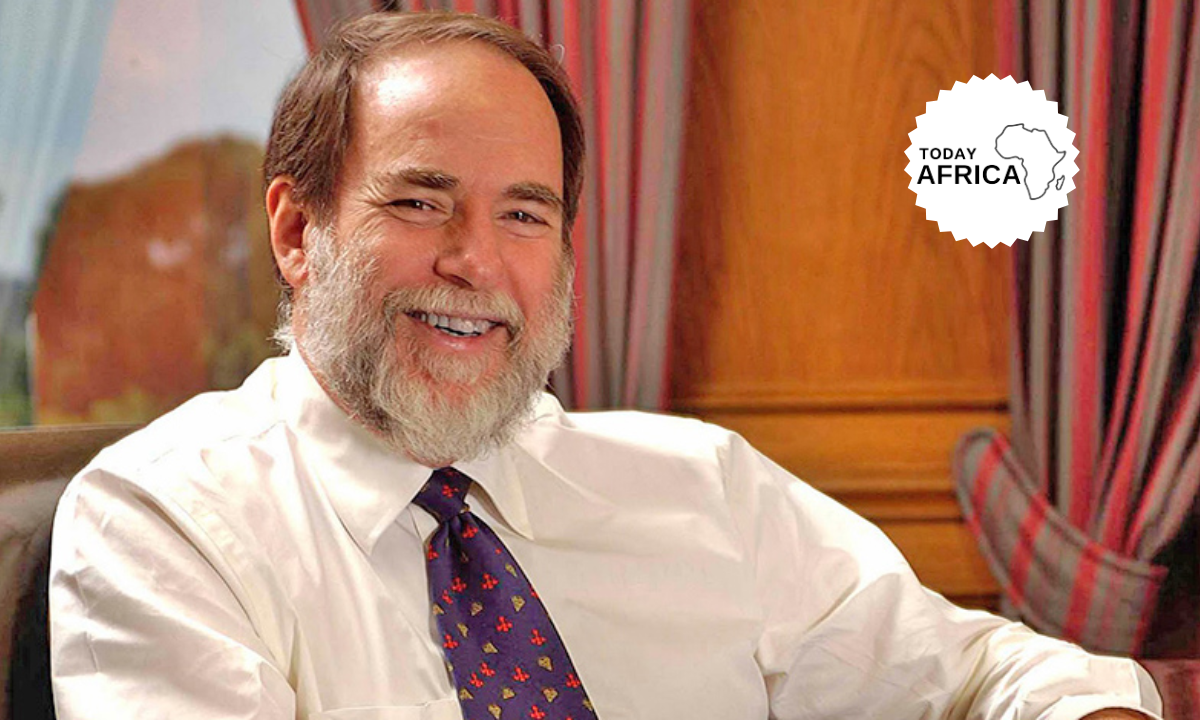

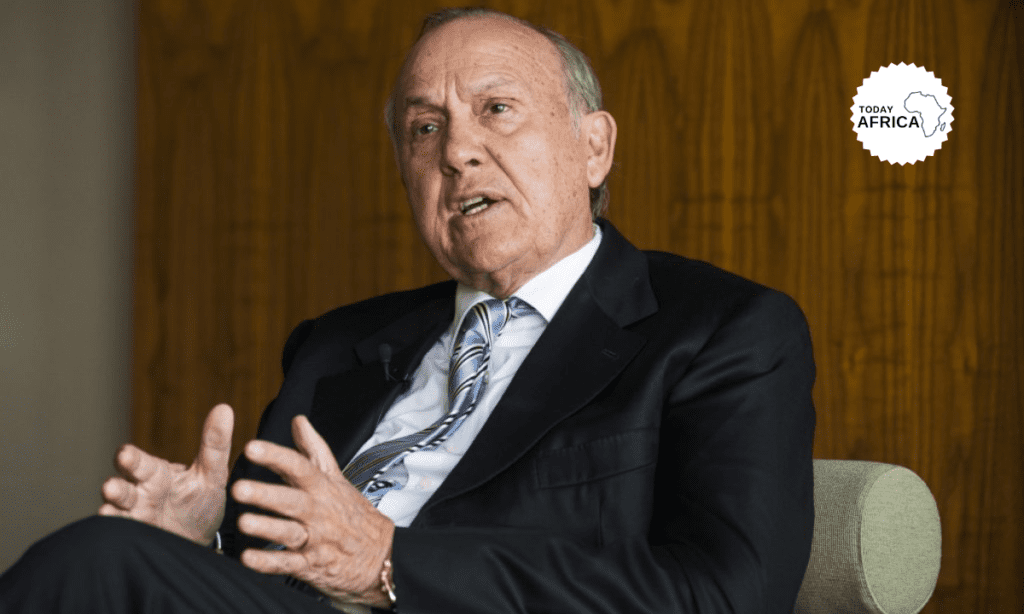

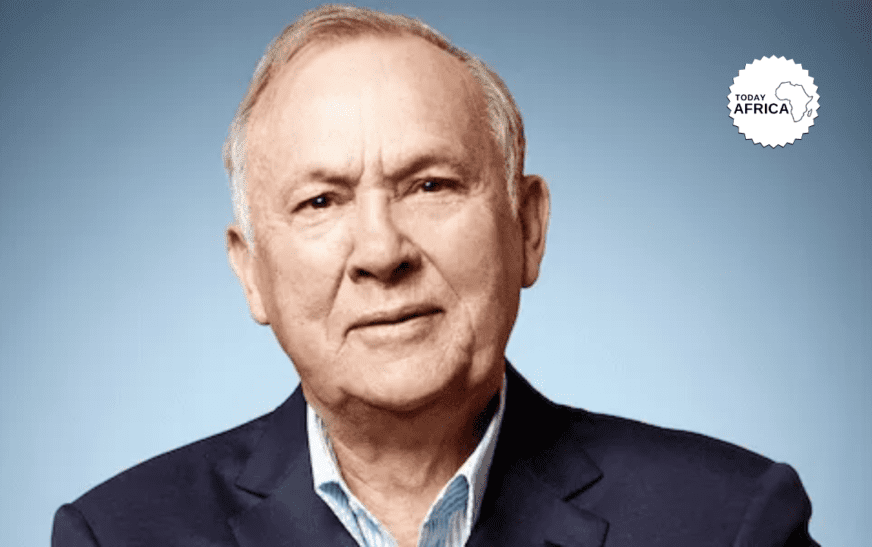

From a confiscated briefcase at Heathrow Airport to being lambasted by the press over his business with the tax man, Christo Wiese has no airs about him. Only his gold Rolex watch gives you a glimpse of his wealth.

There is no doubt that Wiese is a formidable businessman, who has made a meaningful impact in the South African retail industry. As he sits in his boardroom which is larger than his family’s first store overlooking Industria, Cape Town.

He’s either on the phone making arrangements, giving assurances or chatting to his broker. This is a far cry from his childhood in a small South African farming town, a place he calls an oasis.

Wiese’s father was a farmer and businessman in Upington in the Northern Cape, like many in his family before him, armed with basic informal schooling and his entrepreneurial spirit. Wiese is proud when he talks about how his parents never worked for anyone.

Christo Wiese Biography

Christoffel was born on 10th September, 1941 in Upington, South Africa. Growing up, he attended Paarl Boy’s High School in the Western Cape region of South Africa. Following that, he proceeded to Stellenbosch University where he obtained his BA and LLB degrees.

Christo Wiese is the brain behind Shoprite, Africa’s most storied retail chain.

This South African billionaire Christo Wiese’s story is like two shoe salesmen who went to a poor country to undertake due diligence. Because their parent company was looking to make a foray into the country.

Wiese went to Zambia in the early 1990s to open up a clothing store, he discovered that clothing was sold on the street pavement by hawkers.

There were no clothes shops in the country, and a colleague from Pep Stores with whom he had made the trip told him, “You know, we can’t come and open shops here because people prefer to buy their clothes from hawkers,” Wiese recalled during an interview with South Africa’s Leadership magazine.

