Copia begins liquidation after failing to raise money, the Kenya B2C e-commerce startup that entered administration on May 24. They have abandoned efforts to revive its business, opting instead to liquidate assets and pay creditors, according to an internal memo seen by TechCabal. The liquidation marks the end of the e-commerce platform that allowed customers in rural and peri-urban areas to order household goods like sugar, cooking oil, and toiletries.

The company will lay off all employees, and sell assets, including delivery tracks, warehouses, and office equipment to raise money to pay creditors.

“It was anticipated that Copia’s business will be maintained as a going concern albeit with significantly reduced operations to attract the much-needed through a new company to enable business continuity,” Copia’s administrator said in an email to staff.

“However, this has regrettably not been successful, and it is apparent that the company’s options are limited to the 3rd objective of administration as provided for in the Insolvency Act of 2015: realisation of assets to settle creditors’ claims.”

See Also: Tiger Global-backed Minka is the Latest LATAM Fintech to Set up Shop in Africa

Employees will receive severance packages on July 4, a memo from the company administrators said. The company has also called its creditors to a meeting on July 14 for guidance on “their respective claims.”

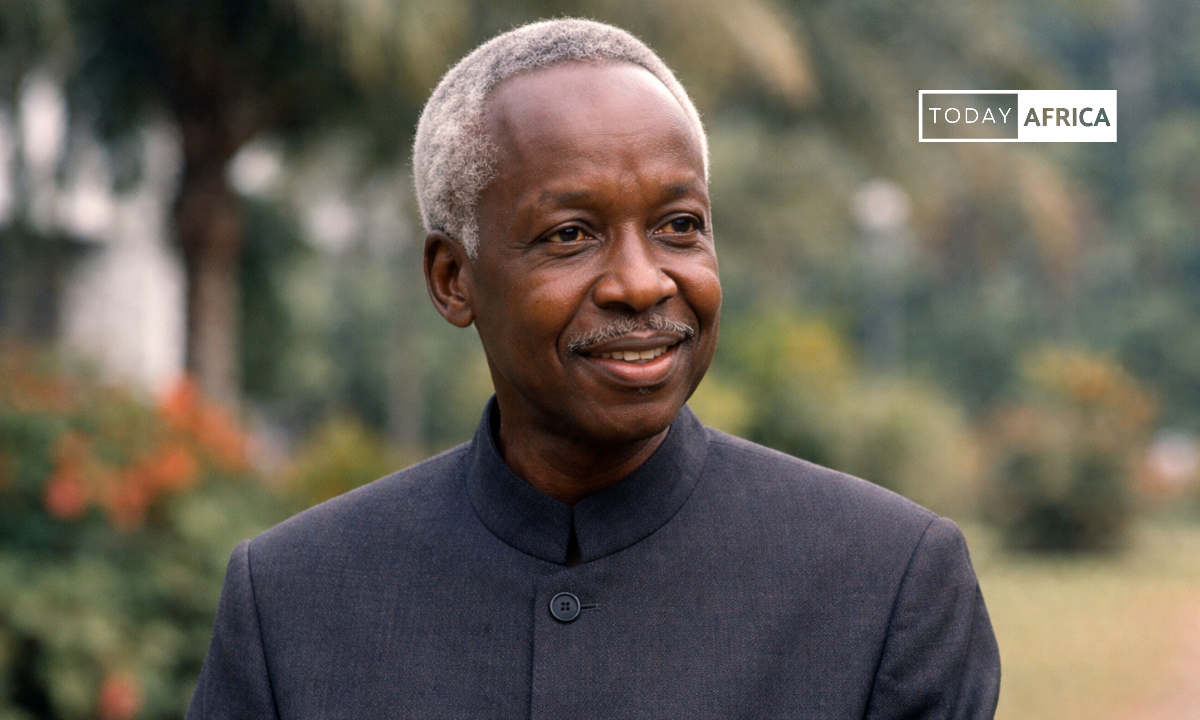

Copia’s administrator Makenzi Muthusi, did not immediately respond to a request for comments.

Founded in 2013

Founded by Tracey Turner and Jonathan Lewis in 2013, cash-strapped Copia began talks with potential investors in June 2024, said one person with direct knowledge of the matter. Ultimately, those talks were unsuccessful.

The company appointed Makenzi Muthusi and Julius Ngonga of KPMG as administrators in May 2024 when it became clear it was struggling to make payroll. It laid off 1,060 employees a month later in hopes that smaller overhead costs would ensure survival until it raised funds.

Copia’s liquidation continues a difficult year for B2B e-commerce companies as they have struggled to raise fresh funding as macroeconomic conditions on the continent have worsened.