Starting a business requires careful planning and one of the most important choices is selecting your company’s legal structure. Choosing the business structure is one of the most critical decisions you will make as a business owner.

This decision will significantly impact your business’s taxes, liability, and overall management structure.

But, it can be overwhelming to determine which structure is the best fit for your business. That’s why we’ve written this blog post to help you navigate the process of selecting the right structure for your business.

Without further ado, let’s jump into it.

What is a Business Structure?

A business structure is the legal form of your business that determines what licensing you need, what taxes you will pay, and what legal rights your business has.

You should understand that every entrepreneur’s situation is different, which makes choosing a business structure a very personal decision.

But remember that you can opt to change your company’s existing structure if you realize that another format would be more advantageous to you or your company.

How to Choose the Right Business Structure for Your Business

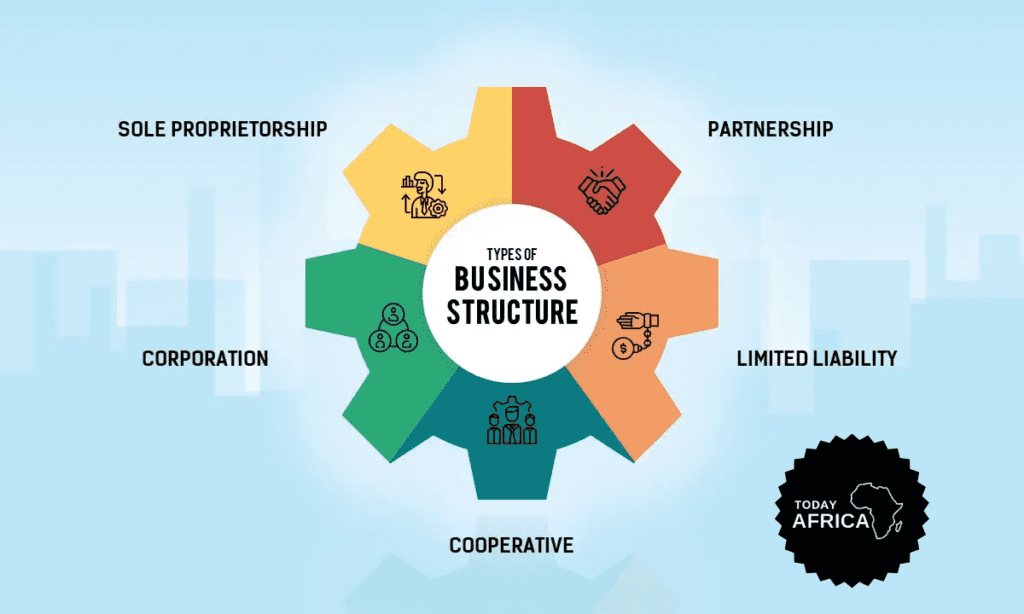

Here in our host country, Nigeria, and in many countries, you can choose from these types of business structures. Each type has its pros and cons.

1. Sole proprietorship

The simplest business structure is the sole proprietorship. Your business is a sole proprietorship if you don’t create a separate legal entity for it. This is true whether you operate it in your own name, or under a trade name.

The main advantage of a sole proprietorship is that it’s fairly simple and inexpensive. The disadvantage is that it doesn’t create a legal separation between you and your personal assets and your business assets. If you’re sued or your business folds, your personal assets are fair game for creditors and in terms of legal liability.

How do you form a sole proprietorship?

As we have already established that a sole proprietorship is the easiest business to form; no official registration action is required on your part.

So, if you’re a fashion designer with a couple of clients? Congratulations—you’re a sole proprietor.

However, there will still likely be registrations, permits, and regulatory hoops to jump through, depending on your country. You’ll want to check with the organization in charge of business registrations in your country.

Related Post: How to Choose the Right Business

2. Partnership

Let’s you’re a personal trainer, who started a sole proprietorship business and offers client coaching.

Later, you want to pair up with a nutritionist, and the two of you plan on building a fitness empire together. You both share ownership and have shared input and participation in the company.

Now you have a partnership.

So a partnership involves two or more individuals sharing ownership of their new business. They’ll both contribute to the business in some way and share in both profits and losses.

However, your partnership agreement should clearly define what happens if a partner withdraws, buy and sell arrangements for partners, and liquidation arrangements if that becomes necessary.

If you think a partnership might work for your business, make sure you do it right. Do well to contact an attorney with experience in partnerships, and ask them for guidance.

Types of partnerships

1. General partnership: A general partnership assumes that all parties are equally involved; that is to say, all profits, liabilities, and duties within the company are distributed evenly. If there is an intentionally unequal split in the partnership (for instance, if one partner opts to accept a greater portion of work in exchange for a greater profit share), this must be noted in the official partnership agreement.

