow us on social media for update:

- Facebook: Today Africa

- Instagram: Today Africa

- Twitter: Today Africa

- LinkedIn: Today Africa

- YouTube: Today Africa Studio