A venture capital (VC) firm has a very different business model from most companies. And it’s important for you as a founder to understand how that model works and how does a VC make money.

If you’re raising venture capital, you should know what motivates your investors. Understand how you can pitch to them better, secure the perfect deal you’re looking for, and make it worthwhile for both you and them.

What is a Venture Capitalist (VC)?

Before diving into the profit-making mechanics, it’s essential to grasp what venture capital is and how it operates. Venture capitalists (VCs) are investors who provide capital to startups and small businesses with long-term growth potential.

These investments are usually high risk because they involve companies that are in their early stages and might not yet be profitable. However, the potential for high returns is what makes VC an attractive investment strategy.

Structure of a VC firm

A typical VC firm is structured as a partnership with General Partners (GPs) and Limited Partners (LPs). The GPs manage the fund and make investment decisions, while the LPs provide the bulk of the capital. LPs are usually institutional investors such as pension funds, endowments, and wealthy individuals looking to diversify their investment portfolios.

What Do Venture Capitalists Want?

Venture capitalists are typically looking to invest in startups that have a “boom” potential. In other words, they’re looking to make exponential returns. They like companies that have extremely high potential to grow.

They understand that not all companies that show promise will succeed. Even then, they want a company that at least shows the potential for a big return in the future.

Otherwise, what would be their impetus to invest? Venture capitalists are surely not philanthropists funding passion projects! Do you think Sequoia Capital would’ve poured $450 million into Web3 company Polygon if it didn’t believe that the company would ride the Web3 wave when it reemerged?

See Also: What Do Angel Investors Get in Return for Their Money

As a startup founder seeking a venture round, it is important for you to understand how you will provide them with this value. But more on that later. First, let’s understand how does a VC make money.

How Does a VC Make Money

Venture capitalists make money in two ways. The first is a management fee for managing the firm’s capital. The second is carried interest on the fund’s return on investment, generally referred to as the “carry.” The third way VCs make money is through dividends or interest.

Management fees

Management fees are the primary source of steady income for VC firms. These fees are charged annually and are typically a percentage of the committed capital of the fund. They cover the operational expenses of the VC firm, including salaries, rent, and other administrative costs.

How it works:

- Typical rate: The standard management fee in the VC industry is around 2% of the committed capital. For instance, if a VC firm raises a $100 million fund, it will charge $2 million annually in management fees.

- Duration: Management fees are usually charged over the life of the fund, which can span 10 years or more. In the later stages of the fund, the management fee might decrease as the investment period winds down.

Carried interest

Carried interest, or “carry,” is the primary way VCs make significant profits. It is a share of the profits generated by the fund’s investments, typically around 20%, but it can vary.

How it works:

- Profit Sharing: After returning the initial capital to the LPs, the remaining profits are shared between the General Partners (GPs) and Limited Partners (LPs) and General Partners (GPs). For example, if a fund generates $200 million in returns on a $100 million investment, the GPs would receive 20% of the $100 million profit, which equals $20 million.

- Hurdle Rate: Some funds include a hurdle rate, which is a minimum return that must be achieved before the GPs can earn carried interest. This ensures that the GPs are incentivized to achieve substantial returns for the LPs.

Dividends or interest

While less common, some VC investments can generate income through dividends or interest, particularly in later-stage companies that are generating revenue. These forms of income can provide additional returns to the VC firm.

How it works:

- Convertible notes: In some cases, VCs invest through convertible notes, which are debt instruments that can convert into equity. These notes often carry an interest rate, providing some income before conversion.

- Preferred shares: VCs may also invest in preferred shares, which can pay dividends. These shares have preferential rights over common shares in the event of liquidation, providing a layer of security and potential income.

The Future of Venture Capital

The venture capital industry is continuously evolving, driven by technological advancements, changes in market dynamics, and shifts in investor behavior. Understanding these trends is crucial for VCs looking to stay ahead of the curve and maximize their returns.

1. Technological disruption

New technologies are constantly reshaping industries and creating opportunities for innovation. Artificial intelligence, blockchain, and biotechnology are just a few areas where significant advancements are occurring. VCs who can identify and invest in these cutting-edge technologies early on are likely to reap substantial rewards.

2. Global expansion

Traditionally concentrated in regions like Silicon Valley, venture capital is now becoming more global. Emerging markets in Asia, Africa, and Latin America are attracting increasing amounts of VC investment. These regions offer untapped potential and can provide significant returns as their economies grow and develop.

3. Increased focus on sustainability

Sustainability and impact investing are gaining prominence within the venture capital community. VCs are increasingly looking for startups that not only promise financial returns but also deliver positive social and environmental impact. This trend reflects a broader shift towards responsible investing and the recognition that long-term value creation must consider broader societal impacts.

4. Democratization of investment

The rise of crowdfunding platforms and angel investor networks is democratizing access to capital for startups. While this poses competition for traditional VCs, it also presents opportunities for collaboration and co-investment. VCs can leverage these platforms to identify promising startups and build syndicates that spread the risk and increase the potential for success.

5. Data-driven decision making

The use of data analytics in venture capital is becoming more prevalent. By leveraging big data and machine learning, VCs can make more informed investment decisions, identify trends, and assess risks more accurately. Data-driven approaches can enhance due diligence processes and improve the chances of identifying successful investments.

Key Takeaways for Aspiring Venture Capitalists (VCs)

For those aspiring to enter the venture capital industry, understanding the fundamental mechanics of how VCs make money is essential. Here are some key takeaways:

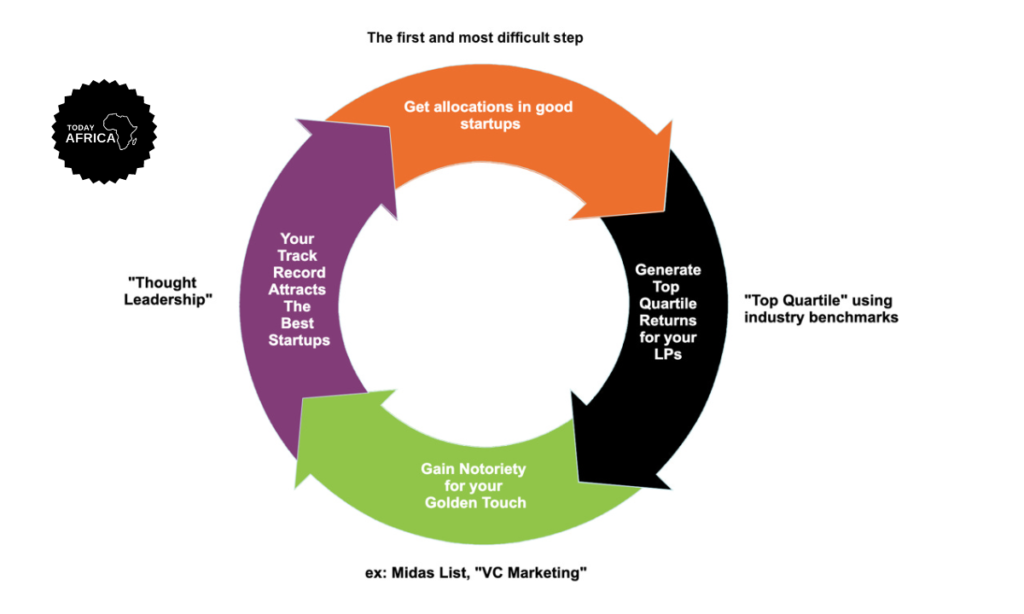

1. Develop a strong network

Success in venture capital is heavily reliant on access to high-quality deal flow. Building a robust network of entrepreneurs, industry experts, and other investors is crucial. Attend industry events, join professional organizations, and actively engage with the startup community to cultivate these connections.

2. Cultivate analytical skills

Effective decision-making in venture capital requires strong analytical skills. Aspiring VCs should develop their ability to assess market opportunities, analyze business models, and evaluate financial projections. This includes staying informed about industry trends and technological advancements.

Read Also: Who is a Pre-Seed Angel Investor?

3. Embrace risk management

Understanding and managing risk is a core component of venture capital investing. This involves not only diversifying investments but also actively supporting portfolio companies to mitigate risks and enhance their chances of success. Aspiring VCs should develop strategies for risk assessment and learn how to provide value-added support to startups.

4. Be patient and persistent

The long-term nature of venture capital means that it can take years to see returns on investments. Patience and persistence are essential traits for aspiring VCs. Building a successful track record requires a long-term commitment and the ability to withstand the inherent volatility of the industry.

Conclusion

Venture capital is a complex and dynamic field that plays a critical role in fostering innovation and economic growth. VCs make money through a combination of management fees, carried interest, and occasionally dividends or interest. The process involves raising a fund, sourcing and investing in promising startups, actively managing these investments, and ultimately realizing returns through successful exits.

By understanding the intricacies of how VCs make money and staying attuned to emerging trends. Both current and future venture capitalists can navigate the challenges and capitalize on the opportunities presented by this ever-evolving landscape. Venture capital remains a powerful engine of innovation, driving the growth of groundbreaking startups and contributing to the advancement of industries and societies worldwide.