2. Limited partnership: A limited partnership (also known as a partnership with limited liability) is often used for partners who serve an investor role only, and have limited input into the actual running of the company.

3. Joint venture: If you plan on partnering up for one specific project, a joint venture might be for you. Joint ventures function the same as a general partnership but for a confined span of time, such as the completion of a one-time project.

3. Limited Liability Corporation (LLC)

A limited liability corporation (or LLC) allows for the flexibility of a partnership or sole proprietorship, but, as the name suggests, limits the liability of those involved, similar to a corporation.

An LLC is usually a lot like an S corporation and offers a combination of some limitation on legal liability and some favorable tax treatment for profits and transfer of assets. It’s a good idea to talk to an attorney if you’re interested in setting up an LLC.

4. Corporation

A corporation is the most complex business structure; so, if you’re starting a very small business and are working either by yourself or with just a few others (like a partner or a few employees), then a corporation might not be for you.

This business structure is recommended for companies that are larger and more established, have many employees, intend to sell stock in their company, will be scaling quickly, have many outside investors, or some combination of these traits.

Types of corporations

1. C corporation: In C corporation all shareholders combine funds and are then given stock in the newly formed business.

2. S corporation: An S corp is similar to a traditional C corporation, with one major difference: Profits and losses can be “passed through” to your personal tax return.

The S corporation is used for family companies and smaller ownership groups. The biggest difference between a C corp and an S corp is that the S corporation’s profits or losses go straight through to the S corporation’s owners, without being taxed separately first. Click here to learn more about S corporation

3. B corporation: Does your company have a dedicated social mission, a good cause built into its foundation that you’d like to continue furthering as your company grows?

If so, you might want to consider becoming a B corporation, which stands for “benefit corporation.”

However, the name is a bit misleading; a B corp isn’t an entirely different structure than a regular C corporation. A C corp that has been vetted and approved for B corp status. Click here to learn more about B corporation

5. Nonprofit

A nonprofit business is great if your business’s mission is charitable, educational, scientific, religious, or literary—essentially, your business may be qualified for tax-exempt status.

This can include organizations that provide shelters for the homeless, conservation groups, performing arts centers and museums, various education centers, and more.

Four Factors to Consider When Choosing the Right Structure for Your Business

When choosing which business structure is most appropriate for your short- and long-term plans, you’ll want to consider the following factors:

1. Complexity

How complicated does your business need to be now and in the future?

Do you intend to stay as a one-person show, or do you hope to build a business empire and sell the venture to investors in a few years?

Those two scenarios lead to two totally different choices—sole proprietorship at one end and C corporation at the other.

2. Legal protection

Separating your business assets from your personal finances is great. The more protection you want, the more formal you’ll want your business structure to be.

It’s either you choose a corporation or an LLC for the liability protection it provides.

Both of these structures will shelter your personal assets and wealth from outside claims. Sole proprietorships and partnerships do not provide that kind of protection.

3. Taxes

Sole proprietorships, partnerships, LLCs, and S corporations are pass-through entities. Meaning that profits are only taxed when they are paid out to the owner(s). That’s not case for a C corporation because profit is taxed both as a company and when payouts are made to shareholders.

4. Number and type of owners

If you plan to go public with your business, you may want to establish it as a C corporation from the start. However, if you’re building a business that you don’t expect to take public, you may want to choose based on the number of owners you anticipate. A sole proprietorship has one owner, while a partnership, LLC and S corporation can have multiple owners.

Pros and Cons of Sole proprietorship, Partnership, & Corporation

| Sole proprietorship | Partnership | Corporation | |

| Legal status | Does not exist as a separate legal entity. Proprietorship = ownership | Does not exist as a separate legal entity. Partnership = partners as owners | Corporation is treated as a separate legal entity from its owner. Corporation = shareholder ownership |

| Control | Owner has total control. | Partners’ agreement determines control between partners. | Directors and shareholders. |

| Profits | Profits are paid to the owner. | To partners according to a partnership agreement. | Earned by the corporation. Dividends may be paid to shareholders and/or retained in the corporation. |

| Debts | The owner is responsible (unlimited liability). | Partners are individually and collectively responsible. | Paid by the corporation. |

| Taxation | The owner is taxed as an individual on the income of the business as if he or she was employed. | Partners are taxed individually according to their share of the income. | The corporation pays corporate taxes separately from taxes paid by directors and shareholders. |

| Assets | Business assets are wholly owned by the proprietor. | Partners jointly own business assets and/or ownership is governed by partnership agreement. | Business assets are owned by the corporation. There is no specific claim on the corporate assets by shareholders. |

References: