In the world of business financing, companies have traditionally relied on debt and equity to raise capital.

However, these options often come with significant challenges—debt requires repayment with interest, and equity involves giving up ownership.

For businesses looking for an alternative way to fund growth without the burdens of conventional loans or the dilution of ownership, royalty financing presents a compelling solution.

In this blog post, we’ll explore the concept of royalty financing, how it works, its benefits and drawbacks, and real-world examples of its application. We’ll also discuss the scenarios where royalty financing might be the best choice and how to approach it effectively.

What is Royalty Financing?

Royalty financing is a type of investment in which an investor provides capital to a company in exchange for a percentage of future sales revenue. The investor does not receive equity in the company, but instead receives a return on their investment through royalties.

There are many benefits to royalty financing, including the fact that it allows companies to raise capital without giving up equity. In addition, royalty financing is typically less expensive than other forms of financing, such as debt financing.

However, there are also some risks associated with royalty financing. For example, if a company is not successful, the investor may not receive any return on their investment. In addition, if a company is sold or goes public, the investor may not receive any proceeds from the sale.

Before entering into a royalty financing agreement, it is important to consider both the risks and rewards. While royalty financing can be a great way to raise capital, it is important to make sure that you are comfortable with the risks involved.

How does royalty financing work?

A royalty financing agreement is a contract between a company and an investor in which the investor agrees to provide funding in exchange for a percentage of future sales. The investor does not receive equity in the company and does not take on any risk other than the risk of not being repaid.

The main advantage of royalty financing for the company is that it does not have to give up equity in the business. The main advantage for the investor is that they can earn a higher return than they would from a traditional loan.

The biggest disadvantage of royalty financing for the company is that it can be difficult to find an investor who is willing to enter into such an agreement. The biggest disadvantage for the investor is that they are not protected if the company fails and they do not receive any equity in the business.

Before entering into a royalty financing agreement, it is important to understand how it works and what the risks and benefits are for both the company and the investor.

Example of royalty financing

Let’s consider a hypothetical example to illustrate how royalty financing works:

- A tech startup needs $500,000 to launch a new product. Rather than taking on debt or selling equity, the company secures royalty financing from an investor.

- The terms are set: the investor will receive 5% of the company’s gross revenues until the investor has received $750,000, representing a 1.5x return on the initial investment.

- As the product launches and revenues grow, the company begins paying 5% of its monthly revenues to the investor.

- Once the investor has received the full $750,000, the royalty payments stop.

Benefits of Royalty Financing to African Businesses

1. No dilution of ownership

One of the most significant advantages of royalty financing is that it doesn’t require the company to give up equity. Unlike venture capital or private equity, where investors typically take a stake in the company, royalty financing allows founders and existing shareholders to retain full ownership and control.

2. Flexible repayment terms

Royalty financing aligns the interests of the investor and the company by tying repayments to revenue. This means that if the company experiences slower growth, the payments decrease accordingly. There are no fixed monthly payments, reducing the financial strain during periods of lower revenue.

3. No collateral required

Unlike traditional loans, royalty financing typically doesn’t require the company to provide collateral. This is particularly beneficial for startups and small businesses that may not have significant assets to secure a loan.

4. Aligns investor and company interests

Since the investor’s return is directly tied to the company’s performance, there is a strong alignment of interests. Both parties are motivated to see the business succeed, creating a partnership-like relationship rather than a traditional lender-borrower dynamic.

Read Also: What is a Discounted Payback Period?

5. Potential for higher returns

For investors, royalty financing offers the potential for higher returns compared to traditional fixed-income investments. If the company grows rapidly, the royalty payments can exceed what would have been earned through a loan or equity investment.

Drawbacks of Royalty Financing

1. Potentially high cost of capital

While royalty financing can be attractive, it can also be expensive. The effective cost of capital may be higher than traditional debt, especially if the company grows rapidly and the royalty payments exceed expectations. Companies need to carefully consider whether the cost is justified by the benefits.

2. Uncertain payment period

Since royalty payments are tied to revenue, the repayment period can be unpredictable. If the company experiences slower-than-expected growth, the payments may continue for a longer period, potentially becoming a financial burden.

3. Revenue pressure

Royalty financing creates a direct link between revenue and repayment, which can pressure the company to prioritize short-term sales over long-term growth. This focus on immediate revenue can sometimes lead to strategic decisions that may not be in the company’s best long-term interest.