Of course, Wiese went ahead and launched a Pepkor store in the southern African country. Needless to say, it thrived- just like all the other previous stores across the continent.

Today, Wiese is the largest individual shareholder and chairman of retail giants Pepkor, Shoprite and Tradehold, and one of the continent’s most successful entrepreneurs.

His life as a lawyer

This successful businessman didn’t start out as an entrepreneur. As a graduate of Law, Christoffel practised law at the Cape Bar for some years after obtaining his university degree.

After acquiring a bachelors’ degree in law from the University of Stellenbosch. Wiese practiced at the Cape Bar for several years before taking up a job as an Executive Director at Pepkor, a discount clothing chain his parents had helped found.

By 1979, Pep Stores made its foray into the food retailing business with its acquisition of Shoprite, a small chain of retail outlets spread across South Africa.

See Also: Johann Rupert – The Richest Man in South Africa

Wiese assumed the position of chairman in 1981, and in 1982 he led the company to change its name from Pep Stores to Pepkor Limited.

With Wiese at the helm, the company made some audacious acquisitions. He acquired Ackermans, a clothing chain, in 1986. Subsequently, Pepkor listed its clothing interests on the JSE as Pep Limited and its food interests as Shoprite Holdings Limited.

In 1991 Pepkor made four additional acquisitions. The company acquired the retail chains Smart Group Holdings, Cashbuild, Checkers and Stuttafords and in the same year, Wiese led the company to open its first retail outlet in Scotland.

Christo Wiese Family

Christo is married to Caro Wiese and they have three children together. One of the children is Jacob Daniel Wiese, a lawyer, and renowned businessman. Another is Clare Wiese-Wentzel, a lifestyle blogger, TV Presenter, and a Writer. Wiese lives in Cape Town.

Christoffer Wiese Journey To Pepkor

A businessman at heart, Wiese bought the controlling stake in Pep Stores from the founder in 1981, at the age of 36, and renamed it Pepkor Limited.

The decision to expand Pepkor’s footprint to Europe in the early ‘90s came about as Wiese realized that international brands would be coming to South Africa to compete with them.

Once again, proving to be a savvy businessman, Wiese made the choice to take the competition to the rest of the world, with what he deemed a good formula that could be transferred to developed economies.

“We realized that as South Africa was opening up to the world, the world was opening up to South Africa,” says Wiese.

Pepkor’s business model is simple: high volume, low margin. If you look at the group’s history all the businesses follow this model except Stuttafords.

The premium department store caters to the high-end customer and was a default acquisition when Pepkor bought Greatermans Department Stores in 1991. This was not the business the group wanted; their target was the Checkers supermarket chain, Stuttafords was sold a few years later.

From PEP Stores to Pepkor

At 21, Wiese left Upington to study law at the University of Stellenbosch, whose alumni include some of South Africa’s wealthiest: Johann Rupert, Koos Bekker, GT Ferreira and Jannie Mouton.

Wiese’s parents co-founded Pep Stores in 1965 and were its second largest shareholders. He worked for the company during his vacations, driving around the country with the major shareholder looking for locations to open new shops.

Wiese graduated in 1967 but returned to the family business instead of practicing law. There, Wiese dealt with administrative duties such as keeping minutes and updating share certificates. He got stuck in it and did what needed to be done.

In 1973, law came calling and Wiese practiced at the Cape Bar until 1979. During this time he bought a stake in a diamond mining company, the largest in South Africa not belonging to De Beers.

After Christo practised as a lawyer, he worked as a Director at Pepkor, a discount clothing chain founded by his parent in 1965. Pepkor is a South African based investment and holding company with business interest in Africa, United Kingdom, Australia, Poland, Romania, Slovakia and New Zealand.

He was the executive director from 1967-1973. Actually, Pepkor was formerly known as PEP Stores before it was changed to Pepkor Limited in 1982. PEP Stores, however, became its subsidiary. In 1981, Christoffel became the company’s chairman, owns a 44% share of the company.

As Chairman of the company, Wiese took some giant business steps. He acquired Ackermans, a clothing chain in 1986. Following that, he listed the company on Johannesburg Stock Exchange (JSE) as PEP Limited. Then in 1991, the company acquired the retail chains, Smart Group Holdings, Cashbuild, Checkers and Stuttafords.

That same year, Wiese led the company to open its first retail outlet in Scotland. Pepkor became a successful retail investment with stores in 10 countries in Africa as well as operations in Australia and Poland.

Acquisiton of Shoprite

Wiese’s Shoprite became the first of the group’s companies to expand into Zambia. The old OK Bazaar chain was bought from the government after being nationalized and run into the ground by the Kaunda government. The chain was rejuvenated and Pep opened in Zambia in 1994.

Needless to say, Shoprite is now a household name known by the young and old in Africa. Interestingly, Christoffel Wiese is the brain behind this Africa’s most storied retail chain.

Under Christoffel’s leadership at Pepkor, Shoprite (a small chain of retail outlets spread across South Africa) was acquired for 1milion rand (equivalent to $122,000 USD). He also listed the outlet on JSE as Shoprite Holdings Ltd.

In addition, he was able to grow the outlet from eight supermarkets in Cape Town to a multibillion-dollar business spread across Africa due to its various acquisitions made in the first 30 years of operations. More so, Christoffel played a key role in helping Shoprite acquire distributor Senta.

Later, he expanded the business through franchising. In 2011, Shoprite Stores was named the sixth overall favourite brand, and a third most valued brand in term of community upliftment in South Africa.

Between March 2011 and March 2012, Shoprite’s shares rose by 50% on the South Africa stock market. Wiese made $1.5billion profit as a result.

Other Business Interests Of Christoffel Wiese

As a man who has done business across the continent for decades, Wiese calls himself a committed and optimistic African. Wiese feels that Africa is shedding its old image; that a new Africa is emerging. He marvels at how people can still look at the continent with, what he calls, “old eyes”.

He says that whenever something negative happens in Africa the “afro-pessimists”, as he calls them, turn it into a catastrophe but if the same were to happen anywhere else, it would purely be a setback. Christo considers the events at Marikana, where Lonmin mine strikes turned violent, a prime example.

Apart from the aforementioned acquisitions, Wiese also purchased OK Bazaars from South African Breweries for one Rand in 1997. Wiese added 157 supermarkets and 146 furnitures stores to the company.

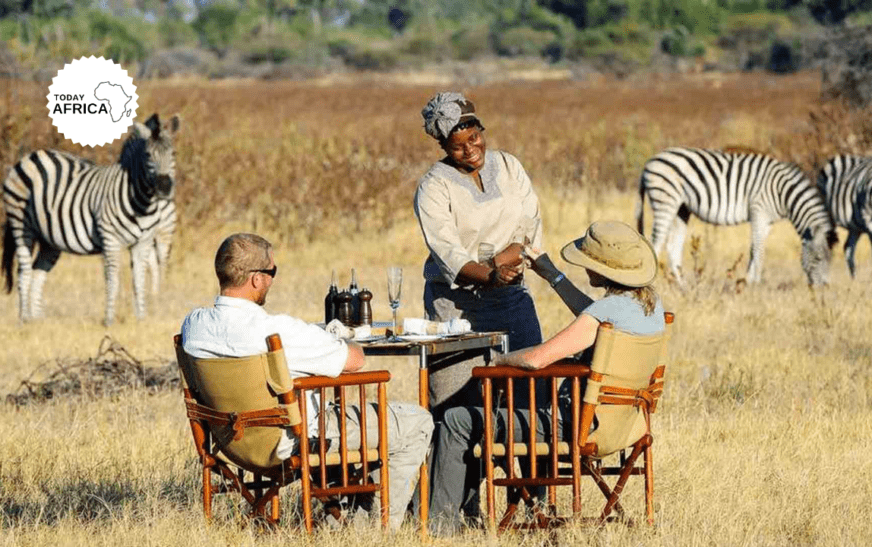

In addition to that, Christoffel owns more than 1,200 corporate outlets under different names. He owns various properties including a private game reserve in the Kalahari Desert and the Lourensford Estate.

