Venture Capital (VC) firms play a critical role in the entrepreneurial ecosystem. By providing the necessary capital and resources to start-ups, they help nurture innovative ideas into successful companies.

But how do these VC firms make money themselves?

In this blog post, we will discuss how does a VC firm make money and the mechanisms that drive the profitability for them.

What is a Venture Capital Firm?

Before exploring how does VC firms make money, it’s essential to understand their fundamental structure and operations.

A venture capital firm is an investment company that funds high-risk, high-reward start-ups and early-stage companies. These firms typically manage multiple venture capital funds, each consisting of pooled capital from various investors.

Key players in a VC firm

- Limited partners (LPs): These are the investors who provide the capital for the funds. LPs can include institutional investors, high-net-worth individuals, pension funds, endowments, and family offices.

- General partners (GPs): These are the managers of the VC firm who make investment decisions, manage the portfolio, and work closely with the start-ups.

Structure of a VC fund

A typical VC fund operates with a fixed life span, usually around 10 years. During this period, the fund undergoes three main phases:

- Fundraising: The GPs raise capital from LPs.

- Investment: The capital is deployed into start-ups and early-stage companies.

- Harvesting: The investments are exited through Initial Public Offerings (IPOs), acquisitions, or secondary sales.

How Does a VC Firm Make Money

VC firms make money through several ways. These include management fees, carried interest, and sometimes, transaction fees and dividends.

1. Management fees

Management fees are the primary source of income for a VC firm. These fees cover the operational costs of managing the fund, including salaries, office expenses, and other administrative costs.

How management fees work

Typically, a VC firm charges an annual management fee ranging from 2% to 2.5% of the total committed capital of the fund. For example, if a VC fund has $100 million in committed capital, the firm might charge a 2% management fee, resulting in $2 million per year to cover expenses.

Duration of management fees

Management fees are usually charged throughout the life of the fund but may decrease after the initial investment period (usually the first 3-5 years). After this period, the fees might drop to 1% or 1.5% as the focus shifts from making new investments to managing existing ones and working towards exits.

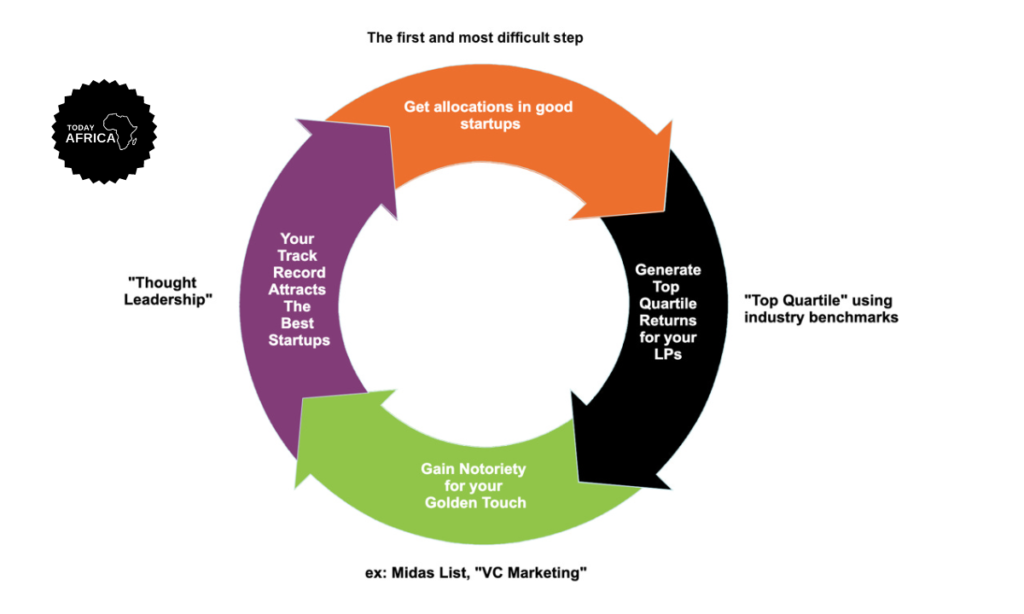

2. Carried interest

Carried interest, often referred to as “carry,” is the primary incentive for VC firms. It represents a share of the profits generated from the successful exit of investments.

What carried interest means

Carried interest typically accounts for 20% of the profits earned by the fund, after returning the initial capital to the LPs. For example, if a fund invests $10 million in a start-up and later sells its stake for $50 million, the profit is $40 million. Out of this, $8 million (20%) would go to the VC firm as carried interest, while the remaining $32 million is distributed to the LPs.