4. Limited availability

Royalty financing is not as widely available as traditional loans or equity investment. It may be challenging for some businesses to find investors willing to provide this type of funding, especially if they operate in industries with unpredictable revenue streams.

When to Consider Royalty Financing

Royalty financing is not a one-size-fits-all solution, but it can be particularly advantageous in certain situations:

1. Companies with predictable revenue streams

Businesses with consistent and predictable revenues, such as subscription-based services, franchising, or product licensing, are ideal candidates for royalty financing. The predictability makes it easier to structure a royalty agreement that works for both parties.

2. Companies looking to avoid dilution

For founders who want to maintain control and avoid diluting their ownership. Royalty financing offers a way to raise capital without giving up equity. This is especially important in industries where retaining control is crucial to the company’s vision and direction.

3. Companies in need of flexible financing

If a company anticipates fluctuations in revenue. This type of financing provides the flexibility to make payments based on actual performance rather than fixed schedules. This can help manage cash flow more effectively, especially during periods of uncertainty.

4. High-growth potential companies

For businesses with high growth potential but limited access to traditional financing. It can provide the necessary capital to fuel expansion. The alignment of investor and company interests can also be beneficial in navigating rapid growth.

How to Choose a Royalty Financing Partner?

If you’re an entrepreneur considering raising money through a royalty financing agreement, there are a few things you should keep in mind.

First, it’s important to choose a partner who is a good fit for your business. Second, you need to make sure that the terms of the agreement are fair and that you understand all the details. And finally, you need to be aware of the potential risks involved.

Choosing a partner

When you’re looking for a royalty financing partner, it’s important to find someone who shares your vision for the business and who you feel comfortable working with. It’s also important to find a partner who is a good fit for your particular business. For example, if you’re looking for help with marketing and distribution, it might make sense to partner with a company that specializes in that area.

Making sure the terms are fair

It’s important to make sure that the terms of your royalty financing agreement are fair. You should understand all the details of the agreement, including how much money you’ll be expected to pay back and when. You also need to be aware of any penalties or interest charges that may apply if you don’t make your payments on time.

Understanding the risks

There are some risks associated with royalty financing, and it’s important to be aware of them before you enter into an agreement. For example, if your business doesn’t do well, you may have to pay back more money than you originally agreed to. Additionally, if you don’t make your payments on time, you may be subject to late fees or other penalties.

How to Negotiate a Royalty Financing Agreement?

Entering into a royalty financing agreement can be a great way to raise capital for your business without having to give up equity or control. However, it is important to negotiate a fair agreement that is beneficial for both parties.

When negotiating a royalty financing agreement, there are a few key points to keep in mind:

- The royalty percentage should be based on the expected revenue of the product or service. If the product or service is not successful, the financier will not receive any return on their investment.

- The royalty should be paid out of gross revenue, not net profit. This ensures that the financier receives their return even if the company is not profitable.

- The royalty should be paid monthly, so that the financier can receive a regular return on their investment.

- The agreement should specify how long the royalty will be paid for. This ensures that the financier receives a return on their investment even if the product or service is no longer sold.

- The agreement should specify what happens if the product or service is sold or transferred to another company. This protects the financier’s investment in the event that the company is sold or changes hands.

