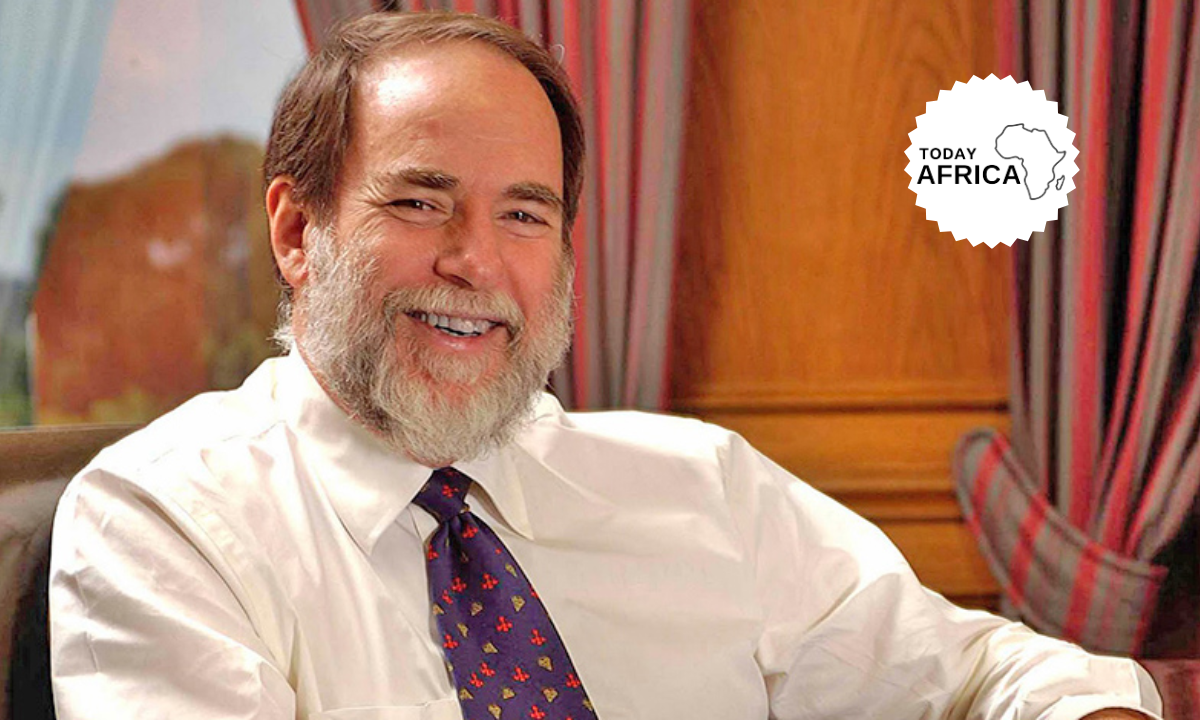

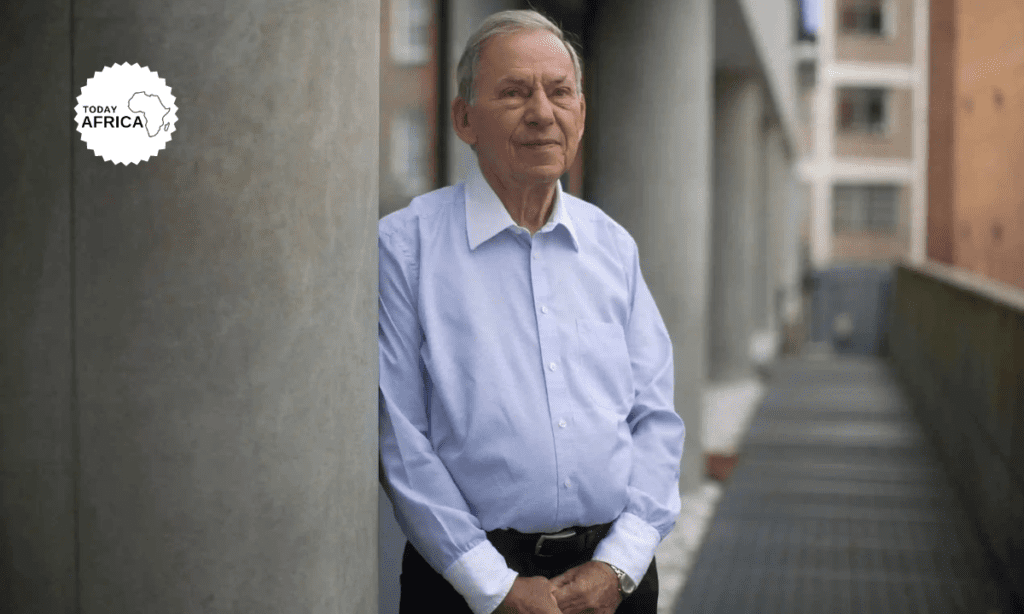

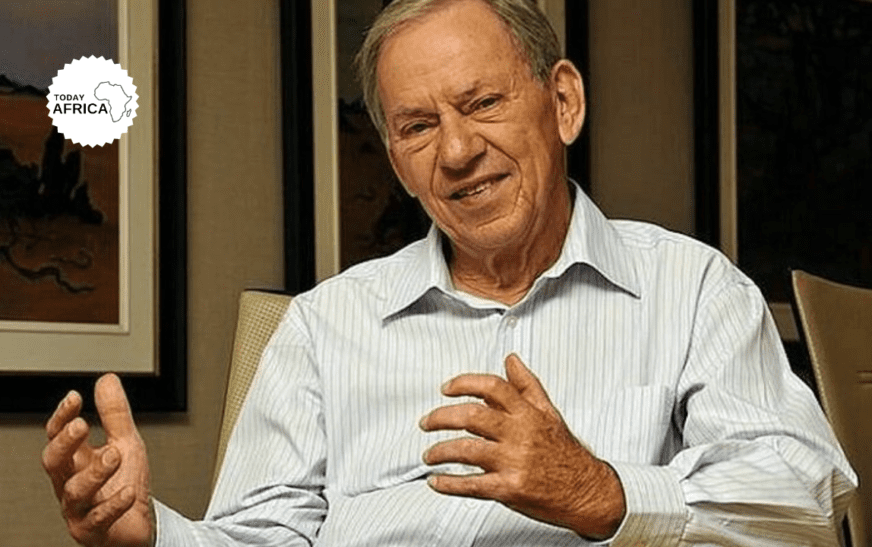

Nathan Kirsh (Natie Kirsh), a renowned Swazi and South African billionaire businessman, has firmly established himself as a leading figure in the business world through his immense wealth and successful ventures.

As the richest man in Eswatini (formerly Swaziland) and one of the richest individuals in Southern Africa, Kirsh holds a prestigious position among Africa’s billionaire elite.

Kirsh’s remarkable journey to wealth began with a modest £1,200 ($1,630) inheritance, which he utilized to establish a corn and malt milling business in Eswatini.

Today, he stands as the richest individual in the country, a testament to his entrepreneurial acumen and unwavering determination.

Natie Kirsh Biography

Nathan “Natie” Kirsh was born on 6 January 1932 to Jewish parents who immigrated to South Africa from Lithuania, and he grew up in Potchefstroom. He later matriculated from Potchefstroom Boys High, in 1949.

He encountered little antisemitism in Potchefstroom: “It was a very comfortable and good environment to grow up in.” Kirsh also joined the Labor Zionist youth movement Habonim Dror.

Kirsh earned a Bachelor of Commerce at the University of the Witwatersrand, in 1952. He also holds an honorary doctorate from the University of Swaziland. He started his own business in nearby Swaziland at age 26, leaving the family company in the hands of his younger brother.

Using a 1,200 pound inheritance from his father and additional funding from contacts at home, Kirsh began milling corn and malt.

His company later expanded into a conglomerate which helped reduce the country’s dependence on South Africa for food staples. Through an agreement with the government, Kirsh’s company was obligated to buy all corn grown in Swaziland and became its only importer of the crop.

He maintained close ties with the king and served as chairman of Swaziland’s electricity board for 23 years, helping to build the country’s power grid and to break down racial segregation at its sporting clubs.