Hurdle rate and catch-up

Some funds have a hurdle rate, which is the minimum return that must be achieved before carried interest is paid. If the hurdle rate is 8%, the fund must generate at least an 8% return for the LPs before the GPs can receive any carried interest. Once the hurdle rate is met, there may be a “catch-up” clause, allowing the GPs to receive a larger share of the subsequent profits until the agreed carry percentage is reached.

3. Transaction fees

In addition to management fees and carried interest, some VC firms charge transaction fees for services provided during the investment process. These fees might cover deal sourcing, due diligence, and legal expenses.

Types of transaction fees

- Deal fees: Fees charged when an investment is made.

- Monitoring fees: Fees for ongoing management and oversight of portfolio companies.

- Exit fees: Fees associated with the sale or IPO of a portfolio company.

4. Dividends and interest

Although less common in venture capital, some VC firms may receive dividends or interest from their investments. This typically occurs if the firm invests in more mature companies that generate regular cash flow.

Dividends

If a portfolio company decides to distribute profits to shareholders, the VC firm, as an equity holder, might receive dividends. However, this is rare for early-stage companies, which usually reinvest profits for growth.

Interest

In some cases, VC firms may provide debt financing or convertible notes to start-ups, earning interest on the principal amount. This can provide an additional revenue stream, though it is not the primary focus of most venture capital investments.

What is the Lifecycle of a VC Investment?

Knowing how VC firms make money requires a closer look at the lifecycle of a VC investment. So this process can be broken down into several stages:

1. Sourcing and due diligence

VC firms constantly scout for promising start-ups and innovative ideas. This involves networking, attending pitch events, and leveraging industry connections. Once a potential investment is identified, the firm conducts thorough due diligence to assess the viability and potential of the start-up. This includes evaluating the business model, market opportunity, competition, team, and financial projections.

2. Investment decision

Based on the due diligence findings, the GPs decide whether to invest. If the decision is affirmative, the terms of the investment are negotiated, including the amount of capital, the equity stake, and any special provisions such as board seats or liquidation preferences.

3. Post-investment management

After the investment is made, the VC firm works closely with the start-up to help it grow. This involves providing strategic guidance, operational support, and leveraging the firm’s network for partnerships and customer acquisition. The goal is to increase the value of the start-up, positioning it for a successful exit.

4. Exit

The exit is the culmination of the investment process. Successful exits can occur through:

- Initial public offering (IPO): The start-up goes public, allowing the VC firm to sell its shares on the open market.

- Acquisition: The start-up is acquired by a larger company, providing a return on investment to the VC firm.

- Secondary sale: The VC firm sells its stake to another investor or private equity firm.

Successful exits generate profits, which are then distributed to the LPs and GPs according to the agreed terms, including the distribution of carried interest.

Challenges and Risks in VC Investments

While VC firms can achieve significant returns, the industry is fraught with challenges and risks. Understanding these risks is crucial for comprehending how VC firms operate and make money.

1. High failure rate

The majority of start-ups fail, leading to a complete loss of the invested capital. VC firms must carefully balance their portfolios to mitigate this risk, often relying on a few high-performing investments to offset the losses from failed ones.

2. Long investment horizon

VC investments typically have a long horizon, often 7-10 years, before realizing returns. This long period can be challenging for both the VC firm and its LPs, requiring patience and resilience.

Read Also: Do Angel Investors Get Dividends?

3. Market and economic risks

Start-ups are highly sensitive to market conditions and economic cycles. A downturn can adversely affect the growth and exit prospects of portfolio companies, impacting the returns for VC firms.

4. Regulatory and legal risks

VC firms operate within a complex regulatory environment, and changes in laws or regulations can impact their operations and profitability. Additionally, start-ups may face legal challenges that can affect their performance and, consequently, the returns for the VC firm.

Conclusion

Venture capital firms are essential players in the entrepreneurial world, providing the funding and support needed for start-ups to grow and succeed. However, the high risks and challenges, successful VC firms can achieve substantial returns by effectively sourcing, managing, and exiting investments.

So understanding the financial mechanisms and challenges faced by VC firms provides valuable insight into their operations and highlights the importance of their role in fostering economic growth. Through their strategic investments and hands-on support, VC firms continue to drive the success of countless start-ups, contributing to the dynamic and ever-evolving landscape of entrepreneurship.