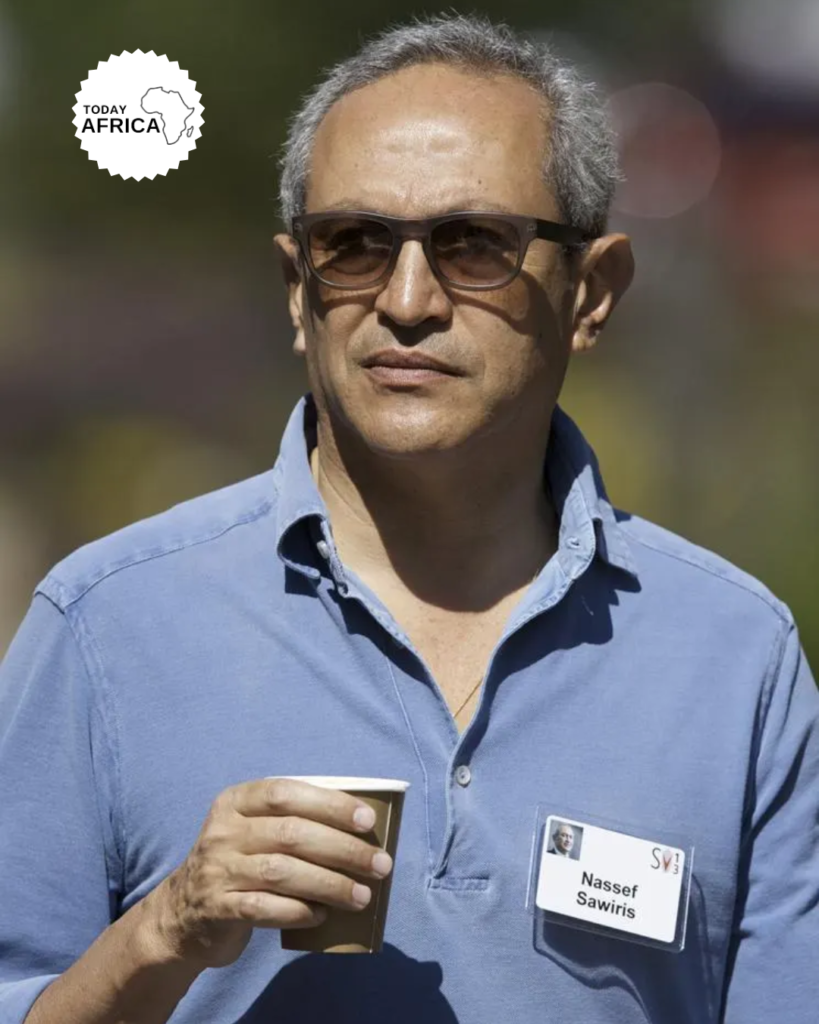

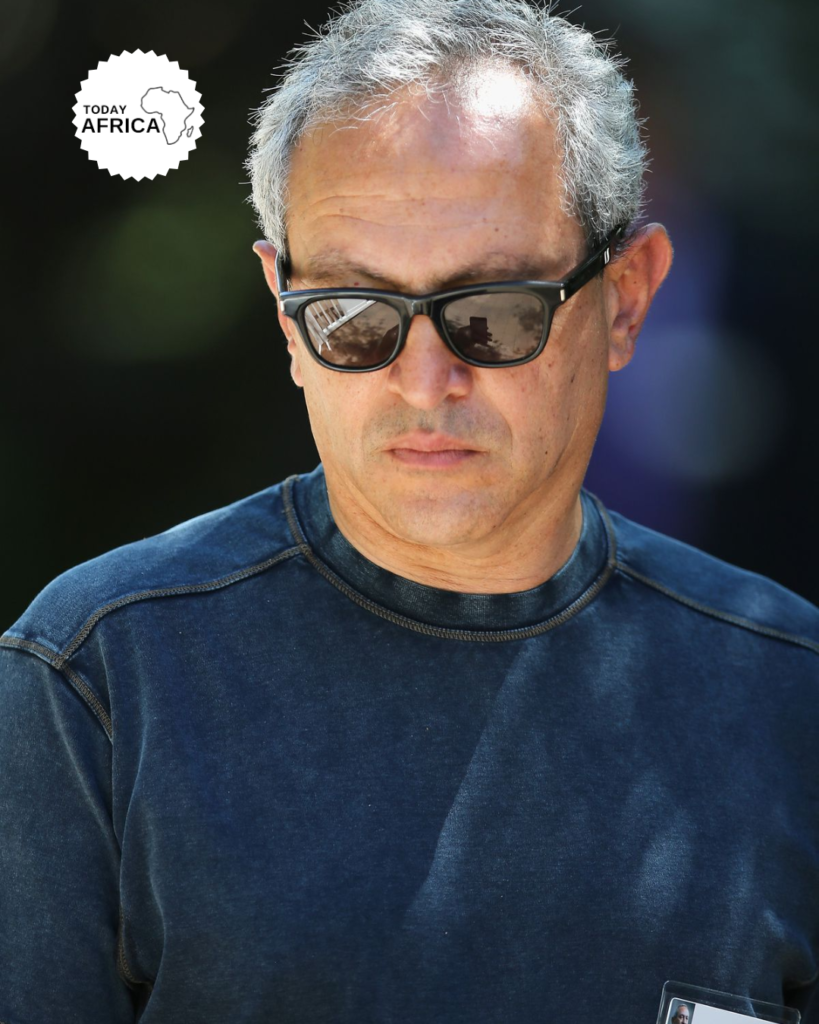

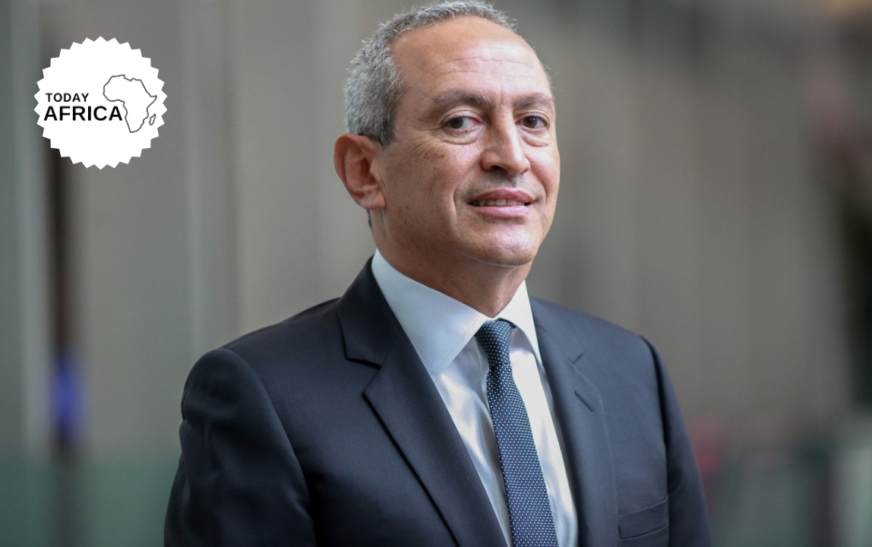

Nassef Sawiris is Egypt’s richest man. He owns 39% of OCI, a Geleen, Netherlands-based fertilizer producer which was formed out of a demerger from his family’s original business, Orascom Construction.

It reported revenue of $6.3 billion in 2022. His other assets include 7% of Adidas and a stake in Arkema SA, a French producer of specialty materials.

Nassef Sawiris Biography

Nassef Onsi Sawiris was born on January 19, 1961, in Cairo, Egypt. The youngest of three sons born to Yousriya and Onsi Sawiris. His father, the son of a lawyer, had founded a construction company in 1950.

By the time Nassef was eight years old. It had become one of Egypt’s largest contractors, building roads and waterways along Egypt’s upper Nile region.

The business was nationalized in 1961 by President Gamal Abdel Nasser and renamed El Nasr Civil Works Company.

Frustrated at being reduced to an employee at his own company. Onsi moved to Libya, where he built a new general contracting company.

After the signing of the Camp David Accords, relations between Libya and Egypt deteriorated and Sawiris moved back to Egypt. Again leaving the family business behind for the second time.

Onsi founded a new company called Orascom Construction Industries. Through partnerships with international companies working on local projects. Orascom grew to be one of the largest private builders in Egypt by the mid-1990s.

Nassef attended high school at the German International School of Cairo. Move to the U.S. for his college. And in 1982, he graduated with a degree in economics from the University of Chicago.

He joined his father and two older brothers at OCI. By this time the company had diversified into communications and real estate.

Nassef oversaw the construction activities of Orascom Construction following the transfer of management control from his father Onsi Sawiris in 1995.

The Company split into three entities

By the end of the decade, the company had split into three separate entities:

- Orascom Telecom, helmed by the oldest brother Naguib

- Orascom Hotels and Development, headed by the immediate elder brother Samih

- Orascom Construction, now led by Nassef.

