While you may be familiar with seed funding, pre-seed funding is considered the earliest form of funding for startups.

It involves securing capital for an idea that may not have a product or prototype yet.

So, if you’re starting a business and you need capital, here’s everything you need to know about securing a pre-seed investment.

What is Pre-Seed Funding?

Pre-seed funding is the initial step toward getting enough capital to develop a product.

It is the first stage of fundraising, and securing funding at this time is challenging for most startups.

While sourcing for preseed funds, you’ll have only a prototype or just an idea, which makes it difficult to convince investors to invest.

That’s why, most times, pre-seed capital can come in the form of a loan, which can be converted into equity when certain growth conditions are met.

Pre-Seed Funding vs. Seed Funding: What’s the Difference?

Both pre-seed funding and seed funding are asking for funds for a product that has yet to prove its potential in the market, there are some major differences among them.

Pre-seed funding is investing in an idea that is yet to find its market.

On the other hand, seed funding is sought for a product that already exists and has a customer base.

Because pre-seed funding involves betting on an idea, it is more challenging to secure compared to seed funding.

Investors perceive it as a higher risk because the product may never even make it to market.

The Importance of Pre-Seed Funding for Your Startup

Securing pre-seed funding is important for your startup because most of the money will go toward constructing your company’s foundation.

At this stage, funding is primarily directed toward full product development, including scaling a prototype into a marketable product.

Additionally, pre-seed funding helps cover expenses such as hiring new staff, finding office space, and marketing to early customers.

Without this capital, your startup will face significant challenges in surviving and competing with established brands.

Related Post: Biography of Tony Elumelu [Investor, Entrepreneur, & Philanthropist]

It’s worth noting that not all industries require pre-seed funding, as some may have lower startup costs.

Industries with high startup costs, such as tech companies building hardware, are more suited for pre-seed funding.

While fundraising for startups, in general, is challenging, securing pre-seed investment is even more difficult due to the limited evidence of market traction.

However, the support of pre-seed investors can accelerate a business’s growth significantly.

Types of Pre-Seed Funding

There are several avenues available for startups seeking pre-seed funding.

The following are the most popular methods:

1. Family and friends: This is the most common option for pre-seed startups, where founders invest their personal wealth and seek contributions from their network of family and friends.

2. Venture capitalists: Certain venture capitalists specialize in investing in startups at the earliest stages of development. Note that venture capitalists are often picky and success rates are low.

3. Angel investors: Wealthy individuals investing in startups. Pre-seed angel investors often look for big risks and invest an average of $100,000 in startups during the pre-seed phase.

4. Crowdfunding: Individuals from around the world donate small amounts to fund an idea. This method heavily relies on effective marketing to generate interest.

Click to get access to 200 Pre-seed Funding Companies Providing Support and Funding

5. Incubators: Incubators not only provide capital but also offer additional business services, such as training courses, office space, and access to active investors.

6. Accelerators: Accelerators focus on fast scaling for startups with high growth potential. While they typically target growing startups, some accelerators also provide pre-seed capital.

It’s important to note that traditional financial organizations are less likely to invest in an idea, which is why pre-seed funding options are limited until founders explore seed funding.

When Should You Start Raising Pre-Seed Funding?

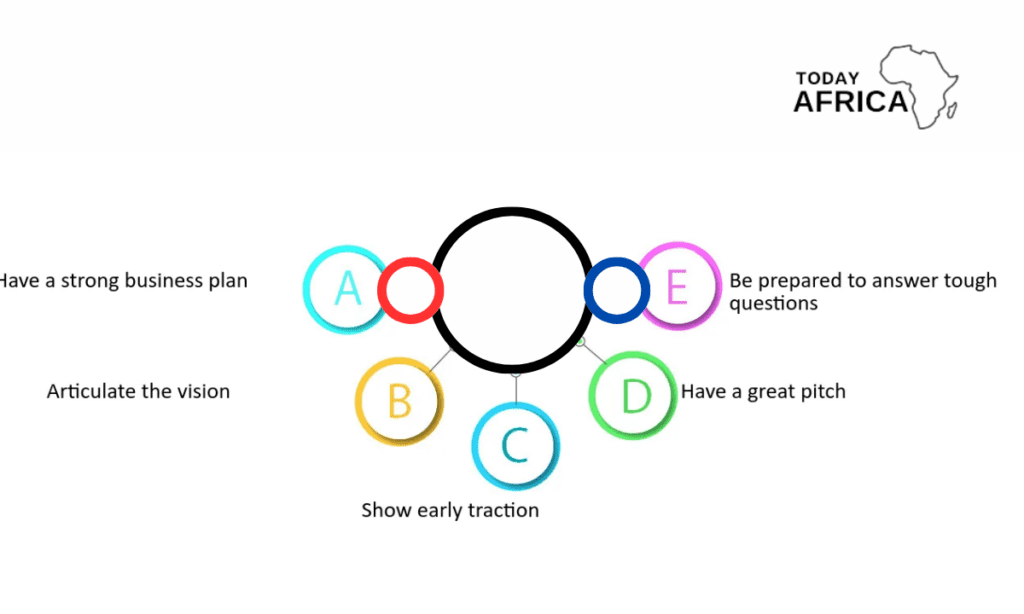

Timing is crucial when seeking pre-seed funding.