In April 2015, news has it that Virgin Group and its private equity backers sold out Virgin Active to Brait (a company owned by Wiese).

Also, Christoffel was the former Chairman and largest shareholder of Steinhoff International. In 2014, Pepkor was sold to Steinhoff and Wiese became the Chairman of Steinhoff. However, he resigned in 2017 following the Steinhoff accounting scandal.

Lanzerac Manor & Winery

In 1991, Wiese bought a South African farm. He changed the outlook and converted it into a five-star hotel, called Lanzerac Manor & Winery with 48 rooms. Subsequently, he sold the hotel to a foreign investment firm on 7th March 2012.

Although Wiese is best-known for his business interests in retail, he has also tested other waters. Wiese was not looking to get into the hospitality industry when he bought the Lanzerac Wine Estate in 1991, on the outskirts of Stellenbosch.

With a five star hotel on the premises, Wiese bought it as a new home for his family but as much as they loved the estate they loved their Clifton beach house even more.

Wiese chose not to walk away from Stellenbosch when his family did, simply because the place gave him too much pleasure. The wine estate was run down and the vineyards had been neglected for 25 years. But he saw something in it.

Wiese spent a lot of money refurbishing the hotel, replanting the vineyards, building the cellars and developing the property. The magnificent 300-year-old estate was sold in 2012. The billionaire now owns Lourensford Wine Estate in Stellenbosch, bought in 1998.

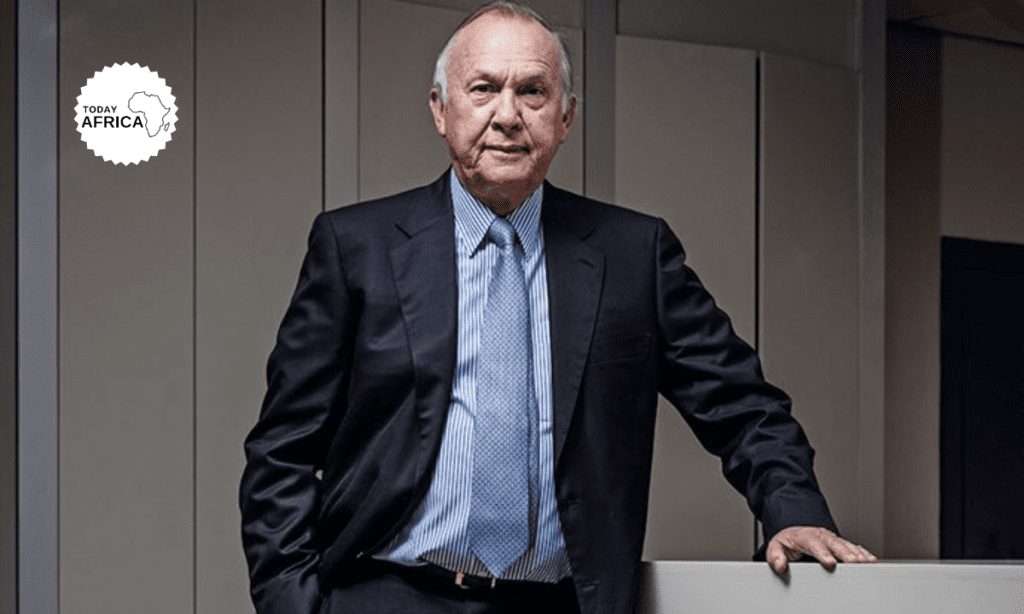

Value of Christo Wiese’s Holdings

Wiese’s investment strategy is three pronged: get the best possible returns; invest in ethical businesses and remember that investing is a long-term game. This is the philosophy of the chairman of Pepkor, Shoprite, Tradehold and non-executive chairman of Invicta Holdings and Brait SA.

Tradehold is an investment holding company listed on the main board of the JSE, its main interests lie particularly in property in the United Kingdom, which is hoping to expand. Wiese owns around 80% of the company, with a market capitalization of around $137.5 million.

