Regulator grants Access Bank provisional licence in Namibia, marking a significant milestone in its African expansion strategy.

The licence, which took effect on October 4, 2024, enables Access Bank to begin operations in Namibia, expanding its footprint across the continent.

The licence is valid for six months, during which the bank will complete the necessary steps to establish full banking operations.

This move comes as part of Access Bank’s broader plan to diversify its revenue streams and capitalise on opportunities created by the African Continental Free Trade Area (AfCFTA).

The bank aims to expand its presence to 26 countries in the next five years, including markets in Africa, the United States, France, Hong Kong, and Malta.

This Namibia entry expands the bank’s already sizable presence in Southern Africa, where it operates in Angola, Botswana, Mozambique, South Africa, and Zambia.

Namibia represents a promising market for Access Bank

With its growing economy and robust banking sector, Namibia represents a promising market for Access Bank. Namibia’s four major banks, FNB Namibia, Bank Windhoek, Nedbank Namibia, and Standard Bank Namibia, have total assets of ₦166.3 billion ($9.47 billion), making the financial services industry a significant part of the country’s economy.

With the entry of Nigeria’s largest bank by assets, competition in this sector is expected to rise.

Read Also: Competition Beefs up as New MVNO Enters South Africa’s Market

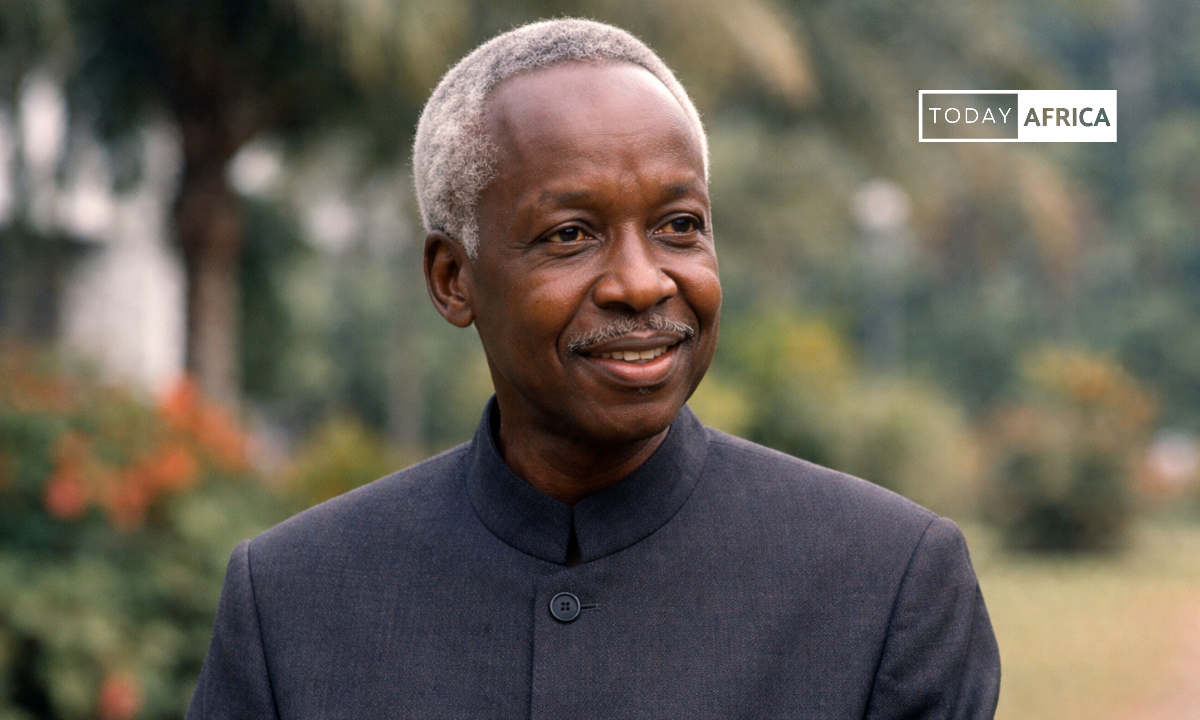

Access Bank CEO, Roosevelt Ogbonna, described the expansion into Namibia as an important step in the bank’s mission to foster intra-African trade and build a strong banking network across Southern Africa.

He emphasised that the move aligns with the bank’s long-term strategy of providing seamless access to banking and financial opportunities for businesses and individuals alike.

“We are confident that our investments in Namibia will benefit shareholders, customers, and the communities we serve,” stated Ogbonna.

The bank’s recent acquisition of ARM Pensions added ₦3 trillion in assets and over two million customers to its portfolio. In the same vein, Access Bank completed the acquisition of African Banking Corporation of Tanzania (ABCT) Limited, a subsidiary of Atlas Mara Limited, through a majority equity stake, initially announced in July 2023.

Now, with Namibia in its sights, Access Bank continues to solidify its standing as one of Africa’s leading financial institutions.

Leave a comment and follow us on social media for more tips:

- Facebook: Today Africa

- Instagram: Today Africa

- Twitter: Today Africa

- LinkedIn: Today Africa

- YouTube: Today Africa Studio