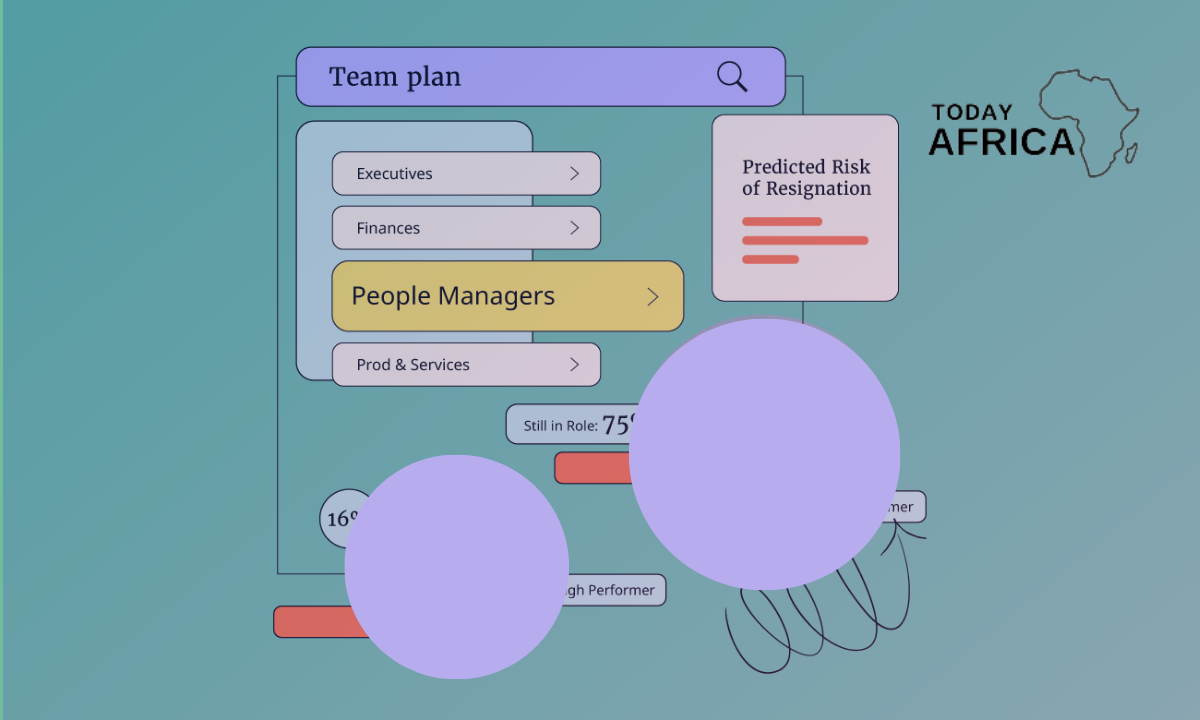

Structuring a Royalty Financing Deal

1. Determining the royalty rate

The first step is determining the royalty rate, which is the percentage of revenue or profit that will be paid to the investor. This rate is typically negotiated based on the company’s revenue projections, industry norms, and the risk profile of the investment. A higher rate may be justified if the company has significant growth potential or if the investment carries higher risk.

2. Setting a cap or multiple

To ensure that the investor receives an adequate return, the deal may include a cap or multiple. For example, the investor may be entitled to receive 1.5x or 2x their initial investment. Once this amount is reached, the royalty payments cease. Alternatively, the deal may have a time limit, with payments continuing for a set number of years.

3. Payment frequency

The frequency of royalty payments—monthly, quarterly, or annually—should be agreed upon during the deal’s structuring. Monthly payments are common, as they provide regular cash flow for the investor and align with most companies’ revenue cycles.

See Also: What Are the Reasons Cash Flow Plans Sometimes Don’t Work?

4. Performance clauses

Performance clauses can be included to protect both parties. For example, if the company’s revenues fall below a certain threshold, the royalty rate might be reduced temporarily. Conversely, if the company exceeds revenue targets, the investor might receive a bonus or higher royalty rate.

5. Exit strategy

An exit strategy is an essential component of the deal, outlining how the investor can exit the agreement. This could involve a buyout clause, where the company can buy back the royalty rights at a predetermined price, or a sale of the royalty rights to another investor.

Risks and Considerations

1. Revenue volatility

For companies with volatile or unpredictable revenues, royalty financing can be risky. If revenues decline, the company may struggle to make royalty payments, potentially leading to financial strain or default. It’s crucial to model different revenue scenarios to assess the potential impact on the business.

2. Investor control

While royalty financing doesn’t involve giving up equity, it can still lead to investor influence. Some agreements may include covenants or restrictions that limit the company’s strategic decisions. Companies should carefully review the terms to ensure they retain the desired level of control.

3. Regulatory and tax implications

Royalty financing can have complex regulatory and tax implications, depending on the jurisdiction and the structure of the deal. Companies should consult with legal and financial advisors to understand these implications and ensure compliance with all relevant laws and regulations.

4. Long-term financial impact

While royalty financing offers short-term benefits, the long-term financial impact should be carefully considered. The cumulative cost of royalty payments may exceed the cost of traditional financing, especially if the company experiences rapid growth. Companies should weigh the immediate need for capital against the long-term financial commitment.

Conclusion

Royalty financing is an innovative and flexible alternative to traditional debt and equity financing. However, it also comes with potential drawbacks, such as a higher cost of capital and the pressure to maintain consistent revenues.

For companies with predictable revenue streams, high growth potential, or a desire to maintain control, royalty financing can be an excellent option. By carefully structuring the deal and considering all risks and implications, businesses can leverage this financing method to fuel their growth and achieve their goals.

Author’s Note: This article is intended to provide general information about royalty financing and should not be construed as legal or financial advice. Businesses considering royalty financing should consult with legal and financial professionals to ensure the best outcome.

References: