Nigerian venture capital firm, Aduna Capital has today announced the launch of a $20 million fund. The fund will invest 55.5% of its capital in startups in Northern Nigeria, with the rest split between other regions of the country and Africa. The fund also aims to get 50% female representation in the startups it backs, General Partner, Surayyah Ahmad, told Techpoint Africa.

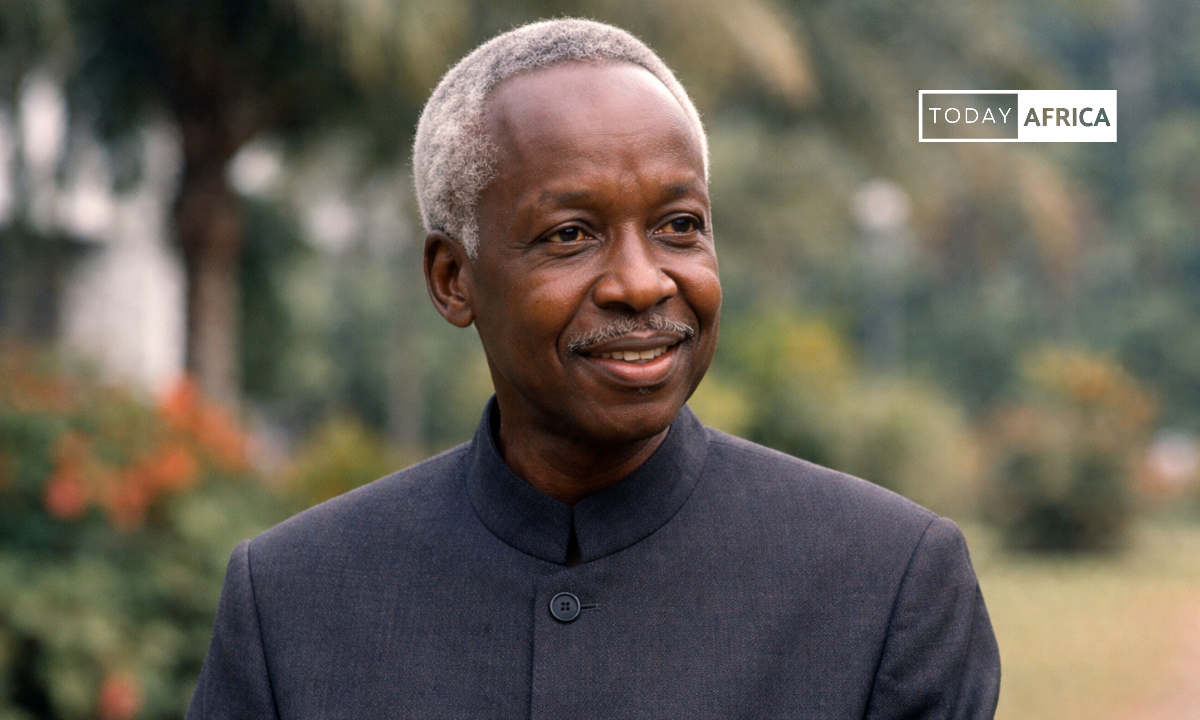

Ahmad is an experienced founder, having started the eCommerce startup, YDS Online in 2017. The startup was acquired in 2022. She’s also the co-founder of Ethco, a startup helping ethnic stores go digital, and the chairman of the Northern Founders Community.

Her co-founder, Sanusi Ismaila, has been at the heart of technology innovation in Northern Nigeria, founding what is probably the largest innovation hub in Kaduna State, Colab. Colab has been instrumental in nurturing startups and tech talents in the region, producing startups like Sudo and Payant.

Aduna Capital’s vision is geared towards the transformation of the Northern Nigeria region, home to more than 100 million Nigerians. It also hopes to shift the focus from Lagos, which is home to more than 80% of startups in Nigeria.

On the other hand, all-male founding teams continue to receive more than 80% of startup investment that flows to the country.

Such a development means startups in Nigeria’s secondary cities often do not receive the capital and support they need. Furthermore, female founders are often unable to raise capital for their startups. Aduna Capital is hoping to be the bridge between investors and founders in the region.

Its investments will focus on pre-seed and seed-stage startups, and it aims to invest in more than 50 startups at the pre-seed and seed stages. As a new entrant to the country’s venture capital scene, the firm will work with larger funds to increase the pool of resources available to its portfolio companies.

According to Ahmad, the fund will be investing between $50,000 and $200,000 in startups, but will occasionally write angel checks to bridge the region’s angel investing gap. With exits hard to come by for many investors, Aduna Capital will look to exit investments at the Series A stage.

However, Ahmad explains that it intends to retain about 20% of its portfolio companies, setting aside follow-on investment for this group.

While she declined to disclose the percentage of the fund that has been secured, she insisted that the fund had secured a significant portion of the fund and was ready to start making investments.

With venture capital still a hugely unpopular investment vehicle for much of Africa, Aduna Capital will explore alternative routes to provide a return for its LPs.

“Given the region we are focused on, we have a few LPs from the region who aren’t comfortable with the traditional VC model. As such, we are happy to work with them as part of our rollout experiment with other forms of return, such as profit-sharing, among other things.

The jury is still out on whether the traditional VC model that currently dominates is most optimized for Africa; as such, we will be experimenting with a few other models that appeal to the region via our sub-funds,” she said.

Source: Techpoint Africa