Invicta is an investment holding and management company with a market capitalization of around $770.6 million. The company controls and manages assets of $934 937 and finalized an acquisition in Singapore, its first outside Africa. Wiese owns around 37% of the company.

See Also: Patrice Motsepe, the South African Billionaire CAF President

Wiese feels that the driving force of any entrepreneur should be to build businesses and help people develop. This, he says, is the true measure of success.

Pepkor is testament to this in its 57 years; Wiese has been part of 47 of them. As the man behind this growth, Wiese points out that it was a step-by-step process that had its ups and downs. His worst knock happened in 1985 when the rand collapsed.

| Company | Market Cap | Wiese’s Shareholding | Value of Wiese’s share |

| Invicta Holdings | R3.5 billion | 37.57% | R1.3 billion |

| Pepkor Holdings | R68.24 billion | 5.42% | R3.7 billion |

| Shoprite Holdings | R132.76 billion | 10.67% | R14.2 billion |

| Brait PLC | R5.11 billion | 28.24% | R1.4 billion |

| TradeHold | R1.94 billion | 11.9% | R231 million |

Invicta Holdings

Pepkor Holdings

Shoprite Holdings

Brait PLC

TradeHold

Companies Christo Wiese Owns

| Company | Effective Interest | Brands |

| Invicta Holdings | 37.57% | |

| Replacement Parts Auto-Agri | ||

| Replacement Parts Industrial | ||

| Replacement Parts Equipment | ||

| Capital Equipment | ||

| Kian Ann Group | ||

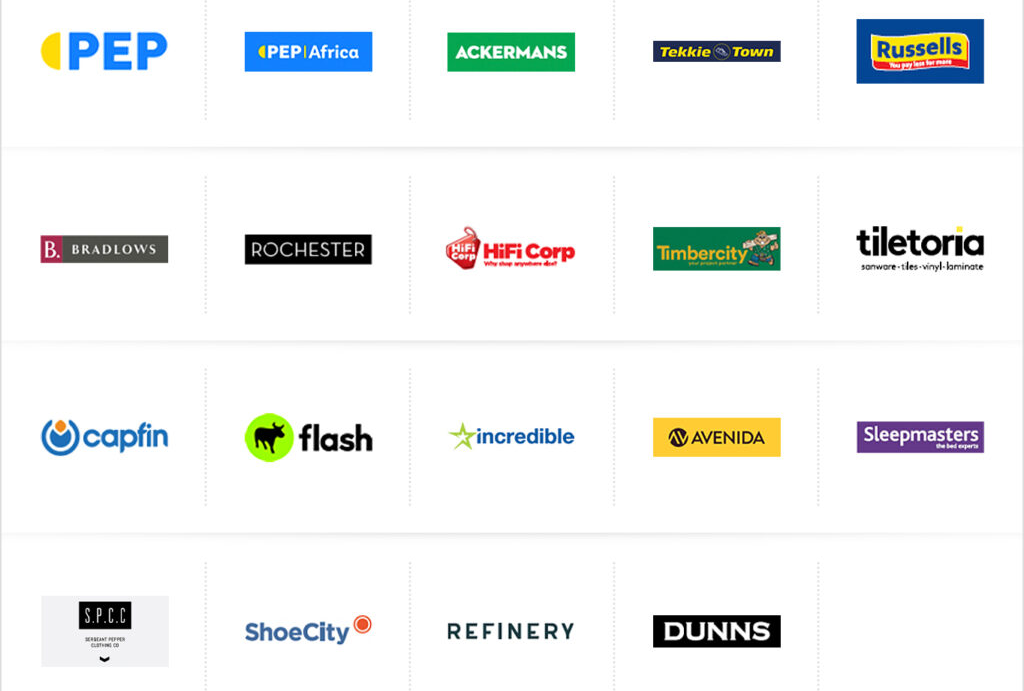

| Pepkor Holdings | 5.42% | |

| Pep | ||

| Pep Africa | ||

| Ackermans | ||

| Tekkie Town | ||

| Russells | ||

| Bradlows | ||