Entry into South Africa

Kirsh began eyeing South Africa for a new venture and acquired a wholesale food operation in 1970. Once in control, he transformed it into a cash and carry business that served the country’s black-owned local grocery stores.

He expanded into real estate, selling 49 percent of the conglomerate to insurance company Sanlam in 1984. Saddled with real estate loans, he lost most of his fortune in South Africa’s 1980s economic crisis, keeping only Jetro, a cash and carry outpost in Brooklyn, New York, that he opened in 1975.

At the time, there were just five Jetros operating in major cities along the east coast. Kirsh focused on providing fresh goods at low prices and capitalized on the unwillingness of large distributors to service small shops. He added the Restaurant Depot concept in 1994.

There are more than 130 Restaurant Depots and 10 Jetro locations across the United States, according to the company’s website in March 2018. He sold 27 percent of the company in 2004 to two private equity firms, New York-based CCMP Capital Advisors and Los Angeles-based Leonard Green & Partners.

He gave 10 percent of the company to executives and employees. In 2012, he issued a $1 billion private placement of debt, in part to pay a one-time shareholder dividend, and borrowed another $1.4 billion a year later to buy back about half of the interest held by the private equity partners.

According to an industry source familiar with the transactions who asked not to be identified because the information is private. CCMP spokeswoman Allison Cole declined to comment. Representatives for Leonard Green didn’t respond to requests for comment.

Kirsh has also accumulated a collection of real estate assets to help hedge against inflation.

Natie Kirsh Family

Kirsh is married to Frances Herr, and they have three children, one son, Philip Kirsh, and two daughters. They reside in Ezulwini, in Eswatini, where he holds citizenship. He keeps kosher but does not consider himself religious. His brother, Issie, founded Radio 702 and Primedia.

Companies Owned by Eswatini’s Richest Man, Natie Kirsh

Kirsh’s success story serves as an inspiration to aspiring entrepreneurs across Africa. With his impressive wealth and extensive holdings, Today Africa has identified and cataloged five companies where Kirsh holds direct or indirect ownership, showcasing his influence in the business realm:

1. Kirsh Group

Natie Kirsh controls the majority of his investments through Kirsh Group, a private conglomerate operating in Australia, Eswatini, the UK, the United States, and Israel. The group manages a diverse portfolio of assets in various industries, and its dominant ownership of Jetro Holdings reinforces its position as a significant global player.

2. Jetro Holdings

Natie Kirsh owns a significant 75-percent stake in Jetro Holdings, a New York-based holding company that manages subsidiaries involved in wholesale distribution of dry and perishable groceries, including alcoholic beverages like beer, wine, and liquor. The company operates two wholesale grocery businesses in the United States: Jetro Cash & Carry and Restaurant Depot.

3. Abacus Property Group

Through Jetro Holdings, Kirsh holds a 52-percent stake in Abacus Property Group, a Sydney-based real estate investment trust. Abacus is among 200 publicly listed companies on the Australian Securities Exchange, focusing on investing in Australian real estate, particularly in the Office and Self Storage sectors, with some legacy property developments under its management.

4. Jetro Cash & Carry and Restaurant Depot

Kirsh’s diverse investment portfolio includes interest in Jetro Cash & Carry and Restaurant Depot. These stores operate in over 30 U.S. states, offering a wide range of products at competitive prices. They provide convenient and cost-effective solutions to their business customers.

5. Kirsh’s global property holdings

Kirsh’s impressive real estate portfolio spans four continents, featuring iconic properties such as London’s Tower 42 and Sydney’s Birkenhead Point. Tower 42, purchased for £238 million ($307 million) years ago is now worth $364 million. This property contributes significantly to Natie Kirsh’s total fortune of $7.56 billion.

Natie Kirsh Net Worth

According to Blommberg, Natie Kirsh is worth $9.19B while Forbes states that he’s worth $7.2B. The majority of Kirsh’s fortune is derived from a 75% stake in Jetro Holdings. A New York-based company that manages two U.S. wholesale grocery businesses: Jetro Cash & Carry and Restaurant Depot.