Being fully prepared is essential, as investors meet thousands of founders each year, and being unprepared can lead to immediate rejection.

Here are some signs that indicate you may be ready to start meeting pre-seed investors:

1. Product/market fit: You have already confirmed that your product fits into a specific market, even if you haven’t fully tested it with a finished product.

2. Building a team: If you need to hire experts and expand your team, it indicates the necessity of pre-seed investment.

3. Prototype: While not mandatory, having a prototype showcasing the primary features of your product enhances your credibility and chances of securing pre-seed funding.

4. Early interest: Positive feedback from early customers demonstrates your startup’s high growth potential.

5. Revenue modeling: Developing an ambitious yet realistic revenue model shows investors how you plan to generate profits.

Although investors entering the pre-seed stage are aware that the product is at an early stage, they still expect some tangible evidence and facts to support your claims. Therefore, be prepared with any available data and figures.

How Much Pre-Seed Funding Should You Ask For?

The amount raised during a pre-seed round is typically lower compared to seed and Series A funding phases.

On average, pre-seed startups secure approximately $500,000, but the amount may vary depending on the investment avenue.

The key rule when asking for pre-seed funding is to be realistic.

Justify the amount you request, ensuring it aligns with what you need to reach profitability or survive until the next funding round.

While some companies aim to reach the next funding milestone, exceptional startups may achieve profitability quickly.

Avoid the temptation to ask for an astronomical figure, as it will raise expectations and require your startup to perform exceptionally well.

Experienced investors will analyze your proposal and assess whether your funding request is realistic, so it’s essential to stay conservative.

To calculate how much funding you’ll need, analyze your monthly costs and determine the lowest possible number your startup can operate with.

Consider the number of months it will take to reach profitability or progress to the next funding stage.

How to Secure Pre-Seed Funding

Securing pre-seed funding shares similarities with obtaining seed funding, but it requires additional effort to convince investors about the potential impact of an untested product.

Here are the primary steps to follow when approaching pre-seed investors:

Step 1: Build your pitch deck

Even at this early stage, you still need a pitch deck to begin raising capital.

It should include information about your startup, the product, the market, and financial projections for the near- and long term.

It should also highlight your product’s problem-solving capabilities and include market research findings, even if you don’t have existing traction.

Keep your pitch deck concise, focusing on key concepts and using visual aids such as pie charts and graphs.

Aim for 10 to 12 slides, with a maximum of 15 slides. Include long-term projections to demonstrate your ambition and seriousness.

You can find pitch deck examples online for reference.

Step 2: Make an investor list

Leverage your business connections to find investors interested in pre-seed startups.

Research incubator and accelerator platforms that provide access to investors specializing in pre-seed capital.

Prioritize your investor list based on factors such as their type, experience with pre-seed startups, funding amount, expertise in your industry, and track record with other startups at the pre-seed stage.

Focus on finding investors with pre-seed experience specifically, as their understanding of the challenges faced during this growth period is crucial.

Step 3: Present to investors

Most investors will require an in-person presentation before committing to your startup.

This presentation is an opportunity to showcase yourself and your passion.

Keep your presentation simple, engaging, and focused. Listen actively to investors’ points and concerns, and tailor your pitch to their interests.

Research the investors beforehand to understand their preferences and past investments.

Strike a balance between ambition and realism, and let your charisma and passion shine through.

Practice your pitch thoroughly before meeting investors, ensuring you know it by heart.

Step 4: Negotiate for success

Negotiation is the final hurdle to securing pre-seed funding.

Don’t accept the first offer and be willing to negotiate terms, such as equity stake and investment amount.

Take your time to consider each offer and ensure you have a written agreement to avoid future disputes.

Finding Investors for Your Startup

Finding investors for your startup, especially during the pre-seed stage, requires persistence and hard work.

While securing pre-seed funding is challenging due to the limited market traction, it provides a significant advantage to your startup.

Pairing with the right investor can make a substantial difference. To find pre-seed investors who are ready to invest in your startup idea, leverage resources such as angel investor software, which can help you connect with the right investors for your specific startup.