| Rochester | ||

| HiFi Corporation | ||

| Timber City | ||

| Tiletoria | ||

| Capfin | ||

| Flash | ||

| Incredible Connection | ||

| Avenida | ||

| Sleepmasters | ||

| S.P.C.C | ||

| ShoeCity | ||

| Refinery | ||

| Dunns | ||

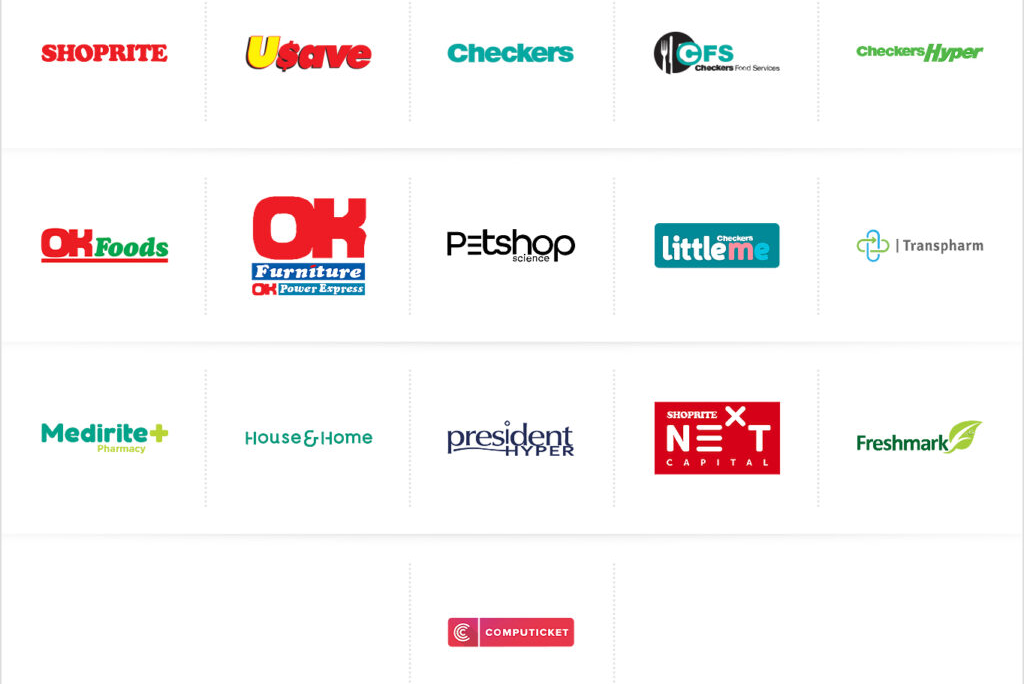

| Shoprite | 10.67% | |

| Shoprite | ||

| Usave | ||

| Checkers | ||

| Checkers Food Services | ||

| Checkers Hyper | ||

| OK Foods | ||

| OK Furniture | ||

| Petshop | ||

| Littleme | ||

| Transpharm | ||

| Medirite | ||

| House & Home | ||

| Presidents Hyper | ||

| Shoprite Next Capital | ||

| Freshmark | ||

| Computicket | ||

| Brait PLC | 28.24% | |

| Virgin Active | ||

| New Look | ||

| Premier Foods | ||

| TradeHold | 11.9% | |

| Collins Group | ||

| Moorgath Property Group (UK) |

Christo Wiese Net Worth

According to Forbes, in 2016, Christoffel Wiese was worth $6.23bilion. In September 2017, he was worth $5.1billion. As of December 2017, he was worth $742million. According to Forbes real time net worth, Christo Wiese net worth is $1.1 billion.

Christo Wiese Interests

When Wiese isn’t too busy buying companies and making deals worth millions, he enjoys hunting, clay pigeon shooting, playing with his dog, catching up with old friends and spending the last three weeks of the year at his beach house.

None of this compares to his private game reserve in the Kalahari. Wiese always dreamt of owning a farm close to where he grew up but never spends more than two or three days at a time there. It’s his way of giving back through conservation, while running it as a business to keep it sustainable.