As CEO of Orascom Construction Industries following the company’s incorporation in 1998. He served on the board of Besix, following OCI SAE’s acquiring a 50% stake in the company in 2004. And was a member of the remuneration and nominations committee until 2017.

Nassef focused on expanding the business abroad and into a new sector of cement and building materials. A division he sold to Lafarge in 2008 for $12.8 billion.

That same year, he entered the fertilizer business with the purchase of the Egyptian Fertilizer Company. Through the expansion of its own operations and acquisitions. Orascom’s fertilizer operation grew to become the world’s third-largest nitrogen-based fertilizer producer.

Listed on the NYSE Euronext Amsterdam

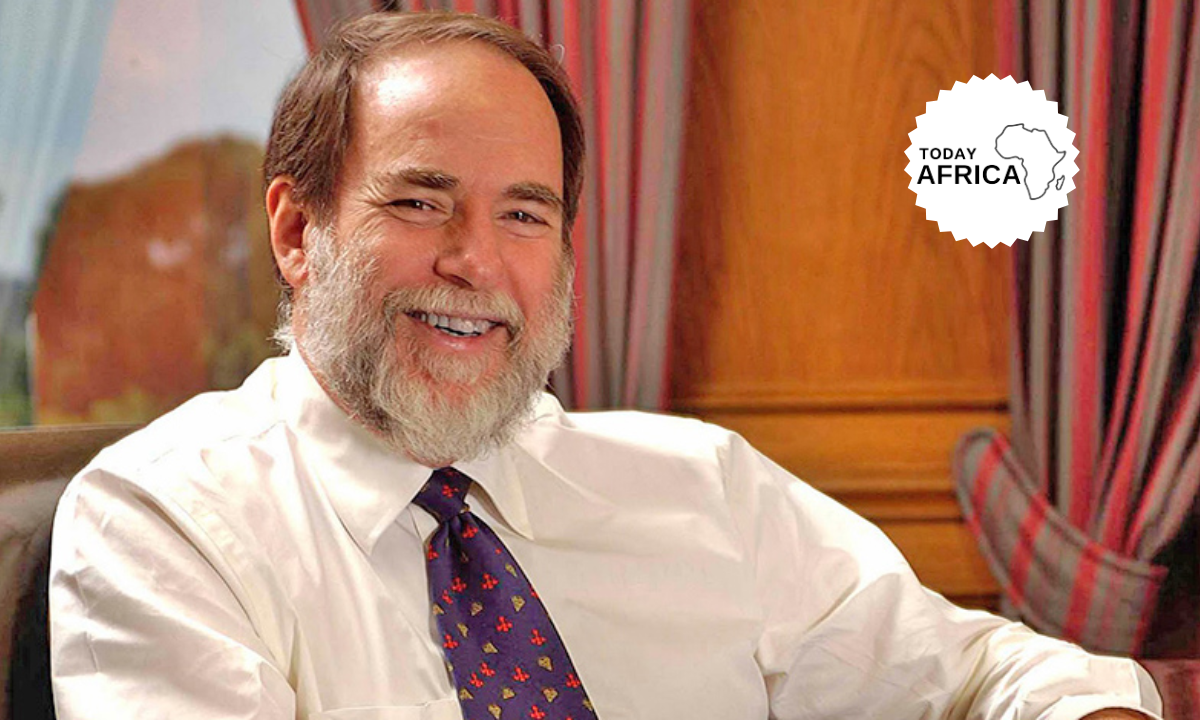

In January 2013, a consortium of investors led by Microsoft co-founder Bill Gates, invested $1 billion in Orascom Construction Industries. This helped the Sawiris family transfer the company’s listing from the Cairo Stock Exchange to NYSE Euronext Amsterdam.

Related Post: Samih Sawiris – The Egyptian-Montenegrin Billionaire

At the time of the announcement, Sawiris said that the move was intended to facilitate future sector consolidation, mitigate Egypt country risk and help lower borrowing costs.

The company, renamed OCI, started trading in Amsterdam on Jan. 25, 2013. Two years later, OCI spun off its construction business into a separate company. Leading them to be dual-listed on the Dubai and Cairo stock exchanges.

He was on the board of directors of the Cairo and Alexandria Stock Exchanges from 2004 to 2007 and was also a board director at the Dubai International Financial Exchange DIFX from July 2008 to June 2010.

In January 2013, he became CEO of OCI NV when they acquired the former parent company OCI SAE.

In 2015, he was elected a board member of LafargeHolcim, having served on Lafarge SA’s board since 2008.

According to reports, Sawiris had acquired a stake in Adidas AG via his investment company NNS Holding Sàrl Luxembourg on October 2015.

