Nairobi-based fintech company specialising in “softPOS” technology, Tuma Ventures enters Tanzania with new PSP licence approval.

This move will enable Tuma to broaden its financial services within Tanzania, offering real-time payment processing for merchants, mobile wallet solutions, and float management for other fintech companies.

These services are designed to advance financial inclusion and foster economic development in the region.

The PSP licence affirms Tuma’s adherence to stringent regulatory standards and unlocks its ability to offer a comprehensive suite of financial services in Tanzania.

This development builds upon Tuma’s foundation as a licensed Payments Institution in the UK, which is the cornerstone of its remittance operations in East Africa. The company is committed to regulatory compliance, innovation, and excellence in financial services across its markets.

In September 2024, Tuma partnered with Interswitch, a Nigerian fintech company, to introduce Tumatap—a new contactless payment solution in Kenya. This partnership aims to make payments smoother for merchants and customers, especially for Micro, Small, and Medium Enterprises (MSMEs).

Tuma’s “softPOS” technology transforms smartphones into secure payment terminals, allowing businesses to accept card and digital payments without the need for additional hardware.

This approach not only reduces operational costs but also democratises access to digital payments for small and micro-sellers who have traditionally relied on cash transactions.

The goal of Tuma in Tanzania

As a newly licensed PSP in Tanzania, Tuma is set to revolutionise cross-border payments by offering solutions that are affordable, efficient, and secure. These services meet global standards while addressing the specific needs of its customers.

This strategic expansion into Tanzania aligns with Tuma’s broader vision of empowering East Africans in the diaspora to seamlessly transact with their home countries as if they were physically present.

By bridging the gap between the diaspora and their loved ones, Tuma fosters deeper connections and enables dependable financial transactions that enhance everyday life.

Tuma joins other fintech players who have recently secured licences in Tanzania. In 2023, Tanzanian fintech startup Nala obtained a PSP licence, enabling it to facilitate cross-border payments and local transactions without relying on third-party providers.

Read Also: Lagos state partners with Huawei to advance smart transport solutions

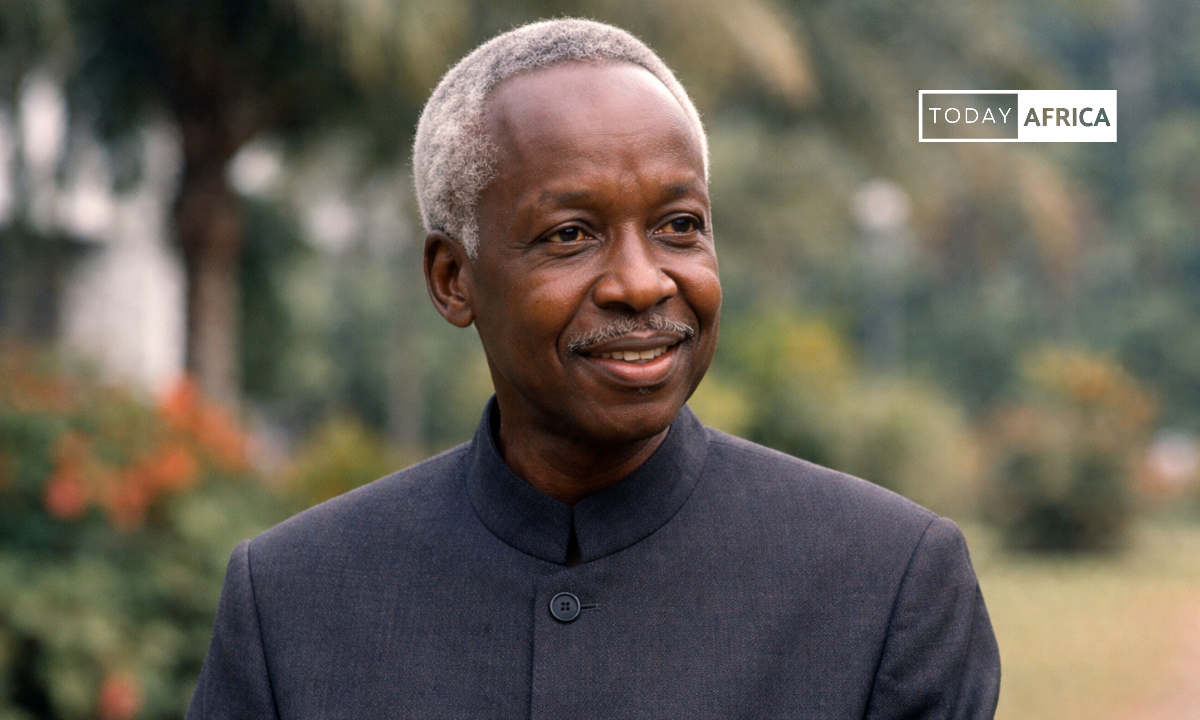

Kuda Technologies

More recently, in March 2024, Nigerian neobank Kuda Technologies also obtained a Payment Service Provider (PSSP) licence in Tanzania, a move that highlights the growing fintech interest in the East African market.

In March 2024, Nigerian neobank Kuda Technologies also obtained a Payment Service Provider (PSSP) licence in Tanzania, while Nala, a Tansignaling a growing interest in the country’s fintech sector.

In summary, Tuma Ventures’ acquisition of the PSP licence from the Bank of Tanzania marks a significant step in the company’s mission to provide secure, reliable, and accessible financial solutions.

Through innovative technology and a commitment to regulatory compliance, Tuma is poised to make a substantial impact on financial inclusion and economic development in Tanzania and the broader East African region.

Leave a comment below and follow us on social media for update:

- Facebook: Today Africa

- Instagram: Today Africa

- Twitter: Today Africa

- LinkedIn: Today Africa

- YouTube: Today Africa Studio