“If it pays and washes its own face and gives a little of a return on the capital employed, then it is sustainable,” says Wiese.

Awards and Recognitions

- Formerly listed as the 69th most successful person in South African history

- Made Forbes list of 1210 billionaires with an estimated net worth of US$1,6bn

- 11th most successful business man in accounting, banking, finance, consumer goods, fashion and retails

- Business Leader of the Year, The Cape Town Sakekamer

- Prestigious Pioneer of the 20th century Award, South Africand Council of Shopping Centres

Christoffel Wiese Quotes

- “I have no idea whether I’m the third richest person in Africa. People who know how much they’re worth aren’t worth a hell of a lot!”

- “I was never cut out to be a number two.”

- “We bought Shoprite for R1 million. Today, it’s worth R100 billion.”

- “My mother taught me to only worry about things you can do something about.”

- “Pep started as one shop in Upington, then grew shop by shop by shop.”

- “I’m extremely positive about investment in Africa because Africa has a wonderful climate, wonderful people, and amazing possibilities.”

- “Africa has been called dark and hopeless, but today it is neither of these. Africa is awakening. It’s a huge market of almost a billion people with huge

- resources and a young population. It’s the best place to invest.”

- “I still enjoy what I’m doing, which is building businesses. I don’t have any particular passion apart from my business and my family, and that gives me all the pleasure that I want.”

- “Money is always the least of the problems. It is finding the right business or growing the right business. You can’t do that without the right people.”

Entrepreneurial Lessons From Christoffel Wiese

1. Start small

Pep started as one shop in Upington before becoming a multi-million dollar company. Many aspiring entrepreneurs want to start big and the major challenge they complain about is a lack of huge capital.

On the contrary, it is better to start small in business so as to test the waters. Business is risky and if peradventure the business doesn’t work out as expected, you will not lose so much money and your loss will be minimal.

2. Follow your passion

Christoffel knew he had passion for nothing else than business and he pursued his passion quite early. The beauty of investing in your passion is that you will be able to record tremendous success in that area. This is evident in Christoffel’s business success.

Read Also: Meet Tunde Onakoya, the Man Chess Saved

Whatever you have passion for, you will create time for it. Not everybody can be an entrepreneur because everyone is not wired to be one. Therefore, if you have a passion for entrepreneurship, it is better to venture into it straight on because business demands a good dose of passion.

3. See problems as opportunities

When Wiese went to Zambia in the 1990s to open up a clothing store, he found out that clothing was sold on the street pavement by hawkers. There were no clothes shop in the country. A Pep Store colleague that went with him told him, “You know, we can’t come and open shops here because people prefer to buy their clothes from hawkers.”

But, Wiese went ahead to open the store and it became successful just like other previous stores across the continent. Business is all about solving problems. So, wherever there’s a problem, a business owner sees an opportunity out of it.

Controversies

Wiese is no stranger to making headlines. In 2009, Wiese was stopped by customs official at London’s Heathrow Airport where he was carrying a briefcase filled with just over a million dollars. The money was confiscated and the matter went to court.

Wiese insists that he acted on the advice that it would not be an issue. Wiese’s advocate stated that the money was less than what his client made in a week. The courts ruled in his favor and the money returned.

“It’s my money. I didn’t steal it from anybody. I didn’t defraud anybody. It’s my money and it’s certainly my right to do with it as I please,” he declares.

The media criticized the earnings of Shoprite CEO Whitey Basson, who topped the list of top earning executives in 2010, which was released by the Business Times. Basson earned more than $82.7 million that year but dropped in rankings to 20th the following year.

He did however earn the largest bonus of $4,398,470 in 2011. Wiese counters that Basson is underpaid for the work he does and all he has produced for Shoprite’s stakeholders. Wiese says it’s too big a job for him to ever be tempted to do it himself.

References:

![Biography of Tony Elumelu [Investor, Entrepreneur, & Philanthropist]](https://todayafrica.co/wp-content/uploads/2023/12/Blue-Simple-Dad-Appreciation-Facebook-Post-1200-×-720-px-7-1.png)