He was appointed supervisory director of Adidas AG, Herzogenaurach, Germany in 2016.

In October 2020, Sawiris founded Avanti Acquisition Corp, a Special-purpose acquisition company. However, after failing to acquire another company, Avanti Acquisition was wound up in October 2022.

Nassef Sawiris Wife

Sawiris is married to Sherine, has four children, lives in Cairo, and maintains a residence in New York City. He is a Coptic Christian.

Sherine graduated ‘cum laude’ from the American University in Cairo with a Bachelor of Arts in Business Administration and a minor in Economics.

Related Post: The Mab Called Mike Adenuga

Sherine is a trustee of the Sawiris Foundation. The foundation is aimed at contributing to Egypt’s development, creating sustainable job opportunities, and empowering citizens to build productive lives that realize their full potential;

Sherine has homes in Egypt, London, and New York; Sherine is an ambassador for Chain of Hope, a London-based charity. Chain of Hope is a charity that works towards giving children across the globe access to quality cardiac care.

Sherine Sawiris has also served for a number of years on the acquisition committee for Middle Eastern art at Tate Modern, London.

Nassef Sawiris Net Worth

According to Bloomberg Billionaire Index, Nassef Sawiris is worth $7.97B

- Cash: $2.33B

- Aston Villa F.C.: $133M (Private asset)

- OCI NA Equity: $2.27B (Public asset)

- ADS GY Equity $2.43B (Public asset)

- AKE FP Equity: $406B (Public asset)

- MSGS US Equity $252M (Public asset)

- ORAS EY Equity $155M (Public asset)

Sawiris’s most valuable asset is a 39% stake in publicly traded fertilizer group OCI. He owns the shares directly and through the Netherlands-based holding company, Capricorn Capital BV.

The billionaire’s father, Onsi Sawiris, founded OCI’s predecessor, Orascom Construction, in 1950. His older brother, Samih, also owns shares in the company.

He has a stake in Adidas, the shoe and sports equipment manufacturer. He owns 7% of the Herzogenaurach, Germany-based company’s voting rights through Cayman Islands-based Elian Corporate Trustee, according to the company’s Sept. 20, 2022 announcement.

His other holdings include a 5% stake in Arkema, a Colombes, France-based specialty materials producer. A 6% stake in MSG Sports, the sports holding company that manages basketball team New York Knicks and Hockey team New York Rangers.

His cash holdings are calculated based on an analysis of dividends, taxes, market performance, and insider transactions including a $3.8 billion payment he made in January 2008 to acquire shares in Lafarge.

Nassef Sawiris Buys Aston Villa

In July 2018, a consortium consisting of Sawiris and fellow billionaire Wes Edens. They refer to themselves as NSWE purchased a 55% controlling stake worth £30m in English Premiership club Aston Villa.

The club had faced significant cash flow issues under previous owner Tony Xia. They also faced a potential winding-up order by HMRC, following an unpaid £4m tax bill. Following the takeover, NSWE invested significant funds into addressing said issues.

Following a significant turnover of management and playing staff. This include the appointment of former Liverpool executive Christian Purslow as CEO and the appointment of Unai Emery as manager. The club would be subsequently promoted back to the Premier League.

This included a period of Villa’s longest-ever winning streak of 10 games. Following the promotion, NSWE bought out the remainder of Xia’s shares to become sole owners in August 2019. This was done by taking on an unpaid £30m debt owed by Xia to former owner Randy Lerner.

Sawiris and Eden’s ownership of Aston Villa have marked a period of heavy investment, with approximately £360m of debt-free share capital injected into the as of August 2022.

Plans to expand Villa Park from 42,682 seats to over 50,000. Including the demolition of the North Stand and the creation of a major retail venue, are at an advanced stage. The project is set to cost over £100M and will be entirely funded by V Sports.

Rebranded to V Sports

In 2021, the NSWE holding company rebranded to V Sports, with a view to investing in other clubs around the world via a multi-club model.

In February 2023, V Sports entered into an agreement to purchase a 46% stake worth €5m in Portuguese Primeira Liga team Vitória S.C.

As part of the agreement, V Sports would invest an additional €2m into sporting infrastructure within the next 2 years, and provide a credit line of up to €20m. The agreement was ratified by Vitória’s members on 4 March 2023.

Nassef Sawiris Investments

Nassef Sawiris has built a diverse investment portfolio. Including stakes in valuable companies and sports franchises in addition to his $2.18-billion war chest. This accounts for more than one-quarter of his wealth.

These are his most valuable assets:

1. OCI N.V.

His stake in the nitrogen and methanol products producer is worth $2.44 billion.