The business has annual revenue of more than $10 billion based on a December 2019 Fitch’s credit report and subsequent performance by peers.

Read Also: Mama Ngina Kenyatta, the Richest Woman in Kenya

Jetro and Restaurant Depot operate as sister businesses and their combined value is calculated using the average enterprise value-to-sales multiple of four publicly traded peer companies: Costco Wholesale, Kroger, Metro and Loblaw Companies.

Through Kirsh Group he controls 52% of Sydney-based Abacus Property Group, a publicly traded real estate investment trust, according to its Sept. 16, 2022 stock exchange filing.

The billionaire has real estate on four continents, including London’s first office skyscraper, Tower 42, and Birkenhead Point in Sydney, Australia.

These properties are valued using either the average dollar-per-square foot rate of recent similar transactions or the income capitalization method, using data from sources including the National Australia Bank, Savills and Knight Frank.

Philanthropy

Natie Kirsh established the Kirsh Foundation, an international charitable organization. He has contributed significantly to Eswatini, primarily through the financing of small business startups and computer education in high schools.

Between 2001-2016, his foundation funded 14, 000 startups, with a 70% success rate. Its projects include a microfinance venture in collaboration with Swazi chiefs to provide “affordable loans and financial literacy training to Swazi women.”

By 2015, around 20,000 people were employed by small-scale businesses started by the fund. In 2021, Kirsh funded a mission for humanitarian NGO IsraAID to aid with the COVID-19 vaccine rollout in Swaziland.

In recent years the fund has also focused on financing business startups and computer education in high schools and yeshivas in Israel. Through the Natan fund, 700 startups had been financed as of 2016, with an 85% success rate.

The Kirsh family also donated $10 million to the Jerusalem Arts Campus, a new downtown campus for the:

- Nisan Nativ Acting Studio

- The Sam Spiegel Film and Television School

- The School of Visual Theater and the Center for Middle Eastern Music

His foundation has also funded the Britain Israel Research and Academic Exchange Partnership. An initiative of the British Council and the British Embassy in Israel. Together with the Pears Foundation, investing in world-leading research jointly undertaken by scientists in Britain and Israel.

He also supports the Jewish People Policy Institute. A think tank with the purpose of promoting and securing the Jewish people and Israel.

His foundation also spearheaded Shine A Light, an initiative to raise awareness about:

- modern antisemitism through education

- community partnerships

- workplace engagement and advocacy in the United States

In 2020, Kirsh donated $8.8 million to his alma mater, the University of the Witwatersrand in Johannesburg.

Milestones in the Life of Natie Kirsh

- 1959 With 1,200 pound inheritance, begins first business venture in Swaziland.

- 1970 Outgrows original Swaziland business, looks to expand in South Africa.

- 1984 Sells 49 percent of South African business to Sanlam; a fateful decision.

- 1985 Loses business to Sanlam in credit squeeze during economic crisis.

- 1985 Moves to the U.S. to restart his investment career with Jetro.

- 1995 Opens his first Restaurant Depot in New York, serving local restaurateurs.

- 2004 Sells 27 percent of Jetro/Restaurant Depot to CCMP and Leonard Green.

- 2009 Earns more than $40 million with run on Minerva Property Management.

- 2011 Acquires Tower 42, his first high profile real estate holding in London.

- 2012 Issues $1 billion private placement debt to pay one-time dividend.

Nathan Kirsh’s inspiring journey from humble beginnings to becoming a billionaire exemplifies resilience and entrepreneurial brilliance, solidifying his position as a notable figure in the African billionaire business world.

Read Also: The Man Called Tayo Amusan

References

Leave a comment below and follow us on social media for more tips and updates:

- Facebook: Today Africa

- Instagram: Today Africa

- Twitter: Today Africa

- LinkedIn: Today Africa

- YouTube: Today Africa Studio

![Biography of Tony Elumelu [Investor, Entrepreneur, & Philanthropist]](https://todayafrica.co/wp-content/uploads/2023/12/Blue-Simple-Dad-Appreciation-Facebook-Post-1200-×-720-px-7-1.png)