Nassef Sawiris’ fortune is largely derived from his 38.8-percent stake in OCI N.V. A leading global producer and distributor of nitrogen and methanol products based in the Netherlands.

OCI N.V. shares were valued at €32.66 ($35.37) at the time of writing. Giving the leading methanol products producer a market capitalization of €6.9 billion ($7.47 billion).

2. Adidas

His stake in the sportswear company is worth $1.87 billion.

In 2015 Nassef revealed that he had acquired a 6% stake in Adidas, one of the world’s largest sportswear manufacturers. Sawiris’ stake in the sportswear behemoth has been his most valuable asset. Not until April 2022, when his investment in OCI N.V. returned impressive returns and surpassed stakes in Adidas.

His six-percent stake in Adidas makes him the largest individual shareholder in the Germany-based sports conglomerate. It’s presently valued at $1.87 billion.

3. Arkema S.A

His stake in the multinational manufacturer is worth $413 million.

His stake in Arkema S.A., a publicly traded multinational manufacturer whose products are used in a variety of industries such as construction, automotive, and electronics, is presently valued at $413 million, contributing significantly to his $7.34-billion net worth.

4. Madison Square Garden Sports Corp

His stake in the New York-based sports company is worth $214 million.

Nassef Sawiris made a strategic investment in Madison Square Garden Sports Corp. in 2020, a leading sports and entertainment company that operates New York City’s iconic Madison Square Garden arena.

Sawiris obtained a five-percent stake in the publicly traded company through his holding company, NS Holdco. His stake in the professional sports company based in New York is presently worth $214 million.

5. Aston Villa

Nassef Sawiris also has a $135-million stake in English club Aston Villa as a co-owner in addition to these investments. In 2018, he invested in the club alongside U.S. billionaire Wes Edens, and he helped the team gain promotion to the Premier League in 2019.

Nassef Sawiris Family Net Worth

The Sawiris family, known as Egypt’s wealthiest family and the wealthiest family in the Arab world, saw their net worth drop by $800 million in 2022, according to a recent report by Forbes.

The combined wealth of the Sawiris family, which includes the fortunes of three Egyptian billionaires — Naguib, Samih, and Nassef Sawiris — fell by $800 million over the course of the year to $11.2 billion.

This decrease in net worth coincides with the economic struggles faced by Egypt, including shortages of foreign currencies, a decline in the value of their local currency, and an increase in the inflation rate.

The Sawiris family was not the only African billionaire family to experience a significant drop in net worth in 2022, as many faced challenges such as rising global interest rates, geopolitical tensions, and global supply chain difficulties that impacted the financial performance and valuation of their companies.

Despite this decline, the Sawiris family is set to benefit from the Netherlands-based fertilizer producer OCI NV, in which they hold direct and indirect stakes.

The Netherlands-based fertilizer producer is planning to distribute a semi-annual cash return of $730 million to its shareholders in April 2023.

Related Post: Johann Rupert, The Richest Man in South Africa

According to its third-quarter earnings report, this distribution will include a base of $200 million for the period ending December 31, following total cash distributions of $1.1 billion in 2022.

OCI N.V. has seen strong growth recently, with revenue increasing 82 percent from $4.1 billion in the first nine months of 2021 to $7.5 billion in the same period of 2022.

This growth was driven by higher selling prices year-on-year for all products, including ammonia, urea, and nitrates. As a result, the company’s net profit reached a record $1.4 billion, up from $284.4 million the previous year.

Milestones

- 1976: Founded new contracting company, Orascom Construction Industries.

- 1998: Becomes CEO of Orascom Construction Industries.

- 1999: OCI lists shares on Egypt’s stock exchange, raising $109 million.

- 2007: Takes a 10 percent stake in building materials firm Texas Industries.

- 2008: Sells OCI’s cement assets to Lafarge for $12.8 billion.

- 2008: OCI expands into fertilizer; buys Egyptian Fertilizer Company.

- 2013: Transfers OCI shares from Cairo to Amsterdam.

- 2014: OCI wins tax case in Egypt.

References:

- https://www.bloomberg.com/billionaires/profiles/nassef-o-sawiris/

- https://billionaires.africa/2023/01/20/four-assets-that-make-egyptian-billionaire-nassef-sawiris-richest-man-in-arab-world/

- https://www.forbes.com/profile/nassef-sawiris/

![Biography of Tony Elumelu [Investor, Entrepreneur, & Philanthropist]](https://todayafrica.co/wp-content/uploads/2023/12/Blue-Simple-Dad-Appreciation-Facebook-Post-1200-×-720-px-7-1.png)